Apparently, we're not buying the latest rally. We are now selling them. Let's take a look:

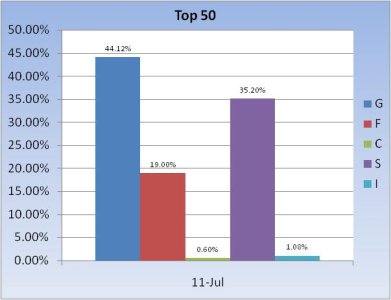

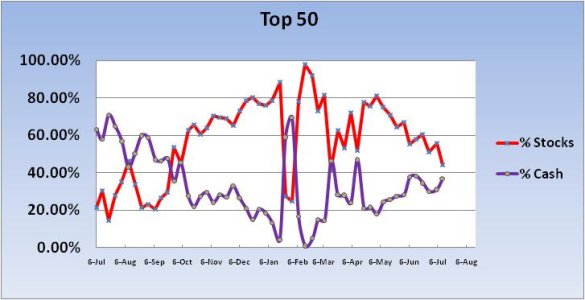

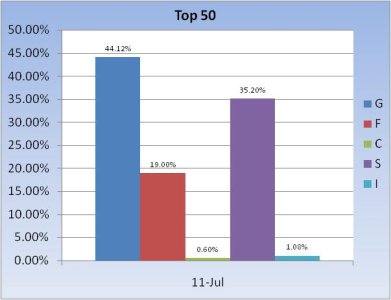

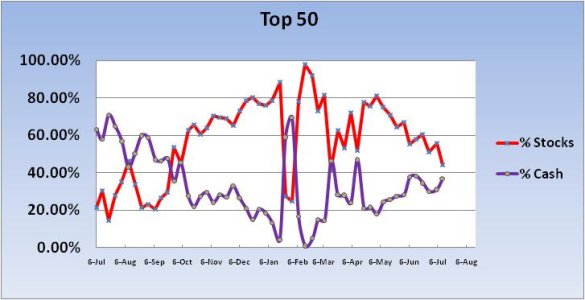

The Top 50 dropped their collective stock exposure by a whopping 11.74% for a total stock allocation of 44.12%. That's a notable drop considering we're technically still in a bull market. Is this a short term perspective, or are they getting more bearish longer term? Fundamentals certainly don't seem to be helping matters if Friday's employment report is any indication. And the debt ceiling is becoming more of an issue every day. And let's not forget that QE2 is now done, so if this market is going to soar it's going to have to do it on its own now.

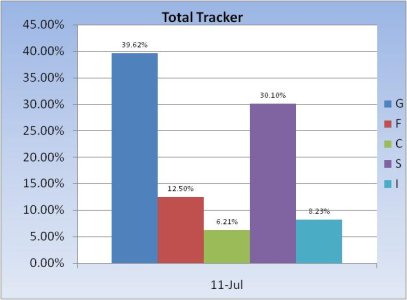

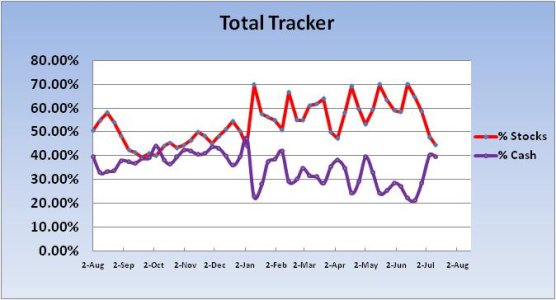

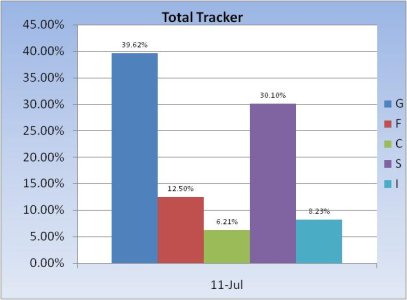

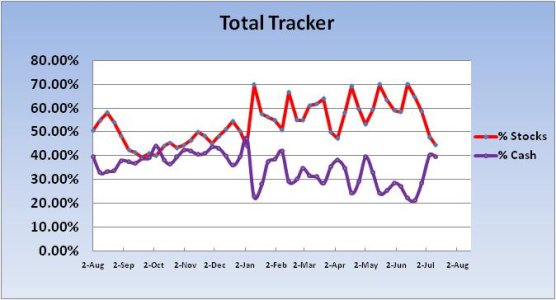

The herd did most of their stock selling the week before, but they reduced their stock allocation a bit more (3.18%) for this coming week. Their collective stock exposure now sits at 44. 54%. That's very near what the Top 50 have.

So it certainly appears we're looking for lower prices, and that happens to be my stance as well. In spite of a Seven Sentinels buy signal that is still in force, this market got overdone very quickly and may not be able to hold current prices in the short term (remember, the Sentinels are an intermediate term system, so we can have some selling pressure without flipping back to a sell condition). Friday saw what began as a hard decline that slowly reversed to moderate losses by the close. That may not be the end of the selling pressure though.

I'm also wondering about that 52% bullish reading on our latest sentiment survey. Our allocations just don't seem to reflect a 52% bullish vote.

I guess those bullish chickens are still here.

The Top 50 dropped their collective stock exposure by a whopping 11.74% for a total stock allocation of 44.12%. That's a notable drop considering we're technically still in a bull market. Is this a short term perspective, or are they getting more bearish longer term? Fundamentals certainly don't seem to be helping matters if Friday's employment report is any indication. And the debt ceiling is becoming more of an issue every day. And let's not forget that QE2 is now done, so if this market is going to soar it's going to have to do it on its own now.

The herd did most of their stock selling the week before, but they reduced their stock allocation a bit more (3.18%) for this coming week. Their collective stock exposure now sits at 44. 54%. That's very near what the Top 50 have.

So it certainly appears we're looking for lower prices, and that happens to be my stance as well. In spite of a Seven Sentinels buy signal that is still in force, this market got overdone very quickly and may not be able to hold current prices in the short term (remember, the Sentinels are an intermediate term system, so we can have some selling pressure without flipping back to a sell condition). Friday saw what began as a hard decline that slowly reversed to moderate losses by the close. That may not be the end of the selling pressure though.

I'm also wondering about that 52% bullish reading on our latest sentiment survey. Our allocations just don't seem to reflect a 52% bullish vote.

I guess those bullish chickens are still here.