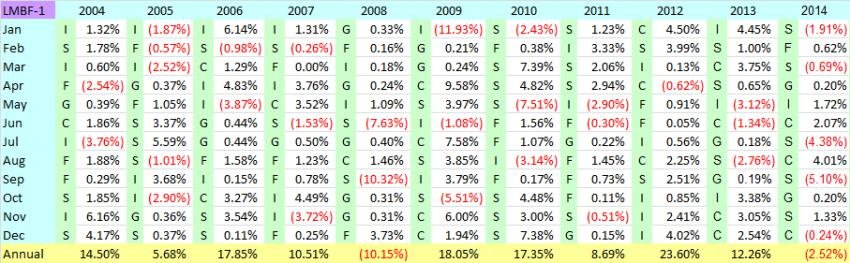

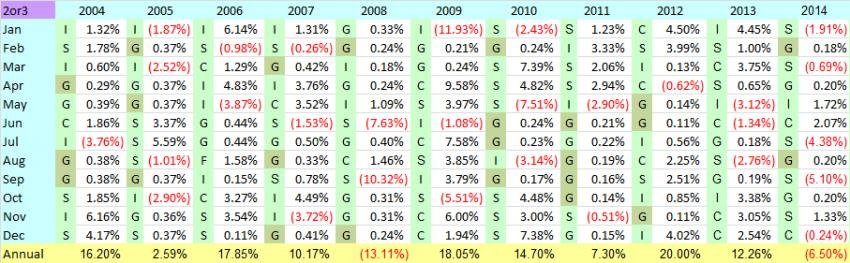

Yes, I saw the original post. I was going to wait until James clarified the rules and settled on what exactly he wanted instead of working on something only to have him tweak it some more. For example, if you look at his original post he stated: "two out of three of the stock/bond funds are in negative territory." Does he mean 2 out of the 3 stock funds (C, S & I) or does he mean 2 out of the 4 funds F, C, S & I. If it's the latter you might as well say any 2 funds since G doesn't go negative (heaven help us if it did). So if C & S are positive and F & I are negative we go to G. That is the way I understand his tweak. Also further down he mentions avoiding "F". What does that mean? Does he mean if LMBF is F we go to G? Does he mean we don't even use F but only the other 4 funds? This isn't clear yet and may not even have been decided until it occurs. Anyways, if I look at producing any back-tested results it would be based on LMBF-1 instead of LMBF. Remember I originally developed LMBF-1 because it was a lot easier to work with and less error prone than working with historical LMBF data in spreadsheets.

OK, Catus, since James is MIA on this, I'm going to have a go at the interpretation game.......

I think James was just using the stock funds as the litmus test as to which fund to IFT into. I think he meant that if say C and I were negative, and S came out on top, similar to December, you would IFT into G. S fund had a nice gain early on in the month, but the trend was definitely heading down.

As far as the F fund, I think he was just tossing that out when it came to the decision IF 2 out of the 3 stock funds were down, and the third one outperformed all the other funds including the F fund.

So, if F wins for the month, you IFT to F. If S wins overall, and 2 of the 3 stock funds are positive, you IFT into S, if C and I are in the red, you IFT into G.

James? James? Hello, hello. testing. testing, is this thing on?? Did I get this right? I'll take a no response as a big "yes", you got it right...:nuts:

Now, as you stated, you could run this using LMBF-1, and the other alternates (LMBF-1 G-->F, LMBF -1 C--S, etc.).