Now this is the kind of day I was anticipating this week. A serious decline with no serious upside challenge throughout the day. And we ended on the lows of the day too. This one will cause the technicians to sit up and take notice along with the bears. Keep in mind that this scenario has led to head fakes in the past few months.

A continuation of selling pressure is certainly possible, but this may have been the most damage we'll see in one day on this current corrective move. Keep in mind that we are within striking distance of filling the 8 Sep gap, so that may be target right now. We'd be violating the 50dma too. If that gap gets filled I'd not be surprised by a recover shortly thereafter.

Hopefully, bearish levels are rising after today. I would expect them to with the data points we've been seeing this week. Assuming those levels are rising again, this would be a good reason for the decline to be contained soon.

The Seven Sentinels are all flashing a sell signal today, but since the system is already on a sell, it doesn't mean that much. Here's the charts:

All four of these signals are below the 6-day exponential moving average.

TRIN and TRINQ are well above their 13-day exponential average, and BPCOMPQ continues to drop, remaining in a sell condition.

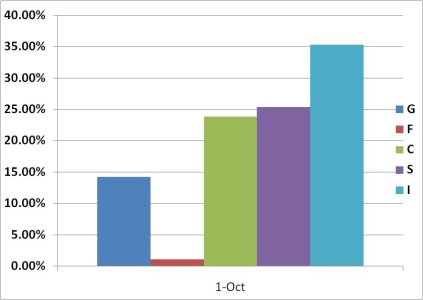

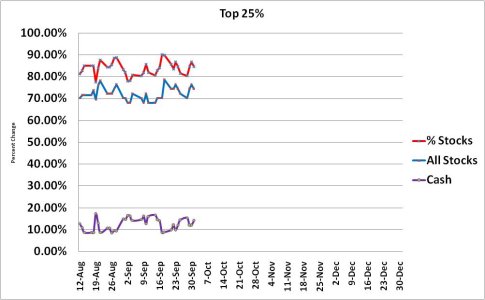

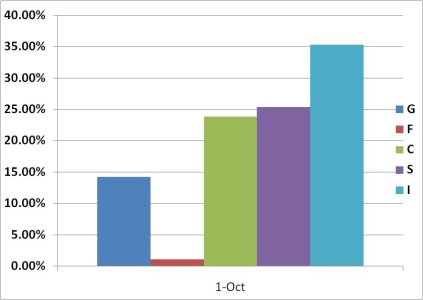

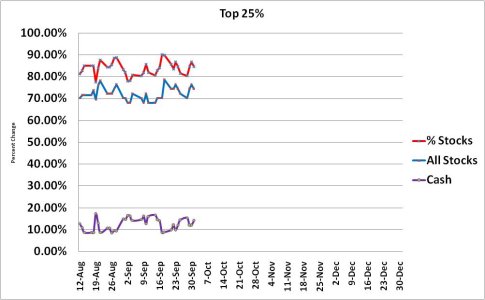

Our top 25% remain relatively unchanged, but I'm seeing the I fund inch higher in exposure, even as the cash level rose modestly. Keep in mind though, that we have yet to see a meaningful shift in allocation, so I would not read too much into these small daily changes. I'd prefer to see a string of moves in the same direction before I'd try to make any assumptions.

Another look at a bullish picture.

So the system remains on a sell, but I'm looking for a possible gap fill soon around 1017 on the S&P, and a resumption of the rally whether or not the gap gets filled. This is only my expectation and is not actionable without a Seven Sentinels buy signal. There is certainly a chance that a more meaningful correction may be underway, so I am keeping my risk low and not making any moves without a green light from the SS.

A continuation of selling pressure is certainly possible, but this may have been the most damage we'll see in one day on this current corrective move. Keep in mind that we are within striking distance of filling the 8 Sep gap, so that may be target right now. We'd be violating the 50dma too. If that gap gets filled I'd not be surprised by a recover shortly thereafter.

Hopefully, bearish levels are rising after today. I would expect them to with the data points we've been seeing this week. Assuming those levels are rising again, this would be a good reason for the decline to be contained soon.

The Seven Sentinels are all flashing a sell signal today, but since the system is already on a sell, it doesn't mean that much. Here's the charts:

All four of these signals are below the 6-day exponential moving average.

TRIN and TRINQ are well above their 13-day exponential average, and BPCOMPQ continues to drop, remaining in a sell condition.

Our top 25% remain relatively unchanged, but I'm seeing the I fund inch higher in exposure, even as the cash level rose modestly. Keep in mind though, that we have yet to see a meaningful shift in allocation, so I would not read too much into these small daily changes. I'd prefer to see a string of moves in the same direction before I'd try to make any assumptions.

Another look at a bullish picture.

So the system remains on a sell, but I'm looking for a possible gap fill soon around 1017 on the S&P, and a resumption of the rally whether or not the gap gets filled. This is only my expectation and is not actionable without a Seven Sentinels buy signal. There is certainly a chance that a more meaningful correction may be underway, so I am keeping my risk low and not making any moves without a green light from the SS.