After yesterday's late day swoon, the S&P 500 managed to get back above its 50 day moving average, but it stopped short of resistance at the 1100 mark.

How much longer can the market stay in this trading range before it breaks out or breaks down?

In the news today, Europe's major bourses rallied after a strong eurozone PMI reading and retail spending data for the UK. That's good news, but tomorrow results from a series of stress tests on European banks are scheduled to be released, which I would think would have an impact on the markets as well depending on the outcome.

Volume wasn’t particularly impressive today, but I'm taking it as a contrarian indicator and one more reason for the bears to press their case in an economic environment mostly dominated by doom and gloom.

On the US economic data front, initial jobless claims climbed 37,000 to 464,000, which was a bit higher than expected. Continuing claims fell 223,000 to about 4.49 mil, but just like the last reading it's likely due to the expiration of jobless benefits.

Additionally, June existing home sales dropped 5.1% to an annual rate of 5.37 million units. That was better than anticipated.

Finally, June leading indicators fell 0.2%, which was bit less than expected.

Here's the charts:

Back to buys here for NAMO and NYMO.

NAHL and NYHL are also on buys.

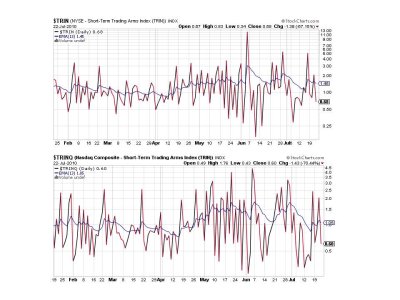

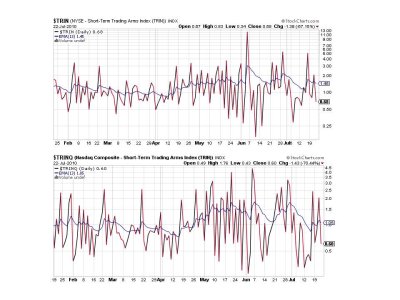

Two more buys here for TRIN and TRINQ.

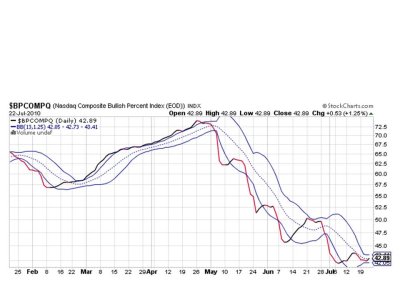

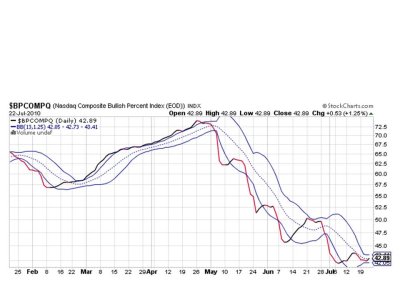

BPCOMPQ ebbed a bit higher today within collapsing bollies.

That's 7 of 7 signals on a buy. Of course the system is still on a buy regardless, but nested signals may be telling us something. In this case I suspect the long side is favored.

That's it for this evening. I'm hoping to see the S&P 500 close above resistance tomorrow, which may trigger more buy signals from other systems, but I'm long in any event.

How much longer can the market stay in this trading range before it breaks out or breaks down?

In the news today, Europe's major bourses rallied after a strong eurozone PMI reading and retail spending data for the UK. That's good news, but tomorrow results from a series of stress tests on European banks are scheduled to be released, which I would think would have an impact on the markets as well depending on the outcome.

Volume wasn’t particularly impressive today, but I'm taking it as a contrarian indicator and one more reason for the bears to press their case in an economic environment mostly dominated by doom and gloom.

On the US economic data front, initial jobless claims climbed 37,000 to 464,000, which was a bit higher than expected. Continuing claims fell 223,000 to about 4.49 mil, but just like the last reading it's likely due to the expiration of jobless benefits.

Additionally, June existing home sales dropped 5.1% to an annual rate of 5.37 million units. That was better than anticipated.

Finally, June leading indicators fell 0.2%, which was bit less than expected.

Here's the charts:

Back to buys here for NAMO and NYMO.

NAHL and NYHL are also on buys.

Two more buys here for TRIN and TRINQ.

BPCOMPQ ebbed a bit higher today within collapsing bollies.

That's 7 of 7 signals on a buy. Of course the system is still on a buy regardless, but nested signals may be telling us something. In this case I suspect the long side is favored.

That's it for this evening. I'm hoping to see the S&P 500 close above resistance tomorrow, which may trigger more buy signals from other systems, but I'm long in any event.