The bulls really turned it on today, adding significant gains on top of those achieved in last weeks trading.

While it certainly feels good to be fully exposed to this upward move today, it is a hollow feeling for me, as I've seen this action over and over these past few months and have been unable to capitalize on these advances as the reversals have quickly wiped out the gains.

I have managed to get in front of a large chunk of these advances on numerous occasions now, and I have to say that in this volatile market I feel compelled to begin using preemptive measures to lock in gains as our TSP accounts have no ability to move as quick as this market does. This is not the way I wanted to use the Seven Sentinels, but as Boghie said once, our TSP accounts are not designed to be traded. He is correct.

So I'm looking for an exit strategy. The Seven Sentinels have shown a wonderful ability to put me in a position to increase my bottom line, but I have to start moving quicker if I want to keep it.

After reviewing today's charts, that time may be getting close already. Take a look:

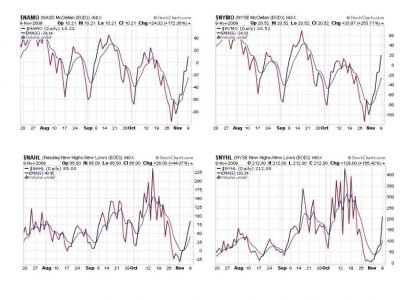

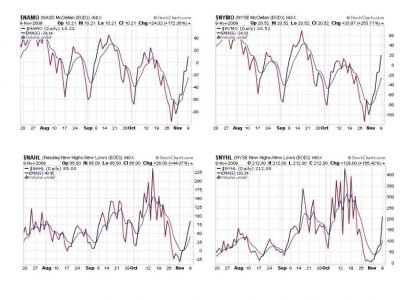

NAMO AND NYMO are quickly advancing to their highs of the past few months, pretty much equaling October's high, but not yet reaching that of September and July. NAHL and NYHL are about at the half-way point to October's highs and could have more upside left.

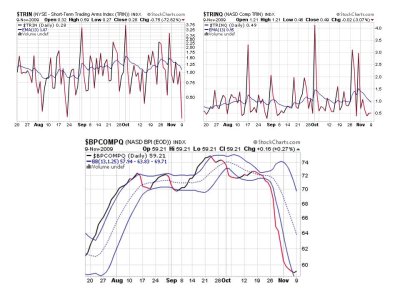

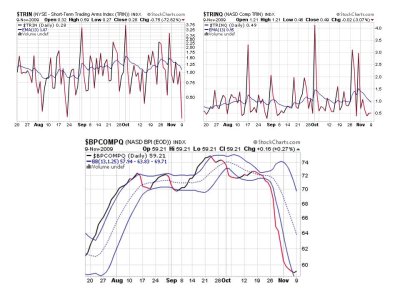

TRIN has spiked lower while TRINQ remained largely unchanged. BPCOMPQ finally turned a little bit positive.

So all seven remain in a buy condition, but I am not sure what to expect at this point. I am a little bit surprised that BPCOMPQ has shown so little movement to the upside after all this buying pressure. Do I wait for it to move higher first before considering selling my position? Or should my finger be on the trigger now? Remember, none of the signals are yet flashing sell signals, so I would expect that to mean I have a little more time to stay long.

If the signals do begin to show any weakness it may be time to get out. Waiting for a sell signal has cost me significant gains since Summer.

Also a consideration is the fact that I'll be out of IFTs by about the mid-month point, assuming I sell this week. I am willing to forgo any further potential gains however, but others following this system may feel differently.

For now, my plan is to watch the action day to day looking for my spot to sell. It could come any day now. I have my eye on BPCOMPQ, but mostly I'm looking for the first signs of weakness to set in. We've moved quickly to the upside once again, and I think we may hit 1100 on the S&P soon. After that, it's a tough call. But this isn't my Scottrade account, and that's foremost on my mind.

While it certainly feels good to be fully exposed to this upward move today, it is a hollow feeling for me, as I've seen this action over and over these past few months and have been unable to capitalize on these advances as the reversals have quickly wiped out the gains.

I have managed to get in front of a large chunk of these advances on numerous occasions now, and I have to say that in this volatile market I feel compelled to begin using preemptive measures to lock in gains as our TSP accounts have no ability to move as quick as this market does. This is not the way I wanted to use the Seven Sentinels, but as Boghie said once, our TSP accounts are not designed to be traded. He is correct.

So I'm looking for an exit strategy. The Seven Sentinels have shown a wonderful ability to put me in a position to increase my bottom line, but I have to start moving quicker if I want to keep it.

After reviewing today's charts, that time may be getting close already. Take a look:

NAMO AND NYMO are quickly advancing to their highs of the past few months, pretty much equaling October's high, but not yet reaching that of September and July. NAHL and NYHL are about at the half-way point to October's highs and could have more upside left.

TRIN has spiked lower while TRINQ remained largely unchanged. BPCOMPQ finally turned a little bit positive.

So all seven remain in a buy condition, but I am not sure what to expect at this point. I am a little bit surprised that BPCOMPQ has shown so little movement to the upside after all this buying pressure. Do I wait for it to move higher first before considering selling my position? Or should my finger be on the trigger now? Remember, none of the signals are yet flashing sell signals, so I would expect that to mean I have a little more time to stay long.

If the signals do begin to show any weakness it may be time to get out. Waiting for a sell signal has cost me significant gains since Summer.

Also a consideration is the fact that I'll be out of IFTs by about the mid-month point, assuming I sell this week. I am willing to forgo any further potential gains however, but others following this system may feel differently.

For now, my plan is to watch the action day to day looking for my spot to sell. It could come any day now. I have my eye on BPCOMPQ, but mostly I'm looking for the first signs of weakness to set in. We've moved quickly to the upside once again, and I think we may hit 1100 on the S&P soon. After that, it's a tough call. But this isn't my Scottrade account, and that's foremost on my mind.