-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

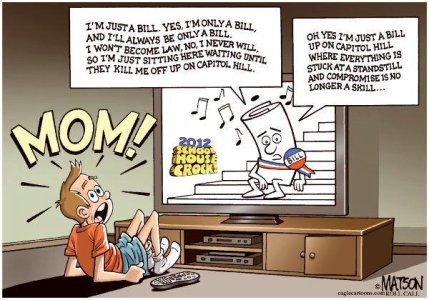

and the HITS just keep on coming!

- Thread starter James48843

- Start date

James48843

TSP Talk Royalty

- Reaction score

- 910

Grab your ankles.

Paul Ryan's (R) bill to raise what we kick in for FERS retirement just passed the House with 218 votes this afternoon.

That sends the bill over to the Senate.

More:

Government News, Research and Events for Federal Employees - GovExec.com

Thank you SIR may I have another?

Paul Ryan's (R) bill to raise what we kick in for FERS retirement just passed the House with 218 votes this afternoon.

That sends the bill over to the Senate.

House passes fed pension hike

By Kellie Lunney

3:46 PM ET

Federal employees would have to contribute more to their government pensions under a bill approved by the House Thursday.

The House voted 218-199 with one Republican voting present for legislation (H.R. 5652) that requires current federal workers to pay 5 percent more toward their retirement, with the increase introduced incrementally over the next five years, beginning in 2013. Members of Congress enrolled in the Federal Employees Retirement System would have to contribute an additional 8.5 percent to their defined benefit plan, with the hike added during the same time period. Federal employees hired after 2012 would begin contributing the additional 5 percent immediately.

More:

Government News, Research and Events for Federal Employees - GovExec.com

Thank you SIR may I have another?

James48843

TSP Talk Royalty

- Reaction score

- 910

FOR raising the FEDERAL EMPLOYEE RETIREE TAX: The FERS contribution from 0.8% to 5.8%, and the CSRS raised by 5% more as well.

Thank you House of Reps for your efforts to cut/slash/tax Federal employees more:

----------------------------------------------------------------------------------------------------------------------------------------------------

[SIZE=+2]FINAL VOTE RESULTS

FOR ROLL CALL 247

[/SIZE](Republicans in roman; Democrats in italic; Independents underlined)

H R 5652 RECORDED VOTE 10-May-2012 2:15 PM

QUESTION: On Passage

BILL TITLE: To provide for reconciliation pursuant to section 201 of the concurrent resolution on the budget for fiscal year 2013

[TABLE="align: center"]

[TR]

[TD][/TD]

[TD="align: center"]Ayes[/TD]

[TD="align: center"]Noes[/TD]

[TD="align: center"]PRES[/TD]

[TD="align: center"]NV[/TD]

[/TR]

[TR]

[TD]Republican[/TD]

[TD="align: right"]218[/TD]

[TD="align: right"]16[/TD]

[TD="align: right"]1[/TD]

[TD="align: right"]6[/TD]

[/TR]

[TR]

[TD]Democratic[/TD]

[TD="align: right"][/TD]

[TD="align: right"]183[/TD]

[TD="align: right"][/TD]

[TD="align: right"]7[/TD]

[/TR]

[TR]

[TD]Independent[/TD]

[TD="align: right"][/TD]

[TD="align: right"][/TD]

[TD="align: right"][/TD]

[TD="align: right"][/TD]

[/TR]

[TR]

[TD]TOTALS[/TD]

[TD="align: right"]218[/TD]

[TD="align: right"]199[/TD]

[TD="align: right"]1[/TD]

[TD="align: right"]13[/TD]

[/TR]

[/TABLE]

[SIZE=+1]---- AYES 218 ---[/SIZE]

[TABLE="align: center"]

[TR]

[TD]Adams

Aderholt

Akin

Alexander

Amodei

Austria

Bachmann

Bachus

Barletta

Barton (TX)

Benishek

Berg

Biggert

Bilbray

Bilirakis

Bishop (UT)

Black

Blackburn

Bonner

Bono Mack

Boustany

Brady (TX)

Brooks

Broun (GA)

Buchanan

Bucshon

Buerkle

Burton (IN)

Calvert

Camp

Campbell

Canseco

Cantor

Capito

Carter

Cassidy

Chabot

Chaffetz

Coble

Coffman (CO)

Cole

Conaway

Cravaack

Crawford

Crenshaw

Culberson

Davis (KY)

Denham

Dent

DesJarlais

Diaz-Balart

Dold

Dreier

Duffy

Duncan (SC)

Ellmers

Emerson

Farenthold

Fincher

Flake

Fleischmann

Fleming

Flores

Forbes

Fortenberry

Foxx

Franks (AZ)

Frelinghuysen

Gallegly

Gardner

Garrett

Gerlach

Gibbs[/TD]

[TD]Gingrey (GA)

Goodlatte

Gosar

Gowdy

Granger

Graves (GA)

Graves (MO)

Griffin (AR)

Griffith (VA)

Grimm

Guinta

Guthrie

Hall

Hanna

Harper

Harris

Hartzler

Hastings (WA)

Hayworth

Heck

Hensarling

Herger

Huelskamp

Huizenga (MI)

Hultgren

Hunter

Hurt

Issa

Jenkins

Johnson (OH)

Johnson, Sam

Jordan

Kelly

King (IA)

King (NY)

Kingston

Kinzinger (IL)

Kline

Lamborn

Lance

Landry

Lankford

Latham

Latta

Lewis (CA)

Long

Lucas

Luetkemeyer

Lummis

Lungren, Daniel E.

Manzullo

Marchant

Marino

McCarthy (CA)

McCaul

McClintock

McCotter

McHenry

McKeon

McKinley

McMorris Rodgers

Meehan

Mica

Miller (FL)

Miller (MI)

Miller, Gary

Mulvaney

Murphy (PA)

Myrick

Neugebauer

Nugent

Nunes

Nunnelee[/TD]

[TD]Olson

Palazzo

Pearce

Pence

Petri

Pitts

Poe (TX)

Pompeo

Posey

Price (GA)

Quayle

Reed

Rehberg

Reichert

Renacci

Ribble

Rigell

Rivera

Roby

Roe (TN)

Rogers (AL)

Rogers (KY)

Rogers (MI)

Rohrabacher

Rokita

Rooney

Ros-Lehtinen

Roskam

Ross (FL)

Royce

Runyan

Ryan (WI)

Scalise

Schilling

Schmidt

Schock

Schweikert

Scott (SC)

Scott, Austin

Sessions

Shimkus

Shuster

Simpson

Smith (NE)

Smith (NJ)

Smith (TX)

Southerland

Stearns

Stivers

Sullivan

Terry

Thompson (PA)

Thornberry

Tiberi

Tipton

Turner (NY)

Turner (OH)

Upton

Walberg

Walden

Walsh (IL)

Webster

West

Westmoreland

Wilson (SC)

Wittman

Womack

Woodall

Yoder

Young (AK)

Young (FL)

Young (IN)[/TD]

[/TR]

[/TABLE]

[SIZE=+1]---- NOES 199 ---[/SIZE]

[TABLE="align: center"]

[TR]

[TD]Ackerman

Altmire

Amash

Andrews

Baca

Baldwin

Barrow

Bartlett

Bass (CA)

Bass (NH)

Becerra

Berkley

Bishop (GA)

Bishop (NY)

Blumenauer

Bonamici

Boren

Boswell

Brady (PA)

Braley (IA)

Brown (FL)

Butterfield

Capps

Capuano

Cardoza

Carnahan

Carney

Carson (IN)

Castor (FL)

Chandler

Chu

Cicilline

Clarke (MI)

Clarke (NY)

Clay

Cleaver

Clyburn

Cohen

Connolly (VA)

Conyers

Cooper

Costa

Costello

Courtney

Critz

Crowley

Cuellar

Cummings

Davis (CA)

Davis (IL)

DeFazio

DeGette

DeLauro

Deutch

Dicks

Dingell

Doggett

Doyle

Duncan (TN)

Edwards

Ellison

Engel

Eshoo

Farr

Fattah

Fitzpatrick

Frank (MA)[/TD]

[TD]Fudge

Garamendi

Gibson

Gohmert

Gonzalez

Green, Al

Green, Gene

Grijalva

Gutierrez

Hahn

Hanabusa

Hastings (FL)

Herrera Beutler

Higgins

Himes

Hinchey

Hinojosa

Hirono

Hochul

Holden

Holt

Honda

Hoyer

Israel

Jackson (IL)

Jackson Lee (TX)

Johnson (GA)

Johnson (IL)

Johnson, E. B.

Jones

Kaptur

Keating

Kildee

Kind

Kissell

Kucinich

Labrador

Langevin

Larsen (WA)

Larson (CT)

LaTourette

Lee (CA)

Levin

Lewis (GA)

Lipinski

LoBiondo

Loebsack

Lofgren, Zoe

Lowey

Luján

Lynch

Maloney

Markey

Matheson

Matsui

McCarthy (NY)

McCollum

McDermott

McGovern

McNerney

Meeks

Michaud

Miller (NC)

Miller, George

Moore

Moran

Murphy (CT)[/TD]

[TD]Nadler

Neal

Olver

Owens

Pallone

Pascrell

Pastor (AZ)

Pelosi

Perlmutter

Peters

Peterson

Pingree (ME)

Platts

Polis

Price (NC)

Quigley

Rahall

Rangel

Reyes

Richardson

Richmond

Ross (AR)

Rothman (NJ)

Roybal-Allard

Ruppersberger

Rush

Ryan (OH)

Sánchez, Linda T.

Sanchez, Loretta

Sarbanes

Schakowsky

Schiff

Schrader

Schwartz

Scott (VA)

Scott, David

Serrano

Sewell

Sherman

Shuler

Sires

Smith (WA)

Speier

Stark

Sutton

Thompson (CA)

Thompson (MS)

Tierney

Tonko

Towns

Tsongas

Van Hollen

Velázquez

Visclosky

Walz (MN)

Wasserman Schultz

Waters

Watt

Waxman

Welch

Whitfield

Wilson (FL)

Wolf

Woolsey

Yarmuth[/TD]

[/TR]

[/TABLE]

[SIZE=+1]---- ANSWERED “PRESENT” 1 ---[/SIZE]

[TABLE="align: center"]

[TR]

[TD]Sensenbrenner[/TD]

[/TR]

[/TABLE]

[SIZE=+1]---- NOT VOTING 13 ---[/SIZE]

[TABLE="align: center"]

[TR]

[TD]Berman

Burgess

Donnelly (IN)

Filner

Heinrich[/TD]

[TD]Mack

McIntyre

Napolitano

Noem

Paul[/TD]

[TD]Paulsen

Slaughter

Stutzman[/TD]

[/TR]

[/TABLE]

MohammadXX

Rising Member

- Reaction score

- 1

During the months following the 2012 election, will the President and the Democrats support raising FERS retirement contributions or will they say NEVER?

James48843

TSP Talk Royalty

- Reaction score

- 910

House passes PAY FREEZE EXTENSION for Department of Defense and Veterans Administration employees:

(sarcasm font)

More on the story:

House passes bill that would extend pay freeze for some civilians - Pay & Benefits - GovExec.com

And the hits just keep on coming.

Thank you (R) House of Representatives for that additional pay freeze for DoD and VA.A spending bill the House approved Thursday night includes language that would effectively extend the two-year pay freeze for some civilian employees. The White House has pledged to veto the measure.

The Military Construction and Veterans Affairs appropriations bill, passed 407-12, would prolong the pay freeze for some employees at the Defense and Veterans Affairs departments by cutting funds that otherwise would have gone toward the 0.5 percent civilian pay hike President Obama requested in his fiscal 2013 budget. The bill reduces Defense civilian personnel spending by $2.3 million and cuts VA spending that would have gone toward raises by nearly $100 million.

According to a statement from Office of Management and Budget, President Obama’s senior advisers would recommend he veto the spending bill because they believe it departs from the agreement the White House and Congress reached in enacting the 2011 Budget Control Act.

OMB encouraged Congress to support the president’s 0.5 percent pay raise proposal. “As the president stated in his fiscal 2013 budget, a permanent pay freeze is neither sustainable nor desirable,” OMB said.

(sarcasm font)

More on the story:

House passes bill that would extend pay freeze for some civilians - Pay & Benefits - GovExec.com

And the hits just keep on coming.

Boghie

Market Veteran

- Reaction score

- 378

Damn,

What am I going to do without that 0.5% cost of living increase? How will I survive? Maybe if the civilian workforce wasn't bloated up the gubmint could afford a decent cost of living raise.

And, I <sarcasm> honestly </sarcasm> thought that my 0.8% investment into FERS would fund my retirement. I had so much faith that future politicians would respect the promises of past politicians. I mean, I pay 6.3% of the money put into FERS. All the Federal Gubmint has to do is fund the other 93.7% - call it kinda like a TSP match or something. And look at the <sarcasm> great return </sarcasm> we get for that investment. I mean, had I had that 12% of gross salary to invest in TSP I would definitely be eating dog food in my golden years - instead I will get 25% of my salary .

.

Folks, if it cannot go on it wont.

The only lock box you got is your TSP.

My greatest hope is that they allow me to opt out.

What am I going to do without that 0.5% cost of living increase? How will I survive? Maybe if the civilian workforce wasn't bloated up the gubmint could afford a decent cost of living raise.

And, I <sarcasm> honestly </sarcasm> thought that my 0.8% investment into FERS would fund my retirement. I had so much faith that future politicians would respect the promises of past politicians. I mean, I pay 6.3% of the money put into FERS. All the Federal Gubmint has to do is fund the other 93.7% - call it kinda like a TSP match or something. And look at the <sarcasm> great return </sarcasm> we get for that investment. I mean, had I had that 12% of gross salary to invest in TSP I would definitely be eating dog food in my golden years - instead I will get 25% of my salary

Folks, if it cannot go on it wont.

The only lock box you got is your TSP.

My greatest hope is that they allow me to opt out.

CrabClaw

TSP Pro

- Reaction score

- 28

My greatest hope is that they allow me to opt out.

yep......

SkyPilot

TSP Pro

- Reaction score

- 40

Grab your ankles.

Paul Ryan's (R) bill to raise what we kick in for FERS retirement just passed the House with 218 votes this afternoon.

That sends the bill over to the Senate.

More:

Government News, Research and Events for Federal Employees - GovExec.com

Thank you SIR may I have another?

Betcha the President can be bipartisan on this one just like he did on the pay freeze!

James48843

TSP Talk Royalty

- Reaction score

- 910

Republicans propose federal pension hikes to fund student loan program

House Republicans have proposed increasing federal retirement contributions by 1.2 percent over the next three years to pay for a one-year extension of the reduced interest rate for student loans.

In a letter to President Obama dated Thursday, Republicans from both chambers of Congress rejected Senate Democrats’ proposal to pay for a one year extension of a reduced interest rate for subsidized Stafford student loans with a tax hike on small businesses. Republicans suggested three alternatives to the tax hike, the first of which targets federal employees’ pension contributions.

“We believe our alternative is reasonable and responsible, but in the interest of finding common ground,” Republican lawmakers wrote.

Under the proposal, those in the Civil Service Retirement System and those in the Federal Employees Retirement System would contribute 0.4 percent more to their pensions in calendar years 2012 through 2015. This would add up to a 1.2 percent increase over current contribution levels. The House passed a bill earlier this month that includes a 5 percent pension hike phased in over five years for CSRS and FERS employees.

And the HITS JUST KEEP ON COMING.....

you know, if the (R)'s were proposing that we payed 1.2% more, and those making over $250'k a year all payed 1.2% more on all sources of income, including capital gains, then I wouldn't be nearly as mad. But no- it's all got to be on the backs of federal workers, teachers, police officers, etc.

Where is the sacrifice by the richest 1%? Where is the surcharge on the over $1 million in CEO stock option tax?

I'M WAITING TO SEE WHAT THEY WILL CONTRIBUTE TO BALANCING THE BUDGET....

MORE:

Republicans propose federal pension hikes to fund student loan program - Pay & Benefits - GovExec.com

SkyPilot

TSP Pro

- Reaction score

- 40

For me the ironic part is that many of those who receive the benefit of the loan subsidy will be from families who are losing income by way of the proposed hike... it really does seem to be a war on federal employees. However, President Obama offered us up for the pay freeze as an accommodation and compromise first (or is my history muddled)? http://www.nytimes.com/2010/11/30/us/politics/30freeze.html

For me the disturbing part is why do we continue to subsidize an individual's education, that is at its very core a personal benefit to the individual? We're effectively taking money from everyone, to help out the few with their student loans. How is that fair? Oh wait, I remember: Upwards of 50% of American taxpayers don't end up paying a dime in federal tax each year so why would they care? Higher education is one of the biggest scams going (rivaled only by the global warming crowd), with costs rising year after year with ever increasing layers of bureaucracy (useless and unneeded adminstrators and professors who don't actually teach), offering degrees in nonsense. To think that everyone needs to go to college to "succeed" in life is ridicules. Like the judge said, "The world needs ditch diggers, too, Danny." The higher education crowd pushes and pushes more and more loan subsidies so they can in turn raise their tuition rates. Coupled with the younger generation believing education is their "right" and you've got a recipe for disaster. Why should I subsidize some young clown's desire to get a degree in the study of XYZ? Pay for it yourself. The government needs to get out of the student loan business entirely. Give it back to the banks and let the market decide what a fair price for an education is.

- Reaction score

- 823

For me the disturbing part is why do we continue to subsidize an individual's education, that is at its very core a personal benefit to the individual? We're effectively taking money from everyone, to help out the few with their student loans. How is that fair? Oh wait, I remember: Upwards of 50% of American taxpayers don't end up paying a dime in federal tax each year so why would they care? Higher education is one of the biggest scams going (rivaled only by the global warming crowd), with costs rising year after year with ever increasing layers of bureaucracy (useless and unneeded adminstrators and professors who don't actually teach), offering degrees in nonsense. To think that everyone needs to go to college to "succeed" in life is ridicules. Like the judge said, "The world needs ditch diggers, too, Danny." The higher education crowd pushes and pushes more and more loan subsidies so they can in turn raise their tuition rates. Coupled with the younger generation believing education is their "right" and you've got a recipe for disaster. Why should I subsidize some young clown's desire to get a degree in the study of XYZ? Pay for it yourself. The government needs to get out of the student loan business entirely. Give it back to the banks and let the market decide what a fair price for an education is.

If the banks would charge low interest then let the government get out of the loan business. I am paying back the government loans I took out for my daughters so they could get a college education and not be strapped down with at least $60,000.00 in debt before they even had a job. I am paying between 4 and 7.5% for those loans. I agree not everyone needs to go to college but the degree today is equal to the high school diploma I got and needed to get a good job. Don't blame the government for making loans available, let's blame the folks that are making a college degree unafordable to almost everyone. Back in the early 70's I could have gotten a BS for under $10,000.00. Now that $10,000.00 might get you room and board for the year not including classes and books. That's if you go to an inexpensive school. It is a right to expect a good education for our kids and we are not doing it. Our whole education system stinks in this country. I could go on and on and on, but I won't. OFF MY SOAPBOX!!!

Not everyone needs or wants to go to college. Why should all taxpayers be forced to subsidize those that do? Taxing the poor to pay for the elite!?!? The 'progressives' should be up in arms about such a scenario, but of course they're not, because it fits into their mold of "College for Everyone!" and "If only everyone was 'educated' we wouldn't have these problems!"

Not to mention that the majority of college administrators and professors are of a liberal bent, and it's no surprise college costs have gone up about 400% in the last thirty years. Do you think the value of that college education has increased proportionately? I don't think so. Ask the recent college grads, 50%+ of whom can't find a job. College costs have gone up precisely because of the cheap money available to fund it. Cheap money primarily made available by government backing and subsidies. Our tax dollars at work, to the tune of about $6 billion a year.

I've seen college graduates of late and many can't seem to string a coherent sentence together. I read a recent study that purported to show that many college students after their first two years actually knew less than when they entered. That should make any taxpayer feel good that they subsidized two years of copious amounts of alcohol consumption, smoking dope and getting laid vice actually learning (there's a concept!).

Sure, I'm generalizing a bit, but we all know the reality. For every one engineering student who actually studies and learns, and has a skill immediately transferrable to the economy, there's three more college students floating through classes for four to six years with absolutely nothing to show for it. The colleges and universities gladly take their money and eventually send them on their way with the peice of paper to hang on the wall.

It's common knowledge that college graduates make more money over their lifetime than non-college graduates. So why should we subsidize their education when they're going to make enough money to pay it back?

Not to mention that the majority of college administrators and professors are of a liberal bent, and it's no surprise college costs have gone up about 400% in the last thirty years. Do you think the value of that college education has increased proportionately? I don't think so. Ask the recent college grads, 50%+ of whom can't find a job. College costs have gone up precisely because of the cheap money available to fund it. Cheap money primarily made available by government backing and subsidies. Our tax dollars at work, to the tune of about $6 billion a year.

I've seen college graduates of late and many can't seem to string a coherent sentence together. I read a recent study that purported to show that many college students after their first two years actually knew less than when they entered. That should make any taxpayer feel good that they subsidized two years of copious amounts of alcohol consumption, smoking dope and getting laid vice actually learning (there's a concept!).

Sure, I'm generalizing a bit, but we all know the reality. For every one engineering student who actually studies and learns, and has a skill immediately transferrable to the economy, there's three more college students floating through classes for four to six years with absolutely nothing to show for it. The colleges and universities gladly take their money and eventually send them on their way with the peice of paper to hang on the wall.

It's common knowledge that college graduates make more money over their lifetime than non-college graduates. So why should we subsidize their education when they're going to make enough money to pay it back?

ILoveTDs

TSP Analyst

- Reaction score

- 10

It's common knowledge that college graduates make more money over their lifetime than non-college graduates. So why should we subsidize their education when they're going to make enough money to pay it back?

My understanding was the difference between a subsidize and un-subsidize loan was the government paid the interest on the subsidize loan for the 4-6 years while the individual was in school, with very few exceptions (military deployment, etc.). Once out of school the individual paid the principle and interest accrued there forth. An un-subsidize loan accrued and compounded interest while in school and the individual paid the principle and all interest since inception, is that not correct?

At least that is how I remember my subsidize school loan for my BS and my un-subsidize loan for my Masters. It made since to me at the time - I made $10 per hour while working on my BS, so they covered my interest while I worked on it. I made 80K a year while working on my Masters and they felt I could afford the interest.

I don't know - I just don't think 4-6 years student loan interest can really be that big of a budget ticket item, and if we can all agree with OBGibby above that "college graduates make more money over their lifetime" than they should have more income being taxed and usually end up in a higher tax bracket. I would place my money on the government gets that loan interest money back a few times fold over an individuals lifetime. One of the few government programs I think actually makes money. Just my two cents.

On a side note I think this whole discussion started because of the house bill passed this week to "continue the federal pay freeze in order to fund student loans". That's pure political maneuvering don't fall for it - these two things have nothing to do with each other.

James48843

TSP Talk Royalty

- Reaction score

- 910

... That should make any taxpayer feel good that they subsidized two years of copious amounts of alcohol consumption, smoking dope and getting laid vice actually learning (there's a concept!).

Woa-ah now! (bolts upright) Wait a minute. What school is that? Where can I sign up?

Today (Today’s Student Loan Recipients are Tomorrow’s Economic Elite)

".....since 2008 the Federal Government has effectively socialized the student loan market by enacting laws to eliminate private lender participation in administering Federal loans......"

".....student loans owned by the Federal Government have grown from $111 billion at the end of 2008 to $425 billion (L. 106) as of December 31, 2011, a compound annualized growth rate of 56%. With a 9% default rate among borrowers in the most recent cohort and no collateral to cushion default severities (there are added protections in bankruptcy), the program’s interest rate would be insufficient to cover expected credit losses at today’s default rates....."

".....With no externality or market failure to correct, the case for subsidized student loans seems to rest on the cost of college tuition and the fact that it has grown faster than the rate of inflation for many decades. But why should anyone believe the cost of tuition is exogenous to government subsidies?....."

".....Imagine a favorite area restaurant that grew so popular that the prices of its menu items grew well in excess of inflation. If the government provided cash and loan subsidies to help patrons of the restaurant finance their meals, the net effect on affordability would probably be nil, as the restaurant’s owners would likely respond by raising prices. By relaxing patrons’ budget constraints but doing nothing to control costs, the policy would simply increase demand for a good that’s already in fixed supply, which is clearly a recipe for inflation....."

".....The effect of cash and loan subsidies for higher education are unlikely to be any different. Colleges and universities have simply responded to the subsidies through increased tuition and housing costs. While the share of the population with college degrees has increased to a high of 30%, college completion rates have fallen as the increase in enrollment has not been matched by a similar increase in graduates. The student loan program appears to have stimulated enrollments, without a corresponding increase in graduates. This leaves households in the worst position of all, with the added debt associated with student loans but no degree to show for them....."

".....since 2008 the Federal Government has effectively socialized the student loan market by enacting laws to eliminate private lender participation in administering Federal loans......"

".....student loans owned by the Federal Government have grown from $111 billion at the end of 2008 to $425 billion (L. 106) as of December 31, 2011, a compound annualized growth rate of 56%. With a 9% default rate among borrowers in the most recent cohort and no collateral to cushion default severities (there are added protections in bankruptcy), the program’s interest rate would be insufficient to cover expected credit losses at today’s default rates....."

".....With no externality or market failure to correct, the case for subsidized student loans seems to rest on the cost of college tuition and the fact that it has grown faster than the rate of inflation for many decades. But why should anyone believe the cost of tuition is exogenous to government subsidies?....."

".....Imagine a favorite area restaurant that grew so popular that the prices of its menu items grew well in excess of inflation. If the government provided cash and loan subsidies to help patrons of the restaurant finance their meals, the net effect on affordability would probably be nil, as the restaurant’s owners would likely respond by raising prices. By relaxing patrons’ budget constraints but doing nothing to control costs, the policy would simply increase demand for a good that’s already in fixed supply, which is clearly a recipe for inflation....."

".....The effect of cash and loan subsidies for higher education are unlikely to be any different. Colleges and universities have simply responded to the subsidies through increased tuition and housing costs. While the share of the population with college degrees has increased to a high of 30%, college completion rates have fallen as the increase in enrollment has not been matched by a similar increase in graduates. The student loan program appears to have stimulated enrollments, without a corresponding increase in graduates. This leaves households in the worst position of all, with the added debt associated with student loans but no degree to show for them....."

James48843

TSP Talk Royalty

- Reaction score

- 910

...That should make any taxpayer feel good that they subsidized two years of copious amounts of alcohol consumption, smoking dope and getting laid vice actually learning (there's a concept!).

You know, I have always been a strong supporter of "life-long learning".

World's oldest graduate, Aussie grandfather picks up fourth degree aged 97

A 97-year-old Aussie man will become the world's oldest university graduate, more than seven decades after attaining his fourth degree.

Allan Stewart became the world's oldest graduate when he earned a law degree aged 91.

He will surpass his own record on Friday when he graduates with a Master of Clinical Science (Complementary Medicine) from Southern Cross University in Lismore.

Mr Stewart, a former career dentist now living at Port Stephens on the state's mid-north coast, said that at 97 years and 58 days, his fourth university degree may be his last.

"I can hang up my mortar board and academic robes after this one, although I said that after my last degree and then I got bored," he said in a statement.

"I have so much time on my hands these days and I like to keep mentally active."

More:

http://www.tntmagazine.com/news/wor...ie-grandfather-picks-up-fourth-degree-aged-97

I always wondered why that guy on the billboard was smiling.

Heck, even old guys like me really need to go back to school.

...they subsidized two years of copious amounts of alcohol consumption, smoking dope and getting laid...

Did I mention that really old guys like me ought to go back to school?

I know I was thinking, maybe I would go back to school.

Yeh, that's the ticket. I could go back and get a second degree. That would be really good.

What school did you say that was?

Last edited:

- Reaction score

- 823

Today (Today’s Student Loan Recipients are Tomorrow’s Economic Elite)

".....since 2008 the Federal Government has effectively socialized the student loan market by enacting laws to eliminate private lender participation in administering Federal loans......"

".....student loans owned by the Federal Government have grown from $111 billion at the end of 2008 to $425 billion (L. 106) as of December 31, 2011, a compound annualized growth rate of 56%. With a 9% default rate among borrowers in the most recent cohort and no collateral to cushion default severities (there are added protections in bankruptcy), the program’s interest rate would be insufficient to cover expected credit losses at today’s default rates....."

".....With no externality or market failure to correct, the case for subsidized student loans seems to rest on the cost of college tuition and the fact that it has grown faster than the rate of inflation for many decades. But why should anyone believe the cost of tuition is exogenous to government subsidies?....."

".....Imagine a favorite area restaurant that grew so popular that the prices of its menu items grew well in excess of inflation. If the government provided cash and loan subsidies to help patrons of the restaurant finance their meals, the net effect on affordability would probably be nil, as the restaurant’s owners would likely respond by raising prices. By relaxing patrons’ budget constraints but doing nothing to control costs, the policy would simply increase demand for a good that’s already in fixed supply, which is clearly a recipe for inflation....."

".....The effect of cash and loan subsidies for higher education are unlikely to be any different. Colleges and universities have simply responded to the subsidies through increased tuition and housing costs. While the share of the population with college degrees has increased to a high of 30%, college completion rates have fallen as the increase in enrollment has not been matched by a similar increase in graduates. The student loan program appears to have stimulated enrollments, without a corresponding increase in graduates. This leaves households in the worst position of all, with the added debt associated with student loans but no degree to show for them....."

Let's agree to disagree. I have no problem with the government offering lower percentage loans than banks for higher education. If these loans provide a chance for low income or middle income kids to get a good education I'm for it. If you want to talk about government subsidies lets look at the oil companies or some of our largest companies. How about the farming industy? Without the loans my girls wouldn't have gone to college. My youngest is a good Interior Designer and my eldest is helping run a well established catering company. I mean this with all sincerety, if you were able to send your children to college without taking out loans that is fantastic and I really mean it. I needed to take advantage of the loans.

Khotso

Market Veteran

- Reaction score

- 27

Today (Today’s Student Loan Recipients are Tomorrow’s Economic Elite)

".....since 2008 the Federal Government has effectively socialized the student loan market by enacting laws to eliminate private lender participation in administering Federal loans......"

....."

Frankly, our system of public higher education is royally screwed up these days. The average middle class family cannot afford the cost of higher education today regardless of how loans are financed. At their current price, BAs or BSs are hardly worth it! Why in the F are public universities costing $80,000 and up for a 4 year degree?!! Stop bitching about "socialized" student loans and bitch about the real problem instead. Geesh !!!!!!

Similar threads

- Replies

- 18

- Views

- 5K

- Replies

- 2

- Views

- 1K