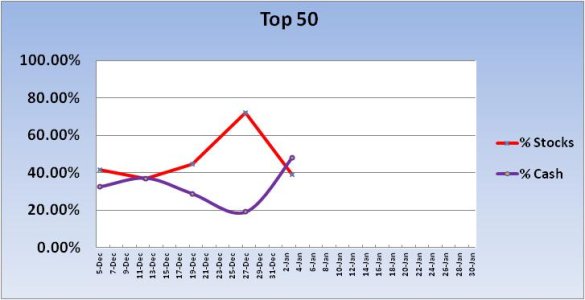

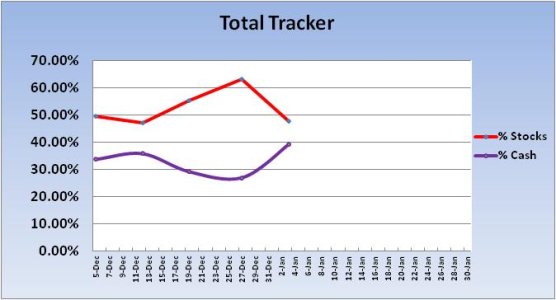

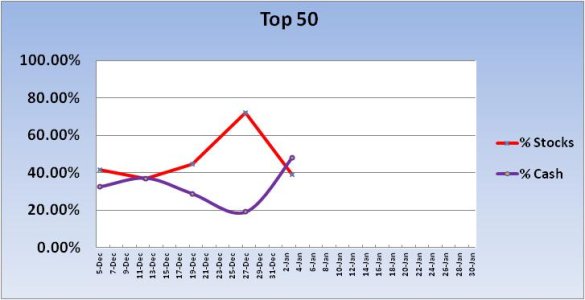

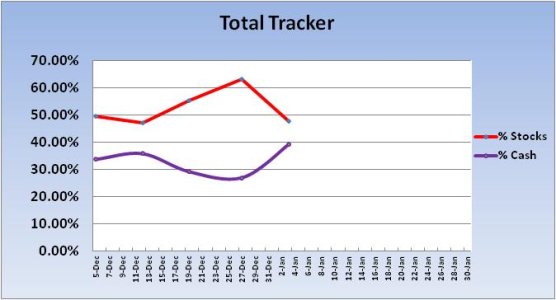

Last week, the Top 50 had increased their stock exposure by 27.62%. The herd increased theirs by 7.68%. Total stock allocations were high with the Top 50 sporting a 72.32% stock allocation, while the herd was holding a 63.06 allocation. Stocks were down moderately overall last week, but volatility offered some measure of opportunities for those who were nimble.

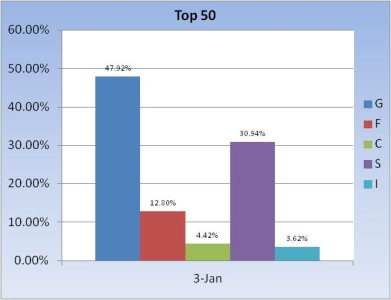

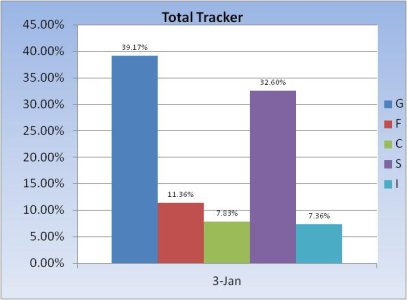

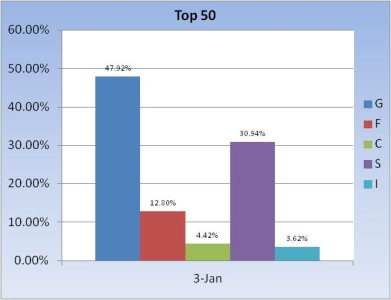

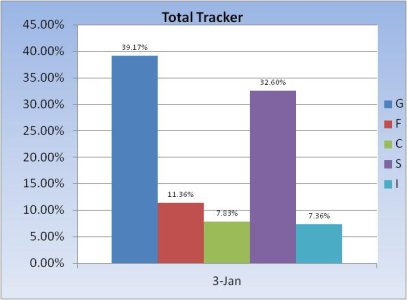

This week, the first week of the new year, stock allocations start out at a more modest level than last week's numbers. Here's the charts:

The Top 50 dropped their stock allocation for this week by a significant 33.34%. Their total stock allocation now sits at 38.98%.

The herd followed suit. They dropped their stock allocation by 15.27% to a total stock allocation of 47.79%.

Our sentiment survey would seem to support this drop in bullishness too. This much of a drop tends to make me think we're going higher this week, in spite of the sell signal by our sentiment survey. Keep in mind though, that Tuesday and Wednesday are still considered part of the Santa Claus rally time frame. If Europe's trading activity is any indication, the party is still in session. So we'll see how it goes.

This week, the first week of the new year, stock allocations start out at a more modest level than last week's numbers. Here's the charts:

The Top 50 dropped their stock allocation for this week by a significant 33.34%. Their total stock allocation now sits at 38.98%.

The herd followed suit. They dropped their stock allocation by 15.27% to a total stock allocation of 47.79%.

Our sentiment survey would seem to support this drop in bullishness too. This much of a drop tends to make me think we're going higher this week, in spite of the sell signal by our sentiment survey. Keep in mind though, that Tuesday and Wednesday are still considered part of the Santa Claus rally time frame. If Europe's trading activity is any indication, the party is still in session. So we'll see how it goes.