After some relentless buying pressure this month, it seems were finally getting some backing and filling. The dip buyers are out there, and they were busy intra-day buying weakness. This could keep the market buoyant for now, and probably work off some of that overbought condition. But sentiment needs to be watched carefully, as we can turn hard once the herd leans too far in one direction. So far though, bearishness is still fairly prevalent in some pockets.

Here's today's charts:

Momo is down at the moment, but it's probably due to some profit taking.

Two sells here for NAHL and NYHL.

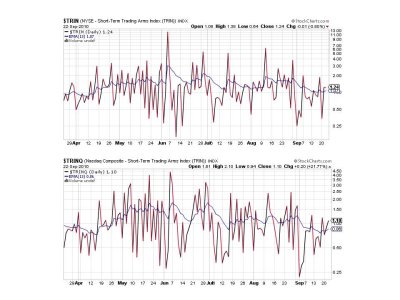

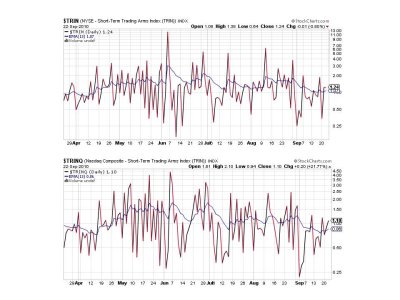

TRIN and TRINQ are also on sells, but we aren't oversold by any stretch, so we could see lower prices yet.

Looks like BPCOMPQ paused today. It's the only signal on a buy.

So we have 6 of 7 signals on a sell, but the system remains on a buy. It's possible that BPCOMPQ can roll over if we have some hard selling pressure, which could tip the system back to a sell. But I don't think sentiment will support a run back down to the August lows even if we get a decent correction.

And that's the big question. Should we be buying dips early on, or wait for lower prices over the coming days. Watch sentiment for the possible answer. Tomorrow's TSP sentiment survey should give us a clue come Friday.

Here's today's charts:

Momo is down at the moment, but it's probably due to some profit taking.

Two sells here for NAHL and NYHL.

TRIN and TRINQ are also on sells, but we aren't oversold by any stretch, so we could see lower prices yet.

Looks like BPCOMPQ paused today. It's the only signal on a buy.

So we have 6 of 7 signals on a sell, but the system remains on a buy. It's possible that BPCOMPQ can roll over if we have some hard selling pressure, which could tip the system back to a sell. But I don't think sentiment will support a run back down to the August lows even if we get a decent correction.

And that's the big question. Should we be buying dips early on, or wait for lower prices over the coming days. Watch sentiment for the possible answer. Tomorrow's TSP sentiment survey should give us a clue come Friday.