After four straight days of gains stocks logged their first loss today. Trading was up and down early on, but by late morning the selling pressure kicked in and took stocks markedly lower until the broader market hit its lows of the day around 3 EST. At that point stocks retraced much of their losses and closed only moderately lower overall.

Banks were especially vulnerable to the selling pressure given the foreclosure problems currently playing out.

You may have noticed that the I fund was much higher than C or S early on today. That was due to more selling pressure against the dollar given the prospects of further QE measures being implemented. Most of those losses were retraced as the day wore on, but the dollar still fell about 0.6% against competing currencies.

Jobs data didn't much matter today. Initial jobless claims were up 462,000, which is more than the 450,000 claims that had been expected. Continuing claims dropped 112,000 to 4.40 million.

The September Producer Price Index was up 0.4%, which was twice what was expected. Excluding food and energy though it was only down 0.1%, which was in-line with estimates.

The Trade deficit for August was $46.3 billion, which was above estimates calling for $44.5 billion.

I was a little unsettled by the fall in treasuries today, which resulted from a low demand for 30 year bonds. We've seen this happen before only to see bonds bounce back again in later offerings. For now it's just something to keep an eye on.

This week is also Options Expiration, so volatility should not come as a surprise. We have lots more data being released tomorrow, and beginning at 8:15 EST Ben Bernanke will be speaking about Monetary Policy Objectives and Tools in a Low-Inflation Environment

at the Federal Reserve Bank of Boston.

Here's today's charts:

One buy and one sell here.

NAHL is neutral, while NYHL flipped to a sell.

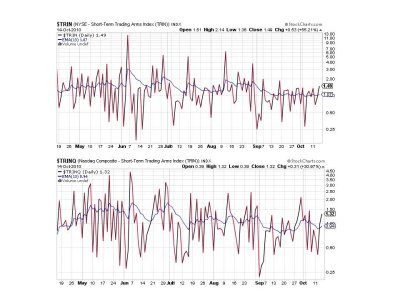

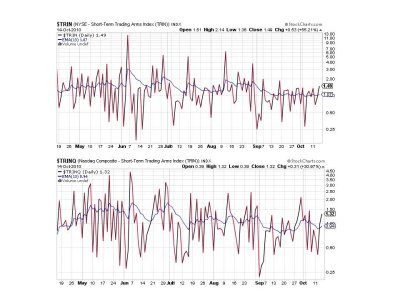

TRIN and TRINQ both flipped to sells.

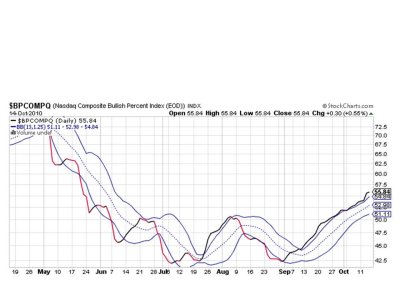

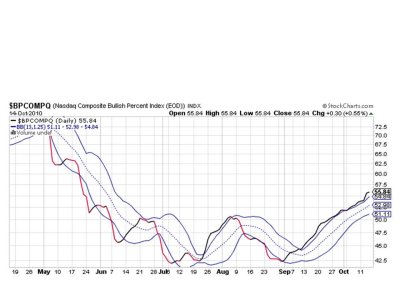

BPCOMPQ remains on a buy.

So we have 2 buys, 1 neutral and 4 sells, which keeps the system on a buy.

I am very interested in how sentiment is shaping up after today's bout of selling pressure. Many bears are still chomping at the bit to short this market and top calling continues to be posted on a various message boards. I am still 68% invested in stocks and looking to lighten up some more on strength, but how aggressive I get will depend on sentiment. So far our own sentiment survey is a bit more bullish (bearish) than last week, so we are seeing a gradual build up of bullish sentiment. I doubt it will be enough to trigger a sell though.

Banks were especially vulnerable to the selling pressure given the foreclosure problems currently playing out.

You may have noticed that the I fund was much higher than C or S early on today. That was due to more selling pressure against the dollar given the prospects of further QE measures being implemented. Most of those losses were retraced as the day wore on, but the dollar still fell about 0.6% against competing currencies.

Jobs data didn't much matter today. Initial jobless claims were up 462,000, which is more than the 450,000 claims that had been expected. Continuing claims dropped 112,000 to 4.40 million.

The September Producer Price Index was up 0.4%, which was twice what was expected. Excluding food and energy though it was only down 0.1%, which was in-line with estimates.

The Trade deficit for August was $46.3 billion, which was above estimates calling for $44.5 billion.

I was a little unsettled by the fall in treasuries today, which resulted from a low demand for 30 year bonds. We've seen this happen before only to see bonds bounce back again in later offerings. For now it's just something to keep an eye on.

This week is also Options Expiration, so volatility should not come as a surprise. We have lots more data being released tomorrow, and beginning at 8:15 EST Ben Bernanke will be speaking about Monetary Policy Objectives and Tools in a Low-Inflation Environment

at the Federal Reserve Bank of Boston.

Here's today's charts:

One buy and one sell here.

NAHL is neutral, while NYHL flipped to a sell.

TRIN and TRINQ both flipped to sells.

BPCOMPQ remains on a buy.

So we have 2 buys, 1 neutral and 4 sells, which keeps the system on a buy.

I am very interested in how sentiment is shaping up after today's bout of selling pressure. Many bears are still chomping at the bit to short this market and top calling continues to be posted on a various message boards. I am still 68% invested in stocks and looking to lighten up some more on strength, but how aggressive I get will depend on sentiment. So far our own sentiment survey is a bit more bullish (bearish) than last week, so we are seeing a gradual build up of bullish sentiment. I doubt it will be enough to trigger a sell though.