It was expected. After a big run higher this month some profit taking and consolidation had to happen sooner or later. The overbought condition had to be moderated and that's happened. But have we seen enough selling pressure to resume the upward bias?

The market started out with a gap down, possibly the result of disappointing European data as Germany had a lower-than-expected PMI reading (Germany is the EU's strongest economy) and Ireland saw a lower GDP reading.

Our own market didn't reverse that initial sentiment though as initial jobless claims came in at 465,000, about 15,000 more than anticipated. But stocks found their footing after the early sell-off and managed to cross into positive territory thanks to an existing home sales posting a 7.6% increase.

Another data point (leading indicators) saw an increase of 0.3%, which was higher than expected.

But the "good" news wasn't enough to sustain the rally and stocks eventually succumbed to more selling pressure, closing not far off their lows of the day.

So getting back to my original question, are we ready to resume the uptrend? Let's look at the charts.

Both NAMO and NYMO are back in negative territory, but obviously they can go lower. But will sentiment put a floor under the market again?

NAHL and NYHL remain on sells.

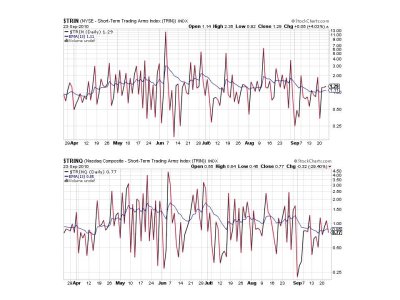

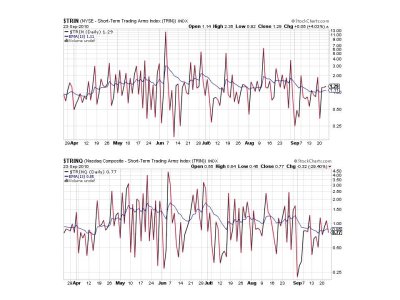

TRIN is still on a sell, but TRINQ actually managed to flip to a buy. Both signals are staying very close to their EMAs, so it's not easy getting a read here. However the EMAs themselves are still near their multi-month lows and seem to suggest we're ready to roll over. But I'm not ready to embrace that thought just yet.

BPCOMPQ actually inched just a bit higher today and remains on a buy.

So we have 5 of 7 signals flashing sells, but the system remains on a buy.

Sentiment is key right now in determining whether the uptrend might still be intact. Our own sentiment survey for next week is a bit more bearish now (54% bears) than it was for this week (52%), which may keep it on a sell. But that's a fair amount of bearishness after the kind of rally we'd had. Other surveys are only moderately bullish, but after today's selling pressure I'd expect bearishness to start rising again. That should keep a floor under the market, so while we may see a bit more selling pressure, I'm not expecting the market to make a big run to the downside from here.

The market started out with a gap down, possibly the result of disappointing European data as Germany had a lower-than-expected PMI reading (Germany is the EU's strongest economy) and Ireland saw a lower GDP reading.

Our own market didn't reverse that initial sentiment though as initial jobless claims came in at 465,000, about 15,000 more than anticipated. But stocks found their footing after the early sell-off and managed to cross into positive territory thanks to an existing home sales posting a 7.6% increase.

Another data point (leading indicators) saw an increase of 0.3%, which was higher than expected.

But the "good" news wasn't enough to sustain the rally and stocks eventually succumbed to more selling pressure, closing not far off their lows of the day.

So getting back to my original question, are we ready to resume the uptrend? Let's look at the charts.

Both NAMO and NYMO are back in negative territory, but obviously they can go lower. But will sentiment put a floor under the market again?

NAHL and NYHL remain on sells.

TRIN is still on a sell, but TRINQ actually managed to flip to a buy. Both signals are staying very close to their EMAs, so it's not easy getting a read here. However the EMAs themselves are still near their multi-month lows and seem to suggest we're ready to roll over. But I'm not ready to embrace that thought just yet.

BPCOMPQ actually inched just a bit higher today and remains on a buy.

So we have 5 of 7 signals flashing sells, but the system remains on a buy.

Sentiment is key right now in determining whether the uptrend might still be intact. Our own sentiment survey for next week is a bit more bearish now (54% bears) than it was for this week (52%), which may keep it on a sell. But that's a fair amount of bearishness after the kind of rally we'd had. Other surveys are only moderately bullish, but after today's selling pressure I'd expect bearishness to start rising again. That should keep a floor under the market, so while we may see a bit more selling pressure, I'm not expecting the market to make a big run to the downside from here.