I knew we could see another Monday rally today, but I didn't think it would hold up particularly well. We got the rally alright, and the market did close well off its highs today. But it was more strength than might usually be expected. It doesn't feel right either. Another gap up day, another target to the downside.

I get the feeling today's action is a set-up for Friday/Monday's trading. Especially Monday. We've seen these rallies too often to start a trading week, and if we continue to melt up this week, I'd not be surprised by a reversal come next Monday. But that's getting ahead of myself.

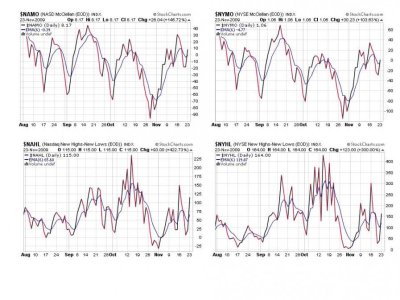

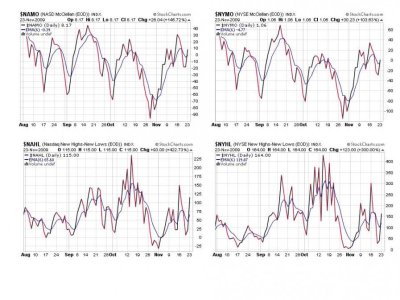

The Seven Sentinels indeed improved today, but not quite enough for a buy signal. As usual BPCOMPQ is the laggard. But it did move up a bit, which is more than it's done on most trading days the past month or so.

Here's the charts:

Yes, they're all flashing a buy today. But I don't think we got enough weakness to fulfill the current sell signal. I have to think these signals have more work to do on the down side.

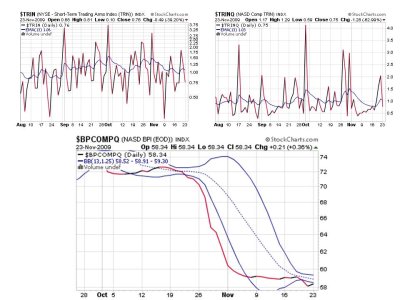

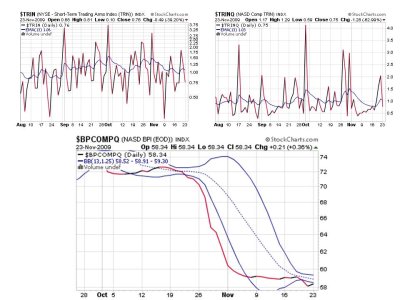

TRIN and TRINQ both flipped to buys and as I mentioned previously, BPCOMPQ is still on a sell, albeit barely.

But I don't trust today's strength. Not unless we're getting ready to blow past previous highs again. And that's a possibility, but I don't like the fast action. I'd be more comfortable if we dropped another 20 - 30 points on the S&P first before another buy signal is issued. And with Black Friday looming I think next Monday may be a big day. In which direction I can't be sure. It depends on how we trade the rest of this week. But today feels like the table is being set for some short term big plays.

Of one thing I'm certain, you can always be sure da boyz aren't about to make things any easier for us.

I get the feeling today's action is a set-up for Friday/Monday's trading. Especially Monday. We've seen these rallies too often to start a trading week, and if we continue to melt up this week, I'd not be surprised by a reversal come next Monday. But that's getting ahead of myself.

The Seven Sentinels indeed improved today, but not quite enough for a buy signal. As usual BPCOMPQ is the laggard. But it did move up a bit, which is more than it's done on most trading days the past month or so.

Here's the charts:

Yes, they're all flashing a buy today. But I don't think we got enough weakness to fulfill the current sell signal. I have to think these signals have more work to do on the down side.

TRIN and TRINQ both flipped to buys and as I mentioned previously, BPCOMPQ is still on a sell, albeit barely.

But I don't trust today's strength. Not unless we're getting ready to blow past previous highs again. And that's a possibility, but I don't like the fast action. I'd be more comfortable if we dropped another 20 - 30 points on the S&P first before another buy signal is issued. And with Black Friday looming I think next Monday may be a big day. In which direction I can't be sure. It depends on how we trade the rest of this week. But today feels like the table is being set for some short term big plays.

Of one thing I'm certain, you can always be sure da boyz aren't about to make things any easier for us.