View attachment 18591

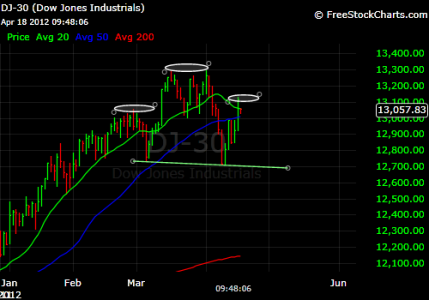

Above chart of the SP-500 also shows a potential H/S pattern forming which if it plays out would put price in the 1290 area, close to the 200 DMA. I have also drawn in fibonacci retracements from the 10/4, 11/25, and 12/19/2011 lows to create a confluence support grid to locate potential support levels should the H/S pattern play out. The first confluence/support level (2 retracements) is at the 1340 level which corresponds to the 3/6/12 low. The next confluence/support level (3 retracements) is at the 1290ish level which also corresponds to the target level should the current H/S pattern play out!!! The 1292 level corresponds with the 10/27/2011 high. Interesting enough as UPTREND has pointed out the Elliott Wave pattern target level is 1286-1315. I'm not trying to be bearish just looking at what the charts are indicating and trying to setup accordingly. I also find it very interesting how some of the European markets have put in similar H/S patterns app 2 weeks ago and have fulfilled their respective downward target levels around the 200 DMA. Continuing to build my position in TZA and sitting in the G fund waiting for a good buying oppurtunity. Any and all suggestions, criticism and comments are welcome.

[/QUOTE

I have updated a chart which I originally posted on 4/18/12. The SP is at a critical juncture. The large H/S pattern has broken down through the neckline and based on today futures looks like we are going to test the 1340 area and make lower lows. This is the first confluence/support level and if it doesn't hold there is very little support until the 1290 level. Needless to say but our markets are once again being driven by the European markets. The Euro is also breaking down.