As much negative press as there is regarding the financial sector, it was all set aside for the moment after Citigroup posted upside bottom line results and reduced credit provisions. In spite of underweight revenue results, the stock had its biggest rally since April and helped lead the broader market higher.

But today's rally was not as impressive as it may seem on the surface as I'll show you in the charts below.

Bonds caught a bid today as our F fund tacked on 0.35%, while the I fund was spared a down day as the dollar was up as much as 0.8% overnight, but closed the day session with a 0.1% loss.

Not that it's mattered much during this rally, but volume was light today after a much higher volume trading day this past Friday.

Overall though this market looks very dicey in spite of today's rally as internals are not as strong as they were. There are many cross-currents and negative divergences are easy to find. Let's take a look at the charts.

NAMO and NYMO are mixed, with one on a sell and the other a buy.

Both NAHL and NYHL are now both flashing sells. This gets my attention for the moment as it suggests that while the broader market may have moved higher, many stocks that have been leading this rally are not.

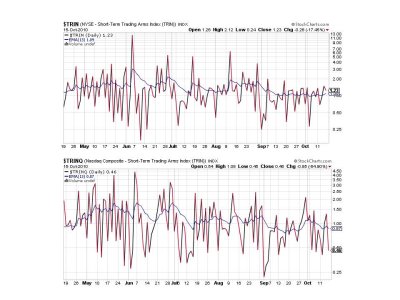

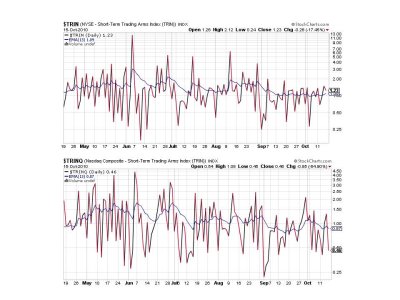

More divergences as TRIN and TRINQ are mixed with one buy and one sell.

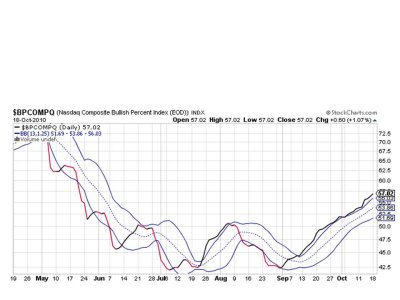

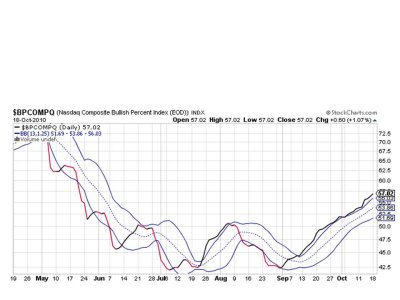

BPCOMPQ does remain in an uptrend and continues to flash a buy signal.

So we have 3 of 7 signals flashing buys, which keeps the system on a buy, but I'm not particularly comfortable in stock for the very short term. I did move another 3% to cash in my TSP account today, which takes me to a 15% cash position along with a 20% bond position. This should temper any selling pressure should the market change character before I can react to it. The market does appear to be at a crossroad here, but it could very well fool the bears again in spite of the negative divergences. I am looking to continue lightening up my stock positions on strength as we enter the 2nd half of October, but how quickly I do so will continue to depend on the charts and sentiment.

But today's rally was not as impressive as it may seem on the surface as I'll show you in the charts below.

Bonds caught a bid today as our F fund tacked on 0.35%, while the I fund was spared a down day as the dollar was up as much as 0.8% overnight, but closed the day session with a 0.1% loss.

Not that it's mattered much during this rally, but volume was light today after a much higher volume trading day this past Friday.

Overall though this market looks very dicey in spite of today's rally as internals are not as strong as they were. There are many cross-currents and negative divergences are easy to find. Let's take a look at the charts.

NAMO and NYMO are mixed, with one on a sell and the other a buy.

Both NAHL and NYHL are now both flashing sells. This gets my attention for the moment as it suggests that while the broader market may have moved higher, many stocks that have been leading this rally are not.

More divergences as TRIN and TRINQ are mixed with one buy and one sell.

BPCOMPQ does remain in an uptrend and continues to flash a buy signal.

So we have 3 of 7 signals flashing buys, which keeps the system on a buy, but I'm not particularly comfortable in stock for the very short term. I did move another 3% to cash in my TSP account today, which takes me to a 15% cash position along with a 20% bond position. This should temper any selling pressure should the market change character before I can react to it. The market does appear to be at a crossroad here, but it could very well fool the bears again in spite of the negative divergences. I am looking to continue lightening up my stock positions on strength as we enter the 2nd half of October, but how quickly I do so will continue to depend on the charts and sentiment.