There wasn't much to drive trading today, but the market did recover nicely from some early selling pressure to finish mixed on the day. Thus ended the last day of what constitutes the Santa Claus rally time frame.

Here's the charts:

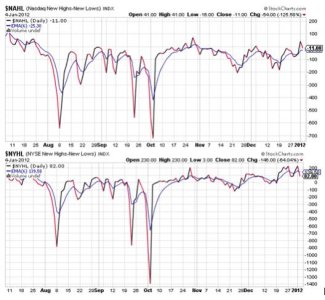

NAMO and NYMO both dipped a bit, but retained their buy status.

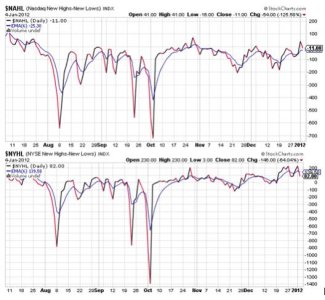

NAHL and NYHL also dipped, but one signal (NYHL) crossed over to a sell condition.

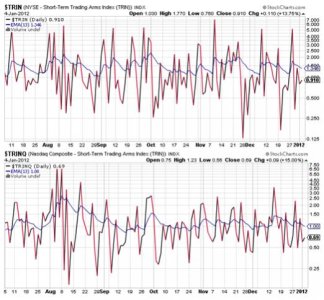

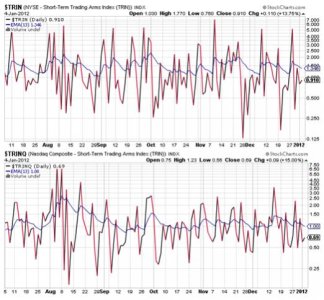

TRIN and TRINQ had only minimal movement, but both remained on buys.

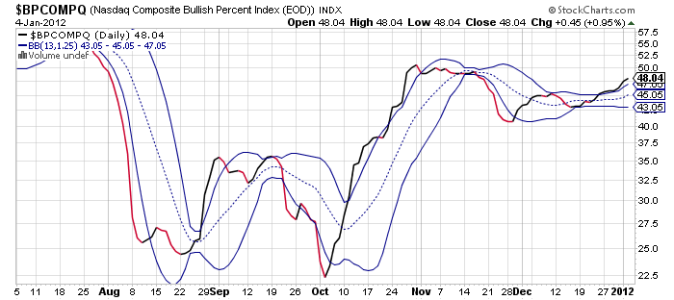

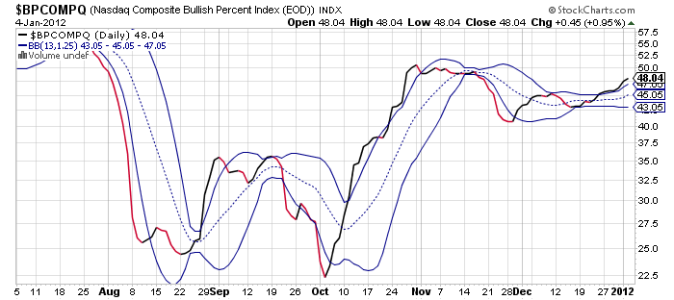

BPCOMPQ also remains on a buy and above the upper bollinger band.

So the signals are mixed, which keeps the system in an intermediate term buy condition.

While the signals are still looking bullish overall, our sentiment survey is on a sell for the week and that leads me to believe we'll be getting a bit more selling pressure by the end of the week. But if it comes it doesn't necessarily mean the current up leg is over. That will depend on how this market acts now that we're on the other side of a seasonally positive period.

I remain 100% G fund and looking for my first buying opportunity of the new year.

Here's the charts:

NAMO and NYMO both dipped a bit, but retained their buy status.

NAHL and NYHL also dipped, but one signal (NYHL) crossed over to a sell condition.

TRIN and TRINQ had only minimal movement, but both remained on buys.

BPCOMPQ also remains on a buy and above the upper bollinger band.

So the signals are mixed, which keeps the system in an intermediate term buy condition.

While the signals are still looking bullish overall, our sentiment survey is on a sell for the week and that leads me to believe we'll be getting a bit more selling pressure by the end of the week. But if it comes it doesn't necessarily mean the current up leg is over. That will depend on how this market acts now that we're on the other side of a seasonally positive period.

I remain 100% G fund and looking for my first buying opportunity of the new year.