It was a relatively quiet news day today. That produced a choppy market with very light volume. At the close the major averages were mixed, with the DOW and S&P 500 gaining 0.43% and 0.11% respectively, while the Nasdaq dropped 0.23%.

It may be that the market is awaiting the ECB policy statement Thursday as well as the results of the EU Summit later in the week.

Here's tonight's charts:

NAMO and NYMO took a break today, but remain in buy conditions.

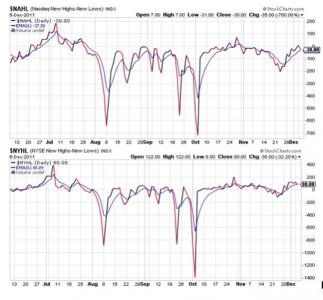

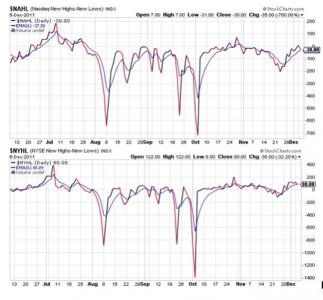

NAHL remained in a buy, while NYHL moved to neutral.

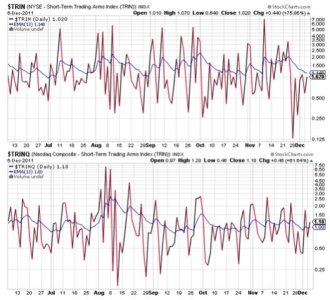

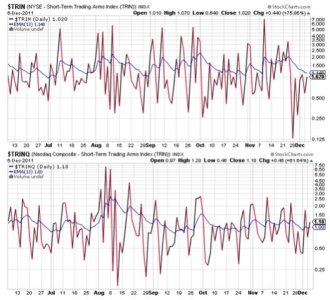

TRIN remained on a buy and TRINQ flipped to a sell. Both signals are relatively neutral.

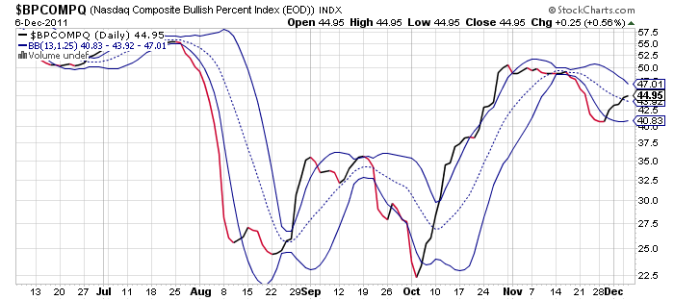

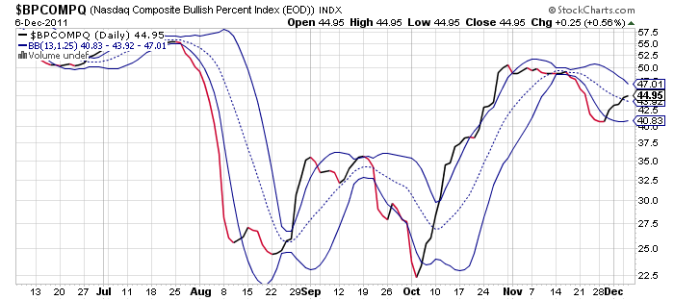

BPCOMPQ continued to rise today and remains on a buy.

So the signals are mixed, but overall remain on the bullish side. Officially, that keeps the system in a sell condition, but with three unconfirmed buy signals since last week, the chances of an official buy signal in the days ahead are relatively good. But I'm still looking for that shot to the downside first. It it comes, I doubt it will be particularly deep given the resilience this market is showing. Seasonality is positive too. But let's not forget our sentiment survey is on a sell, which is a big reason why I think we'll see some measure of weakness by the end of the week.

It may be that the market is awaiting the ECB policy statement Thursday as well as the results of the EU Summit later in the week.

Here's tonight's charts:

NAMO and NYMO took a break today, but remain in buy conditions.

NAHL remained in a buy, while NYHL moved to neutral.

TRIN remained on a buy and TRINQ flipped to a sell. Both signals are relatively neutral.

BPCOMPQ continued to rise today and remains on a buy.

So the signals are mixed, but overall remain on the bullish side. Officially, that keeps the system in a sell condition, but with three unconfirmed buy signals since last week, the chances of an official buy signal in the days ahead are relatively good. But I'm still looking for that shot to the downside first. It it comes, I doubt it will be particularly deep given the resilience this market is showing. Seasonality is positive too. But let's not forget our sentiment survey is on a sell, which is a big reason why I think we'll see some measure of weakness by the end of the week.