At the close Friday, the S&P 500 and DOW logged their seventh weekly loss out of the last eight weeks (-0.24% and -0.58% respectively). But the Nasdaq and the Russel 2000 logged robust gains of 1.39% and 2.05%.

Is that bullish or bearish?

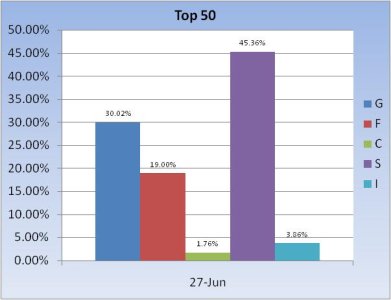

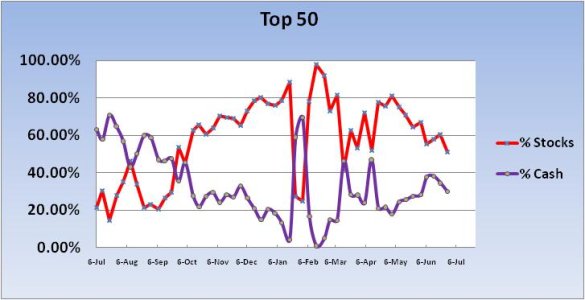

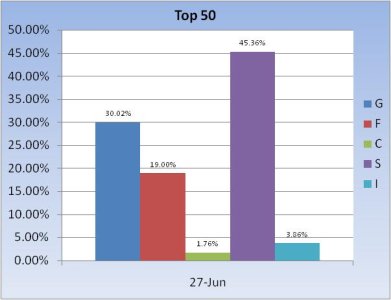

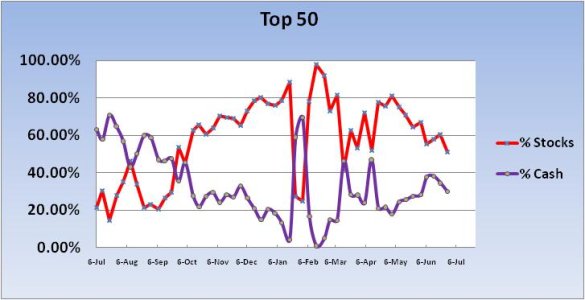

If our sentiment is any indication it must have been bearish as our sentiment survey remained in a buy condition for the fourth straight week. And our stock allocation agrees with our sentiment as shown on this week's charts:

The Top 50 dropped their stock allocations going into next week by a sizable 9.4%. This group now has a collective 49% of their allocation spread between the G and F funds. Their stock allocation is down to 51%.

That's notable as this group is very close to having more cash and bonds than stocks.

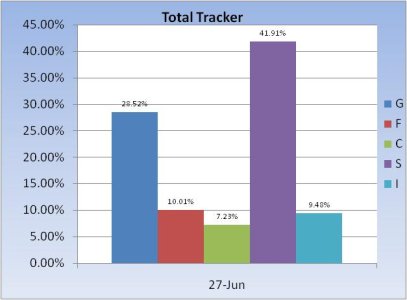

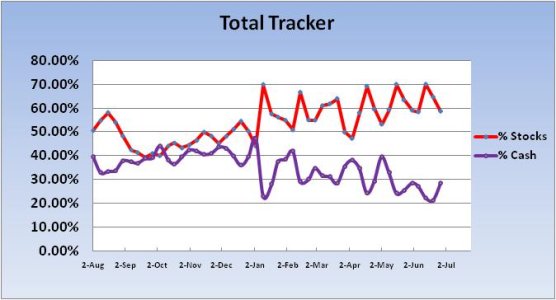

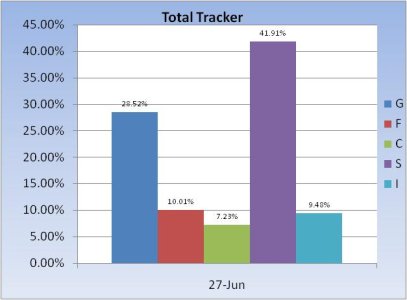

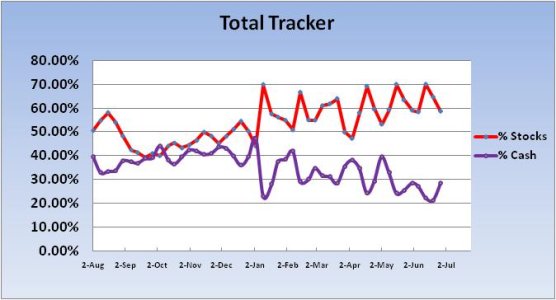

The herd (the entire tracker) also dropped their collective stock allocation, although their allocation is much higher at about 59%.

So where's the market going? If 7 of 8 down weeks for the S&P 500 and the DOW is bearish, than what do we make of those gains in the Nasdaq and Russel 2000?

Small caps and technology lead the market, right? So this ought to be a very interesting week given those numbers. My guess remains higher prices by the end of this week.

Is that bullish or bearish?

If our sentiment is any indication it must have been bearish as our sentiment survey remained in a buy condition for the fourth straight week. And our stock allocation agrees with our sentiment as shown on this week's charts:

The Top 50 dropped their stock allocations going into next week by a sizable 9.4%. This group now has a collective 49% of their allocation spread between the G and F funds. Their stock allocation is down to 51%.

That's notable as this group is very close to having more cash and bonds than stocks.

The herd (the entire tracker) also dropped their collective stock allocation, although their allocation is much higher at about 59%.

So where's the market going? If 7 of 8 down weeks for the S&P 500 and the DOW is bearish, than what do we make of those gains in the Nasdaq and Russel 2000?

Small caps and technology lead the market, right? So this ought to be a very interesting week given those numbers. My guess remains higher prices by the end of this week.