What can I tell you that I haven't already said several times over the past several weeks? It's why I keep saying that I can't get too bearish in this market. Technicals and sentiment have been calling for a trend reversal on and off for some time, but this market refuses to roll over for very long. Of course it was the 1st of the month, which has tended to be a very bullish day in recent months, but the degree of advance has many traders stunned nonetheless. If I was short, I'd be stunned too, but I'm not. Being in cash on a day like today may not be pleasant, but if you're short you're really hating life.

It was gap and go from the start and in the process fresh 2-year highs were set. The S&P blew past and closed well above 1300 in convincing fashion while the DOW closed over 12,000. Only the Nasdaq is lagging, as it did not quite eclipse its high from two weeks ago.

The dollar was trounced 1%, while treasuries tumbled.

In economic data, the January ISM Manufacturing Index hit a six-year high of 60.8, which was more than anticipated. But Construction spending fell in December by a whopping 2.5%, which was significantly higher than expected.

And the Seven Sentinels? Remember last week these signals issued an "unconfirmed" buy? Well, that's where we are at again, only this time it's a bit closer to triggering a full blown buy signal than before.

Here's the charts:

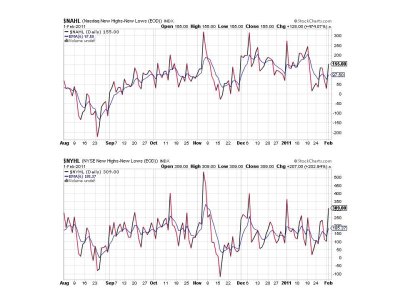

We've made up a lot of ground in just two days. Both signals are flashing buys. NYMO however, did not quite hit its 28 day trading high. More on that in a bit.

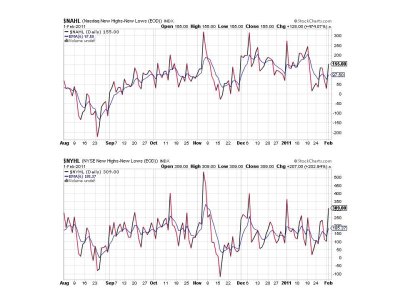

Two buys or NAHL and NYHL.

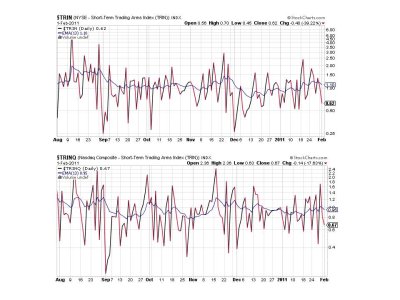

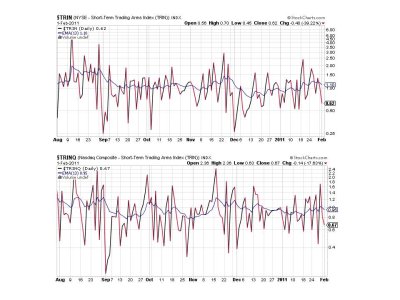

Two buys for TRIN and TRINQ.

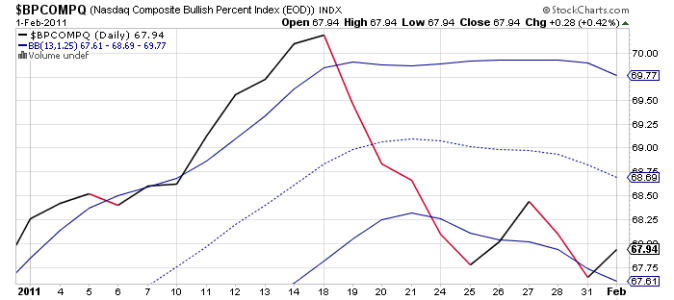

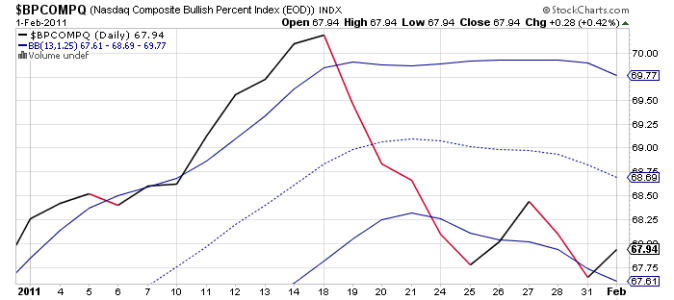

Back to a buy signal for BPCOMPQ as it recrossed up through the lower bollinger band.

So once again all seven signals are flashing buys, which puts the system in an unconfirmed buy condition.

Last week NYMO needed to exceed about 34.0 on the chart to achieve a new 28 day trading high. That requirement still stands. After today we can see this signal got much closer than last week, but still did not quite make it past the high from 3 January. If it gets there it will confirm the seven sentinels buy signal. Until then the system is technically still in sell mode.

As I said last week, if one is inclined towards more risk you may want to run with this buy signal. However, I will not change the system's status on the tracker until this signal gets confirmed. It's close and these sell signals have not been worth following for some time, but the risk is that one of these days a sell signal will pay off and it could be big. It's difficult to see that happening anytime soon given the obvious strength inherent in this market though. But I'd be remiss to completely throw caution to the wind. And that could be an important point if one is close to retirement.

It was gap and go from the start and in the process fresh 2-year highs were set. The S&P blew past and closed well above 1300 in convincing fashion while the DOW closed over 12,000. Only the Nasdaq is lagging, as it did not quite eclipse its high from two weeks ago.

The dollar was trounced 1%, while treasuries tumbled.

In economic data, the January ISM Manufacturing Index hit a six-year high of 60.8, which was more than anticipated. But Construction spending fell in December by a whopping 2.5%, which was significantly higher than expected.

And the Seven Sentinels? Remember last week these signals issued an "unconfirmed" buy? Well, that's where we are at again, only this time it's a bit closer to triggering a full blown buy signal than before.

Here's the charts:

We've made up a lot of ground in just two days. Both signals are flashing buys. NYMO however, did not quite hit its 28 day trading high. More on that in a bit.

Two buys or NAHL and NYHL.

Two buys for TRIN and TRINQ.

Back to a buy signal for BPCOMPQ as it recrossed up through the lower bollinger band.

So once again all seven signals are flashing buys, which puts the system in an unconfirmed buy condition.

Last week NYMO needed to exceed about 34.0 on the chart to achieve a new 28 day trading high. That requirement still stands. After today we can see this signal got much closer than last week, but still did not quite make it past the high from 3 January. If it gets there it will confirm the seven sentinels buy signal. Until then the system is technically still in sell mode.

As I said last week, if one is inclined towards more risk you may want to run with this buy signal. However, I will not change the system's status on the tracker until this signal gets confirmed. It's close and these sell signals have not been worth following for some time, but the risk is that one of these days a sell signal will pay off and it could be big. It's difficult to see that happening anytime soon given the obvious strength inherent in this market though. But I'd be remiss to completely throw caution to the wind. And that could be an important point if one is close to retirement.