G

Guest

Guest

imported post

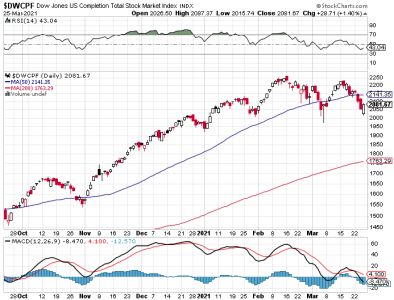

Just made the 100% move to the S fund for the Friday jobs report coupled with oil going down. Will probably bank the gains and back to g for Monday.

Watch and see.

Just made the 100% move to the S fund for the Friday jobs report coupled with oil going down. Will probably bank the gains and back to g for Monday.

Watch and see.