Another Monday, another big, broad-based rally. Ho-Hum.

Yes, the market proved once again that the current seven sentinel buy signal is for real. I've had a bullish bias ever since I sold my stock position 2 weeks ago, but NAMO and NYMO were beginning to get a bit toppy at the time, although I knew more upside may have been available to me, but I didn't want to chance a quick reversal. If I could have bought back into the market last week I would have bought that first big dip. Alas, no more trades were available to me. Not to worry, we won't go straight up. It's now just a matter of being patient and picking the right entry point. I have a whole month to work with and effectively only one trade available, so I want to make it count. That means keeping the odds stacked in my favor.

Of note today was that although the gains in the S&P were strong, the index had some trouble at 1115, which is this year's high, but in the end managed to close just above it and in the process get back above its 50 DMA.

Now that sounds bullish, and it is, but this is an obvious bullish set-up and sentiment may get overly bulled up at this point, which would set the market up for a reveral soon. And that's one of the things I'll be looking for; a better entry point than buying into today's strength.

Today, the dollar continued its march higher and advanced about 0.5% today, which tempered I fund gains. But it could have been worse for I funders, as the dollar was trading about twice as high as that at one point today.

On the economic data front, January personal income increased 0.1% (below expectations), but spending for January increased 0.5%, which was a bit higher than expected. Core personal consumption expenditures were flat, and the ISM Manufacturing Index for February came in at 56.5, below expectations. Finally, January construction spending decreased 0.6% as expected.

But it was Monday, and none of that data really mattered anyway.

To the charts:

NAMO and NYMO are both buys again, but bumping up against their multi-month highs. Look for weakness in the next day or two.

NAHL and NYHL are beginning to ramp up now. A bullish sign.

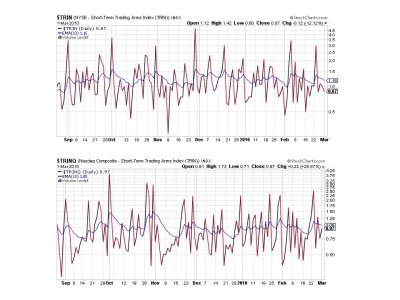

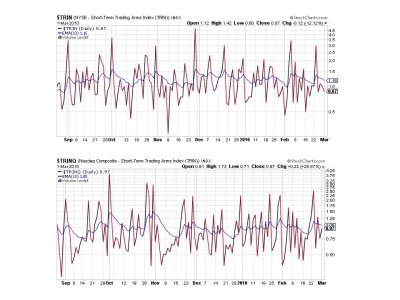

TRIN and TRINQ both remain on a buy.

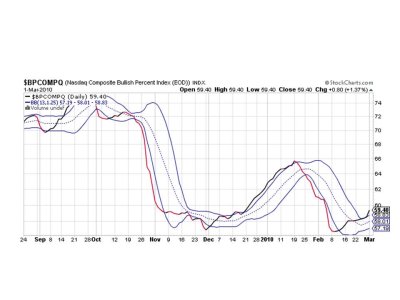

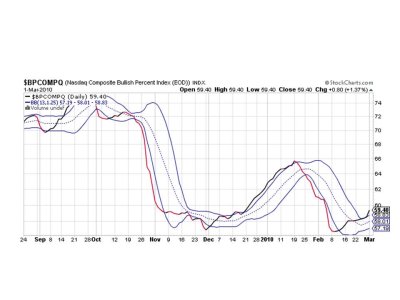

Another bullish sign is BPCOMPQ making a decided push higher today. This leaves all SS signals on a buy.

I believe my bullish bias was correct these past two weeks, but now that the S&P has recaptured its yearly high and the 50 DMA I have to keep an eye on sentiment in the very short term. We could have some follow through action tomorrow, but after that I think we give at least some of these gains back. If it plays out this way it may be a good entry point for those sitting on some cash. And that entry point may be days away yet or perhaps even next week assuming things don't collapse. As I've said, I'm going to be very patient again and pick my spot carefully. See you tomorrow.

Yes, the market proved once again that the current seven sentinel buy signal is for real. I've had a bullish bias ever since I sold my stock position 2 weeks ago, but NAMO and NYMO were beginning to get a bit toppy at the time, although I knew more upside may have been available to me, but I didn't want to chance a quick reversal. If I could have bought back into the market last week I would have bought that first big dip. Alas, no more trades were available to me. Not to worry, we won't go straight up. It's now just a matter of being patient and picking the right entry point. I have a whole month to work with and effectively only one trade available, so I want to make it count. That means keeping the odds stacked in my favor.

Of note today was that although the gains in the S&P were strong, the index had some trouble at 1115, which is this year's high, but in the end managed to close just above it and in the process get back above its 50 DMA.

Now that sounds bullish, and it is, but this is an obvious bullish set-up and sentiment may get overly bulled up at this point, which would set the market up for a reveral soon. And that's one of the things I'll be looking for; a better entry point than buying into today's strength.

Today, the dollar continued its march higher and advanced about 0.5% today, which tempered I fund gains. But it could have been worse for I funders, as the dollar was trading about twice as high as that at one point today.

On the economic data front, January personal income increased 0.1% (below expectations), but spending for January increased 0.5%, which was a bit higher than expected. Core personal consumption expenditures were flat, and the ISM Manufacturing Index for February came in at 56.5, below expectations. Finally, January construction spending decreased 0.6% as expected.

But it was Monday, and none of that data really mattered anyway.

To the charts:

NAMO and NYMO are both buys again, but bumping up against their multi-month highs. Look for weakness in the next day or two.

NAHL and NYHL are beginning to ramp up now. A bullish sign.

TRIN and TRINQ both remain on a buy.

Another bullish sign is BPCOMPQ making a decided push higher today. This leaves all SS signals on a buy.

I believe my bullish bias was correct these past two weeks, but now that the S&P has recaptured its yearly high and the 50 DMA I have to keep an eye on sentiment in the very short term. We could have some follow through action tomorrow, but after that I think we give at least some of these gains back. If it plays out this way it may be a good entry point for those sitting on some cash. And that entry point may be days away yet or perhaps even next week assuming things don't collapse. As I've said, I'm going to be very patient again and pick my spot carefully. See you tomorrow.