It was a volatile day in the market with the major averages spending most of the day in the red, but an end of day final push to the neutral line allowed the averages to close mixed.

There's not a lot to say about today's action as it was probably being driven by this evening's State of the Union address. And tomorrow afternoon will see the Fed's FOMC rate announcement. Until these two events are past us this market will be driven by speculation.

Here's today's charts:

Both NAMO and NYMO remain mixed with one on a buy and one on a sell.

Both NAHL and NYHL are flashing sells.

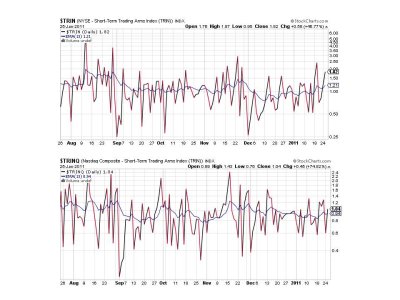

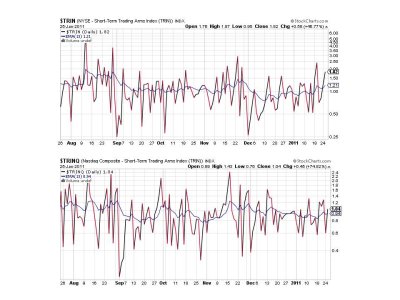

Two sells for TRIN and TRINQ.

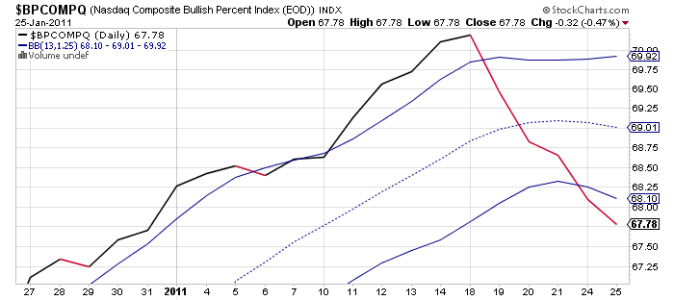

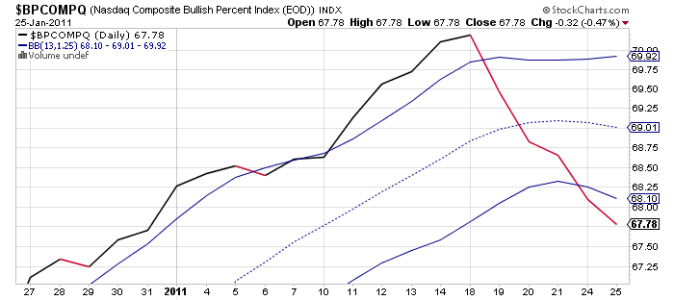

BPCOMPQ continues to move lower and also remains on a sell.

So only one signal is on a buy, which keeps the system on a sell. As I've already mentioned, I can't read too much into the charts with two big events scheduled prior to tomorrow's close. I continue to expect lower prices given the sell signal and will point to BPCOMPQ as reason enough to be very wary of this market.

There's not a lot to say about today's action as it was probably being driven by this evening's State of the Union address. And tomorrow afternoon will see the Fed's FOMC rate announcement. Until these two events are past us this market will be driven by speculation.

Here's today's charts:

Both NAMO and NYMO remain mixed with one on a buy and one on a sell.

Both NAHL and NYHL are flashing sells.

Two sells for TRIN and TRINQ.

BPCOMPQ continues to move lower and also remains on a sell.

So only one signal is on a buy, which keeps the system on a sell. As I've already mentioned, I can't read too much into the charts with two big events scheduled prior to tomorrow's close. I continue to expect lower prices given the sell signal and will point to BPCOMPQ as reason enough to be very wary of this market.