We're running back to the top of the channel again, and approaching resistance once again at the 1100 level of the S&P 500. There was some good economic data out of China and Australia were among the reasons given for today's rally, as well as modestly better-than-expected weekly jobs data in the U.S.

Of course as has been the case lately, today's rally coincides with another rally in the euro, which regained the 1.2100 level for the first time in a week.

The Seven Sentinels are starting to look promising again, but I'm not trading off them for the moment given the past month's volatile action coupled with dire global economic conditions. We have to remember we really are in uncharted territory, so historical references are not as reliable as they might otherwise be.

Here's today's charts:

NAMO and NYMO are both flashing buys again.

NAHL and NYHL are also flashing buys.

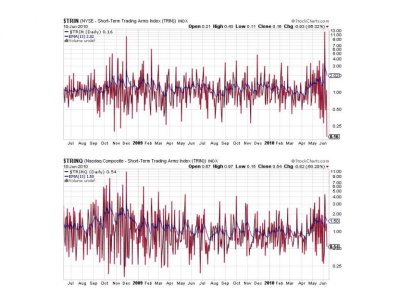

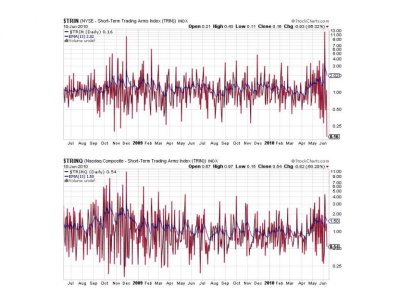

I put up 2 year charts here to show how low the TRIN reading was today. It's in the dirt. Both signals are flashing buys, but are showing overbought conditions.

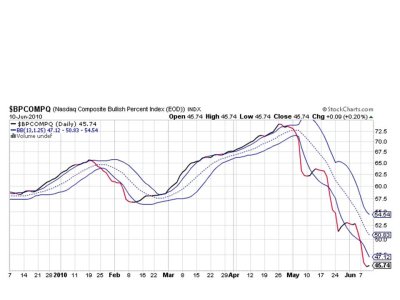

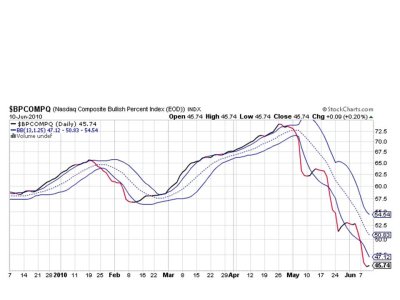

A bit of a turn for BPCOMPQ today, but it remains on a sell. Look at that step ladder from its highs. Those last two whipsaw buy signals are clear in this chart. Are we setting up for a third?

So 6 of 7 signals are flashing buys, which "technically" keeps the system on a buy. As I stated earlier, I am not playing any signals in this market for the time being. The Seven Sentinels are not fast enough to match the volatile action and neither is our TSP accounts. I am long term bearish, but anything can happen near term. That's it for this evening. See you on freaky Friday.

Of course as has been the case lately, today's rally coincides with another rally in the euro, which regained the 1.2100 level for the first time in a week.

The Seven Sentinels are starting to look promising again, but I'm not trading off them for the moment given the past month's volatile action coupled with dire global economic conditions. We have to remember we really are in uncharted territory, so historical references are not as reliable as they might otherwise be.

Here's today's charts:

NAMO and NYMO are both flashing buys again.

NAHL and NYHL are also flashing buys.

I put up 2 year charts here to show how low the TRIN reading was today. It's in the dirt. Both signals are flashing buys, but are showing overbought conditions.

A bit of a turn for BPCOMPQ today, but it remains on a sell. Look at that step ladder from its highs. Those last two whipsaw buy signals are clear in this chart. Are we setting up for a third?

So 6 of 7 signals are flashing buys, which "technically" keeps the system on a buy. As I stated earlier, I am not playing any signals in this market for the time being. The Seven Sentinels are not fast enough to match the volatile action and neither is our TSP accounts. I am long term bearish, but anything can happen near term. That's it for this evening. See you on freaky Friday.