Here are the results through the end of August, and as you can see, August was another month like June where, except for the G Fund, all funds were negative. That, as we now know, led to the tremendous equities rally in July while most of the LMBF family was in the safety of the G Fund. They, of course, joined the fun in the S Fund in August only to miss out on the gains.

[TD="bgcolor: #99CCFF, align: center"]G[/TD]

[TD="bgcolor: #99CCFF, align: center"]F[/TD]

[TD="bgcolor: #99CCFF, align: center"]C[/TD]

[TD="bgcolor: #99CCFF, align: center"]S[/TD]

[TD="bgcolor: #99CCFF, align: center"]I[/TD]

[TD="bgcolor: #99CCFF, align: center"]LMBF[/TD]

[TD="bgcolor: #99CCFF, align: center"]LMBF-1[/TD]

[TD="bgcolor: #99CCFF, align: center"]C>S[/TD]

[TD="bgcolor: #99CCFF, align: center"]CI>S[/TD]

[TD="bgcolor: #99CCFF, align: center"]SIM[/TD]

[TD="bgcolor: #99CCFF, align: center"]LMWF-1[/TD]

[TD="bgcolor: #FF99CC, align: left"]Jan[/TD]

[TD="align: right"]0.13%[/TD]

[TD="align: right"]

(0.56%)

[/TD]

[TD="align: right"]5.18%[/TD]

[TD="align: right"]6.96%[/TD]

[TD="align: right"]4.45%[/TD]

[TD="align: right"]4.45%[/TD]

[TD="align: right"]4.45%[/TD]

[TD="align: right"]4.45%[/TD]

[TD="align: right"]6.96%[/TD]

[TD="align: right"]4.45%[/TD]

[TD="align: right"]

(0.56%)

[/TD]

[TD="bgcolor: #FF99CC, align: left"]Feb[/TD]

[TD="align: right"]0.13%[/TD]

[TD="align: right"]0.51%[/TD]

[TD="align: right"]1.36%[/TD]

[TD="align: right"]1.00%[/TD]

[TD="align: right"]

(0.99%)

[/TD]

[TD="align: right"]0.66%[/TD]

[TD="align: right"]1.00%[/TD]

[TD="align: right"]1.00%[/TD]

[TD="align: right"]1.00%[/TD]

[TD="align: right"]1.00%[/TD]

[TD="align: right"]0.51%[/TD]

[TD="bgcolor: #FF99CC, align: left"]Mar[/TD]

[TD="align: right"]0.13%[/TD]

[TD="align: right"]0.07%[/TD]

[TD="align: right"]3.75%[/TD]

[TD="align: right"]4.69%[/TD]

[TD="align: right"]0.88%[/TD]

[TD="align: right"]3.57%[/TD]

[TD="align: right"]3.75%[/TD]

[TD="align: right"]4.69%[/TD]

[TD="align: right"]4.69%[/TD]

[TD="align: right"]3.75%[/TD]

[TD="align: right"]0.88%[/TD]

[TD="bgcolor: #FF99CC, align: left"]Apr[/TD]

[TD="align: right"]0.12%[/TD]

[TD="align: right"]1.02%[/TD]

[TD="align: right"]1.93%[/TD]

[TD="align: right"]0.65%[/TD]

[TD="align: right"]5.32%[/TD]

[TD="align: right"]1.27%[/TD]

[TD="align: right"]0.65%[/TD]

[TD="align: right"]0.65%[/TD]

[TD="align: right"]0.65%[/TD]

[TD="align: right"]0.65%[/TD]

[TD="align: right"]1.02%[/TD]

[TD="bgcolor: #FF99CC, align: left"]May[/TD]

[TD="align: right"]0.12%[/TD]

[TD="align: right"]

(1.78%)

[/TD]

[TD="align: right"]2.34%[/TD]

[TD="align: right"]2.71%[/TD]

[TD="align: right"]

(3.12%)

[/TD]

[TD="align: right"]

(4.67%)

[/TD]

[TD="align: right"]

(3.12%)

[/TD]

[TD="align: right"]

(3.12%)

[/TD]

[TD="align: right"]2.71%[/TD]

[TD="align: right"]

(1.78%)

[/TD]

[TD="align: right"]2.71%[/TD]

[TD="bgcolor: #FF99CC, align: left"]Jun[/TD]

[TD="align: right"]0.14%[/TD]

[TD="align: right"]

(1.53%)

[/TD]

[TD="align: right"]

(1.34%)

[/TD]

[TD="align: right"]

(0.99%)

[/TD]

[TD="align: right"]

(2.77%)

[/TD]

[TD="align: right"]

(0.79%)

[/TD]

[TD="align: right"]

(1.34%)

[/TD]

[TD="align: right"]

(0.99%)

[/TD]

[TD="align: right"]

(0.99%)

[/TD]

[TD="align: right"]

(1.53%)

[/TD]

[TD="align: right"]

(1.53%)

[/TD]

[TD="bgcolor: #FF99CC, align: left"]Jul[/TD]

[TD="align: right"]0.18%[/TD]

[TD="align: right"]0.13%[/TD]

[TD="align: right"]5.10%[/TD]

[TD="align: right"]6.88%[/TD]

[TD="align: right"]5.29%[/TD]

[TD="align: right"]1.43%[/TD]

[TD="align: right"]0.18%[/TD]

[TD="align: right"]0.18%[/TD]

[TD="align: right"]0.18%[/TD]

[TD="align: right"]0.13%[/TD]

[TD="align: right"]5.29%[/TD]

[TD="bgcolor: #FF99CC, align: left"]Aug[/TD]

[TD="align: right"]0.18%[/TD]

[TD="align: right"]

(0.48%)

[/TD]

[TD="align: right"]

(2.89%)

[/TD]

[TD="align: right"]

(2.76%)

[/TD]

[TD="align: right"]

(1.31%)

[/TD]

[TD="align: right"]

(4.32%)

[/TD]

[TD="align: right"]

(2.76%)

[/TD]

[TD="align: right"]

(2.76%)

[/TD]

[TD="align: right"]

(2.76%)

[/TD]

[TD="align: right"]

(0.48%)

[/TD]

[TD="align: right"]

(0.48%)

[/TD]

[TD="bgcolor: #CCFFCC, align: left"]YTD[/TD]

[TD="bgcolor: #CCFFCC, align: right"]1.12%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]

(2.62%)

[/TD]

[TD="bgcolor: #CCFFCC, align: right"]16.18%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]20.30%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]7.56%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]1.22%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]2.57%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]3.87%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]12.77%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]6.18%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]7.95%[/TD]

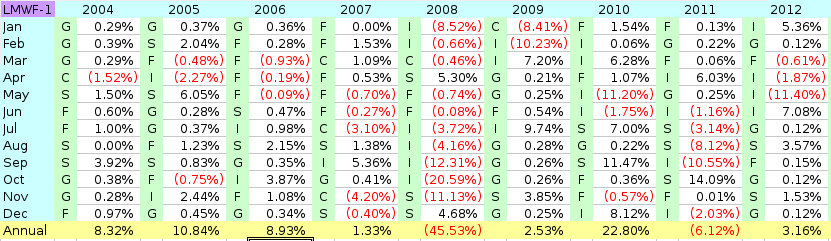

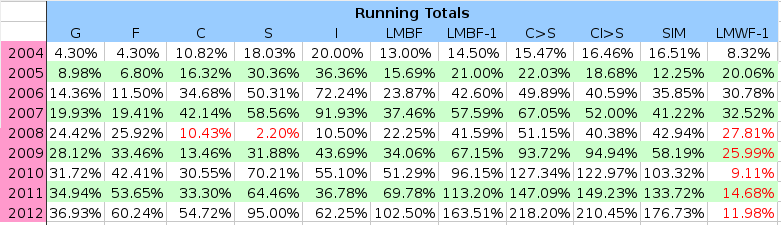

This is getting old. All was well with the LMBF family for the first four months of 2013 but since May it's been a downhill slide. The monthly allocations appear to have gotten 180 degrees out of sync, being out when they should be in and vice versa. Will this continue in September? Let's hope not, but hoping is no way to invest.

was brought up in this thread again recently. So with 4 bad months, I decided to add LMWF-1 to our list this time around. Could it be any worse? Take a look; you'd be surprised.

OK, what are these numbers telling us? Really, it's nothing new.

. Even with the losses they accrued in August, they are way in the lead. They just can't be beat. I'm sorry to be a broken record but so far it holds true. This doesn't appear to be the year for systems like LMBF.

Really?! How bad is it? Well, look at LMBF, LMBF-1 and C>S. They are worse off now than they were at the end of January. Their yearly gains are almost wiped out and they will be on hold in the G Fund earning zilch for September. Historically that's the weakest month of the year so maybe this time it's fortuitous. It's time that things turn around for these funds. LMBF is @ 782 out of 1053 on the AT. It's closing in on the bottom quarter -- not a goal we want it to achieve.

Things don't look that bad for CI>S but that is because it was in the S Fund until July. It essentially benefited from a Buy-N-Hold of the S Fund for most of the year and therefore has a higher base to fall from. I wouldn't count on this happening all the time.

SIM is still living up to its purpose to beat LMBF-1 by being in the F Fund during the weaker 6 months of the year. This month it claimed another victory by beating LMBF, LMBF-1 and C>S. Things definitely look good for SIM here.

Now for the disturbing news. LMWF-1 beat all methods except CI>S. :blink: What's up with that? This makes it look like there is nothing to any of these methods and simply throwing darts every month could produce equal results. Maybe it can, but remember that the last time we looked at LMWF-1 was this spring when things were going well for the LMBF family and poorly for LMWF-1. We've now had 4 months of poor performance for the LMBF family and LMWF-1 has caught up. How did it do it?

It's these 4 months that made me want to look at LMWF-1 again. Does it do well during down times? Let's see. It chose funds with better returns in April and May. May was a real score as most of the LMBF family was negative. June on the other hand was a loss with LMWF-1 choosing a fund that lost more than the others. That was made up in August where LMWF-1 chose a fund that lost less than the others.

The month that really made a difference was July. While the LMBF family was locked up in the safety of the G Fund, LMWF-1 was in equities. It chose the I Fund instead of the winning S Fund, but being in any of the equities (C, S, or I) during this rally was enough to score it the lead. That was quite a rally. Remember I said last month that the S Fund made more in July than all but one of the LMBF family made all year. What a difference a month can make. Will it happen again? The fund allocations did line up. The LMBF family, except for SIM, are in the G Fund for September and LMWF-1 is in the C Fund. I wouldn't advise it, but there you have it.

Well, I still think this is a 1 month fluke for LMWF-1 but I guess I better go back and back test it to compare the historical results to the LMBF family. Stay tuned.

.