After yesterday's weak close it appeared that some selling pressure would be very near. And while the market did indeed open weak, the selling was brief and the rally was on after just 20 minutes below the neutral line. By 1100 EST the market settled into a choppy ascent the remainder of the day, ultimately closing near the highs of the day.

I seriously doubt that weak open was the pullback I was looking for. There were probably too many others looking for a decline in the very short term as well. Bullish levels have picked up in various pockets, so the chance for that decline is still reasonably good. It didn't happen today, I'm thinking it could happen anytime between tomorrow and Monday. But remember, that's just an educated guess on my part. This market doesn't have a script.

In the news today, Standard & Poor dropped Portugal's debt rating yet again, which now stands at BBB-, which puts it almost into junk status. Greece's rating was also lowered to BB-.

On the home front, the March Consumer Confidence Index came in at 63.4, which was lower than expected. The market certainly didn't flinch with that bit of news.

For the second straight day overall market volume was underwhelming at about 800 million shares traded. That's a bit odd given we're winding down the quarter, but there's still two days left, so volume could still pick up.

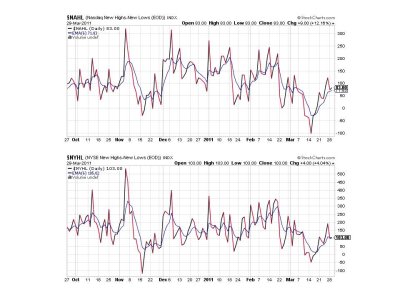

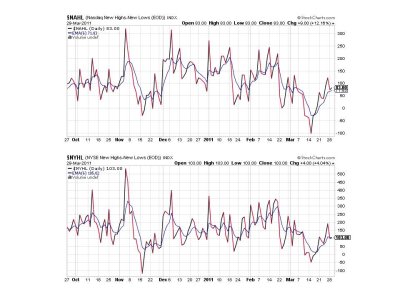

Technically, the Seven Sentinels are mixed today, but only because NYHL is a whisker below its 6 day EMA. Otherwise all signals would be back on buys for the 4th time in 5 days. That's strength. Here's the charts:

Quite the V bottom I'd say. Both signals look very bullish.

NAHL is on a buy, while NAHL is just barely flashing a sell.

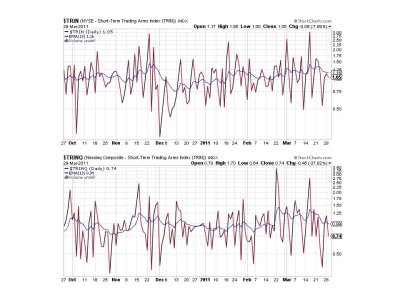

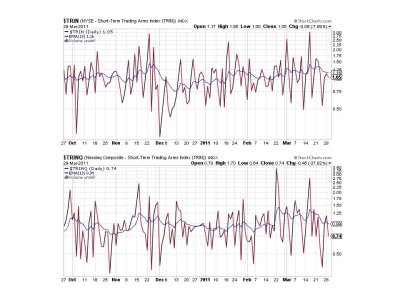

TRIN and TRINQ are also both on buys.

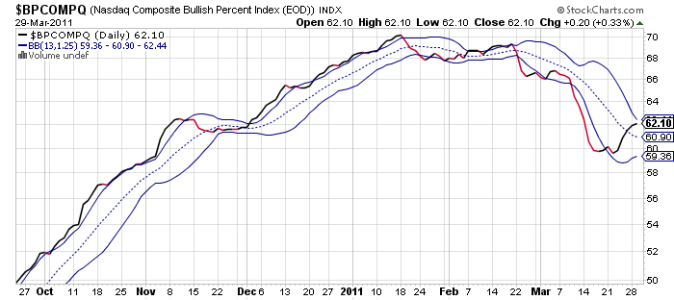

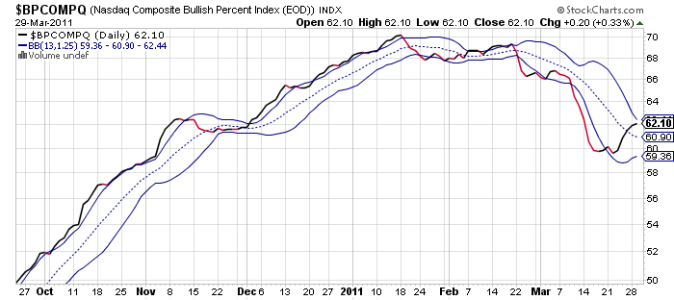

BPCOMPQ ticked a bit higher today and also remains on a buy.

I wish I could say the system has flipped to a buy condition, but NYMO has still not confirmed with a 28 day trading high. But I'm not worried about that in a market environment awash in liquidity.

I chose to trim my stock allocation from 50% to 40% today given the strength I was seeing in the market, but only because I think there's a good chance to buy a dip over the next few days. I won't have an IFT to use until Friday, but since the decline didn't happen at the beginning of this week, it would seem to make an end of the week or early next week drop more likely. This is a calculated risk that I'll be able to buy back in at lower prices, but if I'm wrong or if market strength overwhelms any selling pressure I'll still have some exposure to stocks regardless.

I seriously doubt that weak open was the pullback I was looking for. There were probably too many others looking for a decline in the very short term as well. Bullish levels have picked up in various pockets, so the chance for that decline is still reasonably good. It didn't happen today, I'm thinking it could happen anytime between tomorrow and Monday. But remember, that's just an educated guess on my part. This market doesn't have a script.

In the news today, Standard & Poor dropped Portugal's debt rating yet again, which now stands at BBB-, which puts it almost into junk status. Greece's rating was also lowered to BB-.

On the home front, the March Consumer Confidence Index came in at 63.4, which was lower than expected. The market certainly didn't flinch with that bit of news.

For the second straight day overall market volume was underwhelming at about 800 million shares traded. That's a bit odd given we're winding down the quarter, but there's still two days left, so volume could still pick up.

Technically, the Seven Sentinels are mixed today, but only because NYHL is a whisker below its 6 day EMA. Otherwise all signals would be back on buys for the 4th time in 5 days. That's strength. Here's the charts:

Quite the V bottom I'd say. Both signals look very bullish.

NAHL is on a buy, while NAHL is just barely flashing a sell.

TRIN and TRINQ are also both on buys.

BPCOMPQ ticked a bit higher today and also remains on a buy.

I wish I could say the system has flipped to a buy condition, but NYMO has still not confirmed with a 28 day trading high. But I'm not worried about that in a market environment awash in liquidity.

I chose to trim my stock allocation from 50% to 40% today given the strength I was seeing in the market, but only because I think there's a good chance to buy a dip over the next few days. I won't have an IFT to use until Friday, but since the decline didn't happen at the beginning of this week, it would seem to make an end of the week or early next week drop more likely. This is a calculated risk that I'll be able to buy back in at lower prices, but if I'm wrong or if market strength overwhelms any selling pressure I'll still have some exposure to stocks regardless.