The last few weeks have seen several unconfirmed signals, both buys and sells, and the last "confirmed" sell signal was a bust. Today the Seven Sentinels are flashing yet another unconfirmed signal, this time a sell and only two trading days after confirming a buy.

The extreme news we've been hearing about in the Middle East and North Africa and how it might affect the oil markets would seem to be the main driver for today's sell signal, but a one-day sell-off does not by itself reverse the upward trend. It does raise caution flags however, but it's still too early to get excited just yet. But we need to be on our toes just in case the game has changed.

The S&P 500 suffered its worst loss since last August. Again, most likely due to the turmoil in the Middle East and Northern Africa. And not surprisingly, Libya's Gaddafi seems to be the main focus of those fears. He has threatened to cut off oil supplies from his country and refuses to step down as dictator. This can only make for an uncomfortable situation for all concerned since things could go from bad to worse as this situation plays out.

The sell-off began in Asia and then spread to the Eurozone and finally our own markets. I had thought we were in the process of bouncing not long after the initial gap down, but selling efforts intensified as the day wore on. That's atypical for the market character we've become so adjusted to.

The oil market certainly saw volatile action as April crude oil finished the day higher by about 6%.

Interestingly, the dollar managed a gain of just 0.2%.

Here's the charts:

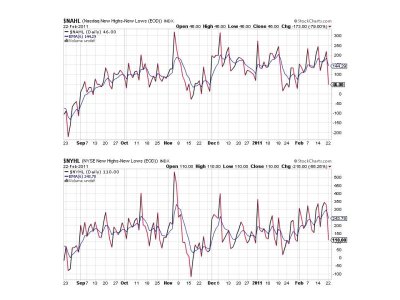

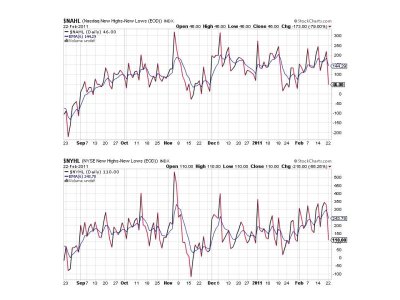

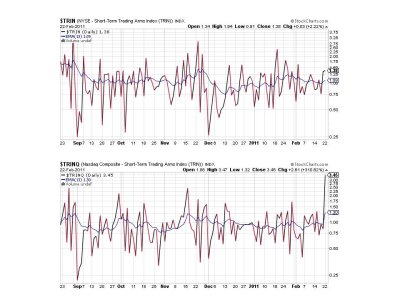

Back to a sell condition here.

Same here.

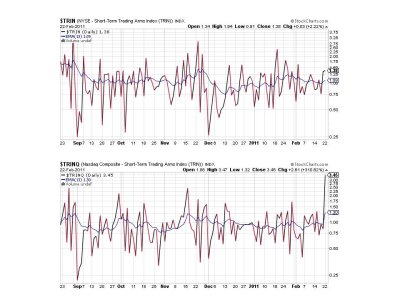

Ditto. But notice TRINQ is at an extreme reading, which is highly suggestive of a bounce.

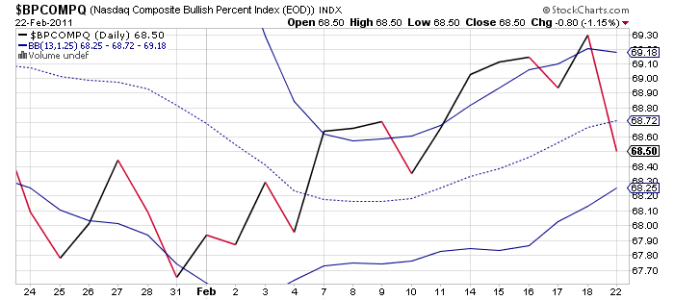

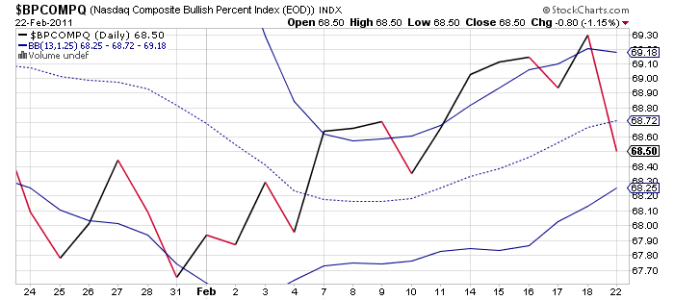

BPCOMPQ also flipped to a sell.

So all signals are back on sells, but the signal is unconfirmed given NYMO has not hit a 28 day trading low with today's action. It would need to hit about -33.5 for that to happen. Currently, it's at -16.1.

So we begin the new trading week with much uncertainty and the biggest one-day drop in 6 months. Liquidity remains high, which may make it difficult for this market to drop too much lower. That's a big plus for the bulls, but we'll have to see if it's enough to off-set any further selling interest.

The extreme news we've been hearing about in the Middle East and North Africa and how it might affect the oil markets would seem to be the main driver for today's sell signal, but a one-day sell-off does not by itself reverse the upward trend. It does raise caution flags however, but it's still too early to get excited just yet. But we need to be on our toes just in case the game has changed.

The S&P 500 suffered its worst loss since last August. Again, most likely due to the turmoil in the Middle East and Northern Africa. And not surprisingly, Libya's Gaddafi seems to be the main focus of those fears. He has threatened to cut off oil supplies from his country and refuses to step down as dictator. This can only make for an uncomfortable situation for all concerned since things could go from bad to worse as this situation plays out.

The sell-off began in Asia and then spread to the Eurozone and finally our own markets. I had thought we were in the process of bouncing not long after the initial gap down, but selling efforts intensified as the day wore on. That's atypical for the market character we've become so adjusted to.

The oil market certainly saw volatile action as April crude oil finished the day higher by about 6%.

Interestingly, the dollar managed a gain of just 0.2%.

Here's the charts:

Back to a sell condition here.

Same here.

Ditto. But notice TRINQ is at an extreme reading, which is highly suggestive of a bounce.

BPCOMPQ also flipped to a sell.

So all signals are back on sells, but the signal is unconfirmed given NYMO has not hit a 28 day trading low with today's action. It would need to hit about -33.5 for that to happen. Currently, it's at -16.1.

So we begin the new trading week with much uncertainty and the biggest one-day drop in 6 months. Liquidity remains high, which may make it difficult for this market to drop too much lower. That's a big plus for the bulls, but we'll have to see if it's enough to off-set any further selling interest.