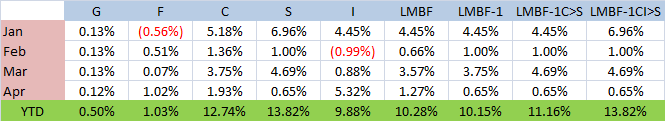

Here are the results through May 31, 2013 and as you can see, we are starting to see more differentiation between the LMBF-1 variants.

[TD="bgcolor: #99CCFF, align: center"]G[/TD]

[TD="bgcolor: #99CCFF, align: center"]F[/TD]

[TD="bgcolor: #99CCFF, align: center"]C[/TD]

[TD="bgcolor: #99CCFF, align: center"]S[/TD]

[TD="bgcolor: #99CCFF, align: center"]I[/TD]

[TD="bgcolor: #99CCFF, align: center"]LMBF[/TD]

[TD="bgcolor: #99CCFF, align: center"]LMBF-1[/TD]

[TD="bgcolor: #99CCFF, align: center"]C>S[/TD]

[TD="bgcolor: #99CCFF, align: center"]CI>S[/TD]

[TD="bgcolor: #99CCFF, align: center"]SIM[/TD]

[TD="bgcolor: #FF99CC, align: left"]Jan[/TD]

[TD="align: right"]0.13%[/TD]

[TD="align: right"](0.56%)[/TD]

[TD="align: right"]5.18%[/TD]

[TD="align: right"]6.96%[/TD]

[TD="align: right"]4.45%[/TD]

[TD="align: right"]4.45%[/TD]

[TD="align: right"]4.45%[/TD]

[TD="align: right"]4.45%[/TD]

[TD="align: right"]6.96%[/TD]

[TD="align: right"]4.45%[/TD]

[TD="bgcolor: #FF99CC, align: left"]Feb[/TD]

[TD="align: right"]0.13%[/TD]

[TD="align: right"]0.51%[/TD]

[TD="align: right"]1.36%[/TD]

[TD="align: right"]1.00%[/TD]

[TD="align: right"](0.99%)[/TD]

[TD="align: right"]0.66%[/TD]

[TD="align: right"]1.00%[/TD]

[TD="align: right"]1.00%[/TD]

[TD="align: right"]1.00%[/TD]

[TD="align: right"]1.00%[/TD]

[TD="bgcolor: #FF99CC, align: left"]Mar[/TD]

[TD="align: right"]0.13%[/TD]

[TD="align: right"]0.07%[/TD]

[TD="align: right"]3.75%[/TD]

[TD="align: right"]4.69%[/TD]

[TD="align: right"]0.88%[/TD]

[TD="align: right"]3.57%[/TD]

[TD="align: right"]3.75%[/TD]

[TD="align: right"]4.69%[/TD]

[TD="align: right"]4.69%[/TD]

[TD="align: right"]3.75%[/TD]

[TD="bgcolor: #FF99CC, align: left"]Apr[/TD]

[TD="align: right"]0.12%[/TD]

[TD="align: right"]1.02%[/TD]

[TD="align: right"]1.93%[/TD]

[TD="align: right"]0.65%[/TD]

[TD="align: right"]5.32%[/TD]

[TD="align: right"]1.27%[/TD]

[TD="align: right"]0.65%[/TD]

[TD="align: right"]0.65%[/TD]

[TD="align: right"]0.65%[/TD]

[TD="align: right"]0.65%[/TD]

[TD="bgcolor: #FF99CC, align: left"]May[/TD]

[TD="align: right"]0.12%[/TD]

[TD="align: right"](1.78%)[/TD]

[TD="align: right"]2.34%[/TD]

[TD="align: right"]2.71%[/TD]

[TD="align: right"](3.12%)[/TD]

[TD="align: right"](4.67%)[/TD]

[TD="align: right"](3.12%)[/TD]

[TD="align: right"](3.12%)[/TD]

[TD="align: right"]2.71%[/TD]

[TD="align: right"](1.78%)[/TD]

[TD="bgcolor: #CCFFCC, align: left"]YTD[/TD]

[TD="bgcolor: #CCFFCC, align: right"]0.62%[/TD]

[TD="bgcolor: #CCFFCC, align: right"](0.76%)[/TD]

[TD="bgcolor: #CCFFCC, align: right"]15.38%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]16.91%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]6.46%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]5.13%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]6.72%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]7.69%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]16.91%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]8.20%[/TD]

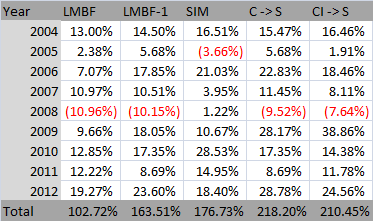

The Buy-and-Hold crowd are still firmly in the lead. Holding S and/or C Funds has been the most profitable so far this year. Will this continue? I don't know. Volatility has started to pick at the end of May.

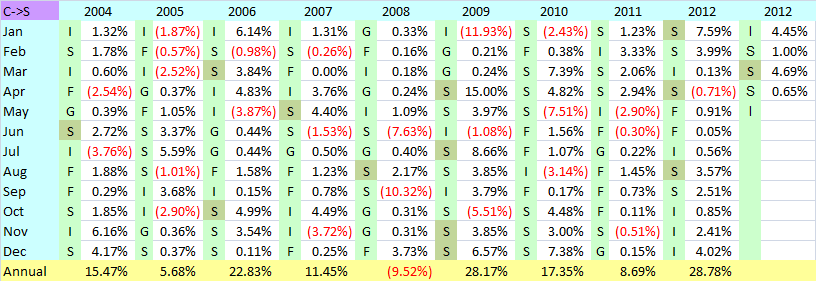

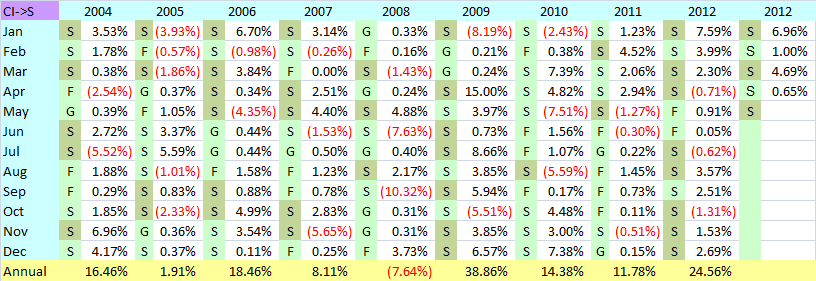

LMBF, LMBF-1, and C>S all took a significant loss in May by being fully invested in the I Fund which had the worst return of our 5 Funds. LMBF is on the TSPTalk AutoTracker and was in the top quintile (top 20%) for the 1st quarter of 2013. It has now fallen to the middle of the pack being at #585 out of 1104.

An interesting sidenote is that LMBF & LMBF-1 will be going into different Funds in June so we should be seeing even more differentiation between these two Methods. LMBF-1 has IFTed into the C Fund and LMBF should IFT into the S Fund by noon eastern Monday. This doesn't happen often, but when two funds are as close as the C & S Fund were on May 30 (only 0.05% difference) they can easily swap positions the next day.

The big surprize came with the SIM Method. It is invested in the F Fund which has been loosing money all month while the equity funds were going up. I felt sorry for those in the Sell-In-May crowd because it didn't seem to work this year. Well surprize, surprize. Come the end of the month, it didn't loose as much as the I Fund, so it is now better off than LMBF, LMBF-1, or C>S. That being the whole intent of this method, it did work for May!

Finally, we have CI>S. It is the clear winner of all the LMBF-1 variants to date. That is because it's been in the S Fund all year so it is, in effect, emmulating Buy-and-Hold so far. I have been asked to continue to post the IFTs for this method, so I will be doing that as well as analyzing it here. That will become more interesting when it leaves the S Fund.

On final note for those of you who feel bad about how much we lost this month. This is a monthly Set-It-And-Forget-It type plan and they do jump around a lot month to month. Take a look at the tables I published at the beginning of this thread and you can see it does produce months with large losses even in years that turned out rather well. If you can't handle that, these methods are not for you and you should probably look at something else. What ever you do, don't base your decision on emotion. That <b>doesn't</b> work. I can vouch for that.

So much for April being the 2nd best month for the market. Oh well, the question you have to ask yourself now is are you going to stick with the traditional LMBF/LMBF-1 or try ILoveTD's seasonal variant where you Sell-In-May and walk away. ILoveTD automatically has you in the F Fund from May through October and in LMBF the other months. I will track that here as LMBF-1SIM, but probably won't use it myself. It should be interesting to see the difference this summer.