After breaking a 6 day losing streak with an up day on Thursday, the bears came back and took the market much lower on Friday. At the close the DOW was down 1.42%, while the S&P 500 and Nasdaq saw losses of 1.4% and 1.53% respectively.

The dollar index rallied to close 0.9% higher on the day. As a result, the I fund fell much harder at 2.31%.

Sentiment has generally been getting more bearish during this down leg, but there's no panic to speak of. Our own sentiment survey remained in a buy condition, but the number of bears dropped in spite of the continued decline, although Thursday's rally may have minted a few bulls, which is also when our survey is being taken.

The charts aren't looking any better. Here they are:

NAMO and NYMO are bouncing around in a fairly tight range at the moment, although NYMO does continue to hit lower lows. NAMO fell back into a sell condition, while NYMO remained on a sell.

NAHL and NYHL also dropped a bit Friday and remain on sells.

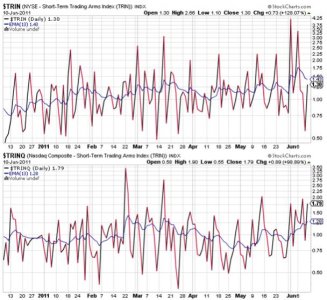

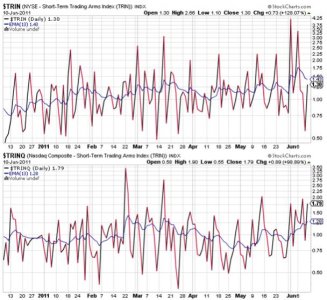

TRIN came out of its overbought condition, but remains on a buy, while TRINQ reached into oversold territory. It

flipped back to a sell on Friday's action.

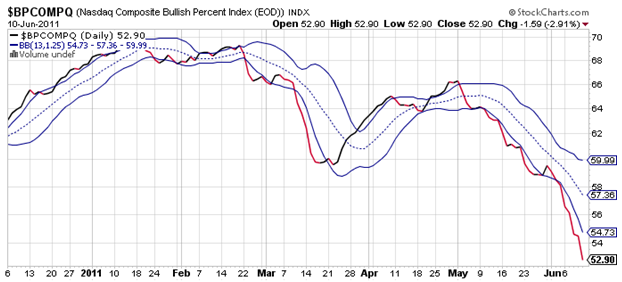

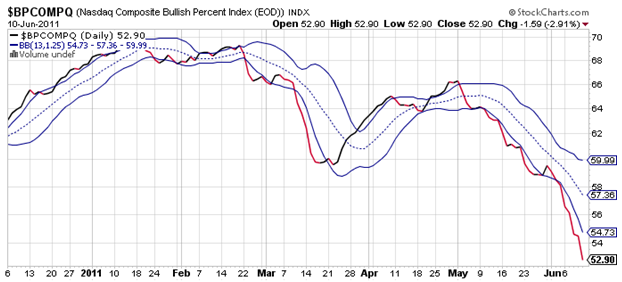

Lower still for BPCOMPQ. It really does look bearish as continues to fall away from that lower bollinger band.

So the Seven Sentinels remain in a sell condition (it's been on a sell since May 23, which makes it look prescient now).

Next week is key to where we go from here. It's OPEX week, which means the action may be volatile, but "normally" the week tends to hold together for the most part. I'm looking for that low any day now, but probably more towards the end of the week. We may get another relief rally in here too, just like the one we saw Thursday. Interestingly, the week after OPEX brings an FOMC rate decision. Will a rally come in the days leading up to that announcement? Time will tell.

The dollar index rallied to close 0.9% higher on the day. As a result, the I fund fell much harder at 2.31%.

Sentiment has generally been getting more bearish during this down leg, but there's no panic to speak of. Our own sentiment survey remained in a buy condition, but the number of bears dropped in spite of the continued decline, although Thursday's rally may have minted a few bulls, which is also when our survey is being taken.

The charts aren't looking any better. Here they are:

NAMO and NYMO are bouncing around in a fairly tight range at the moment, although NYMO does continue to hit lower lows. NAMO fell back into a sell condition, while NYMO remained on a sell.

NAHL and NYHL also dropped a bit Friday and remain on sells.

TRIN came out of its overbought condition, but remains on a buy, while TRINQ reached into oversold territory. It

flipped back to a sell on Friday's action.

Lower still for BPCOMPQ. It really does look bearish as continues to fall away from that lower bollinger band.

So the Seven Sentinels remain in a sell condition (it's been on a sell since May 23, which makes it look prescient now).

Next week is key to where we go from here. It's OPEX week, which means the action may be volatile, but "normally" the week tends to hold together for the most part. I'm looking for that low any day now, but probably more towards the end of the week. We may get another relief rally in here too, just like the one we saw Thursday. Interestingly, the week after OPEX brings an FOMC rate decision. Will a rally come in the days leading up to that announcement? Time will tell.