It looked like we might see some serious follow through action to the downside in early trading as the S&P 500 fell almost 1% in the first half hour trade, but that would be the low of the day as the major averages chopped their way higher for several hours before blasting off in the final hour of trade on news out of Europe that eurozone officials had agreed to increase bailout funds. But it was a knee jerk reaction that may not last as details are still lacking.

And the ratings downgrade continued today. France was put on negative watch by Moody's as well as dropping Spain's bond rating by two levels from Aa2 to A1.

Apple reported a big miss on earnings and had been down as much as 7% so far in after hours trading. Apple earnings rose $7.05 a share on $28.3 Billion in revenue in its fiscal fourth quarter from $4.64 per share a year earlier. Analysts had expected $7.39 per share on revenue of $29.69 billion. That was its first miss since 2004.

Amazing. It will be interesting see how the broader market reacts tomorrow to one of its star companies failing to meet expectations.

Here's today's charts:

Back to buys for NAMO and NYMO

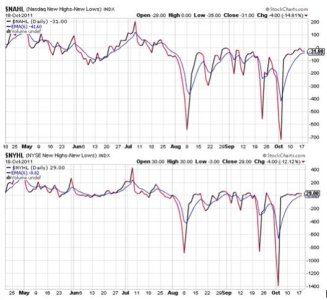

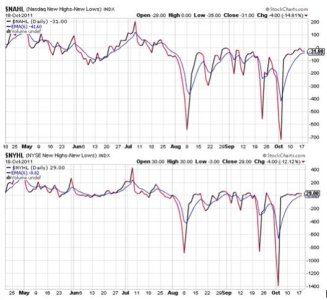

NAHL and NYHL also remain on buys.

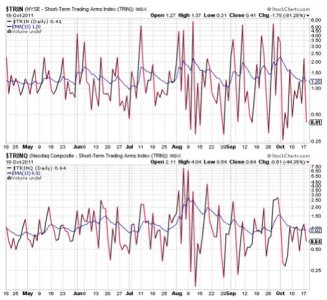

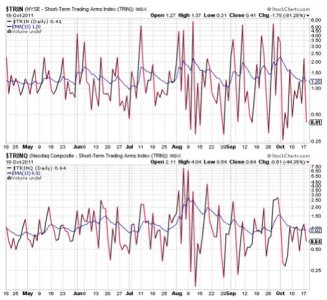

TRIN and TRINQ flipped back to buys as well, although TRIN is showing a moderately overbought market.

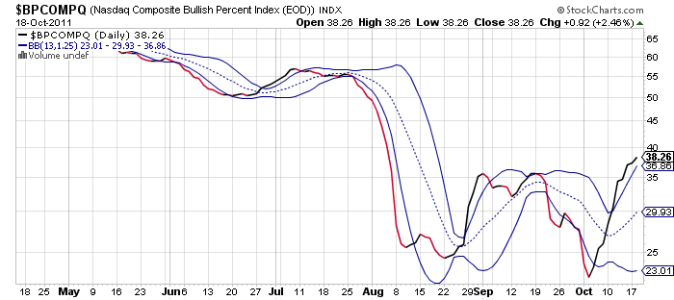

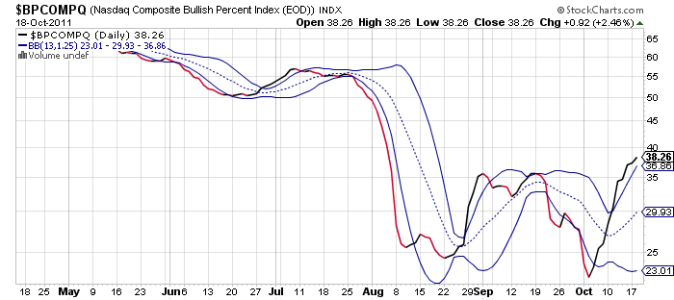

BPCOMPQ rose yet again and also remains on a buy.

So all signals are back to buys and that keeps the system in a buy condition.

Nothing has changed in my outlook from the past couple of blogs. I am still expecting higher prices due to shorting, hedging, and bearish sentiment. Seasonality is also favorable. But none of this makes me comfortable as I know this market is still treacherous to some extent. I'll be looking to sell my position on strength should the market indeed make a move higher in the coming days or weeks ahead.

And the ratings downgrade continued today. France was put on negative watch by Moody's as well as dropping Spain's bond rating by two levels from Aa2 to A1.

Apple reported a big miss on earnings and had been down as much as 7% so far in after hours trading. Apple earnings rose $7.05 a share on $28.3 Billion in revenue in its fiscal fourth quarter from $4.64 per share a year earlier. Analysts had expected $7.39 per share on revenue of $29.69 billion. That was its first miss since 2004.

Amazing. It will be interesting see how the broader market reacts tomorrow to one of its star companies failing to meet expectations.

Here's today's charts:

Back to buys for NAMO and NYMO

NAHL and NYHL also remain on buys.

TRIN and TRINQ flipped back to buys as well, although TRIN is showing a moderately overbought market.

BPCOMPQ rose yet again and also remains on a buy.

So all signals are back to buys and that keeps the system in a buy condition.

Nothing has changed in my outlook from the past couple of blogs. I am still expecting higher prices due to shorting, hedging, and bearish sentiment. Seasonality is also favorable. But none of this makes me comfortable as I know this market is still treacherous to some extent. I'll be looking to sell my position on strength should the market indeed make a move higher in the coming days or weeks ahead.