And if we get one, is it a dead cat?

What a difference a week makes. I never used to have trouble finding my seven sentinels on the tracker. I always knew where it was. Just scroll down to the bottom of the list. Been there for awhile.

Now, after the past two weeks I have to "look" for it. After spending much of its time at the sub-750 level, it's now sitting at 539. But I'm closing on it fast (my actual account). I've dropped from about 149 to my current position of 445 very quickly. :blink:

So where do we go now? After Friday's carnage, Standard & Poor's downgraded the U.S. credit rating below its coveted triple AAA. How will the market react to that come Monday? I think it's safe to say that there were a lot of "insiders" who knew something early on given the recent plummet prior that announcement. Does that mean it's already priced in?

For those of us seeing our accounts fall like a lead brick, anxiety is rising with each hour of trade. What to do? But even if one is on the sidelines, what if the market retraces those losses in the not-so-distant future? Would you believe in any rally early on? There's always that chance that this is a huge head fake and a great buying opportunity ends up flying by for naught.

I am no seer. I don't claim to know what the market is going to do. I can certainly interpret charts to some extent with some measure of success, but in a situation like this one some hard decisions have to be made. How close to retirement are you? How much risk are you willing to take? The answers to those questions, or any others of the sort, are usually different for each of us. Some of us may shift our strategy from a short term one to a longer term one. Maybe we get diversified and hedge our position.

There are no right or wrong answers. It's not that simple. There's just too many moving parts and the pace is frantic. The market has a mind of its own and we're limited in our ability to interact with it, so set realistic expectations and try to learn from these experiences.

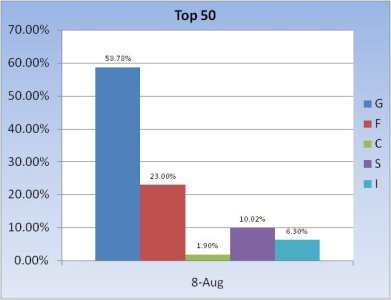

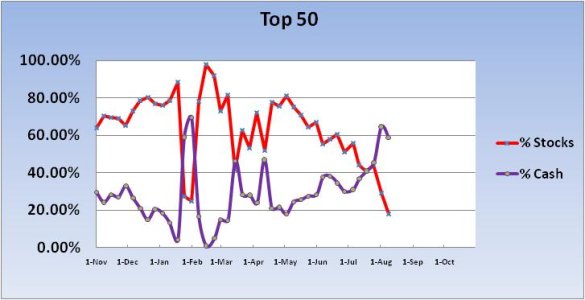

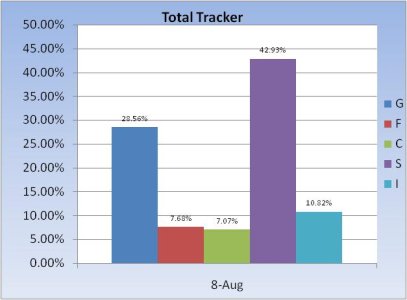

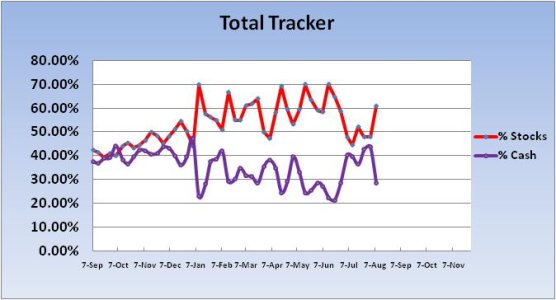

Okay, let's get back to what this blog is really about. The Tracker Charts. Here they are:

The first thing I noticed about this week's Top 50 allocations, is that G fund holdings fell from 64.68% to 58.78%. At first glance it "appears" that maybe some dip buying is going on, but after looking at last week's numbers, I noticed the F fund jumped from 6% last week to 23% this week. All stock allocations fell. In fact, stock allocations are now under 20% for this group. That doesn't mean there wasn't any dip buying going on however. I'll get to that in a moment.

I will also note that before this week began, the Top 50 had dropped their collective stock exposure by more than 15% the previous week. Total stock exposure was only 29.32%. And that was before the real selling pressure kicked in.

Usually, each week some number of tsp'ers move in and out of the Top 50. This far into the year though, it's usually limited to the bottom 10 or 15 because there's such a spread from top to bottom. It's takes a lot to knock someone at the top of the chart out of this group altogether. Not so after the past two weeks. This slide did some serious damage to those who took a stock position. There's been a much greater change of members in this group as a result.

The herd has definitely been doing some dip buying. Last week they had a total stock allocation of 47.93%. This week it's up to 60.81%. I suspect many of them now have that "deer in the headlight" look. Count me among those members.

As I said at the beginning though, I have no idea what happens next, but there's been an awful lot of damage to the charts in a short period of time. And if any rally is forthcoming, it is almost certainly going to see unloading of stocks by those who got caught on the wrong side of the market as a result. Risk is back in vogue and if one was complacent before, I doubt you are now. Sentiment is changing, and that means market character probably will too.

For the immediate term, there are high level meetings going on around the globe as a result of the U.S. debt downgrade and associated market meltdown. I can't help but wonder if the powers that be can find some way to restore market confidence in the days ahead. And what of the central banks and IMF? What role will they play?

The answer to those questions is on everyone's mind.