The month of June has been somewhat of a disappointment for my returns. The volatility of the 888-956 trading range makes it difficult to time an IFT, and my timing this month wasn’t good. While on vacation I saw my 100% I-Fund allocation was getting slaughtered, so to reduce the pain, I went 25% each into FCSI. It seemed like a good idea at the time since I couldn’t monitor the markets while on the road.

For now, I’ll hold this allocation because I like using the F-Fund to hedge against stocks. But the truth is I don’t have a better plan and sometimes doing nothing is better than blindly doing something, hence the “Whole lot of nothing.”

<O

For the good news, we did close out the monthly charts with a higher high and a higher low. But you can tell it was one heck of a war between the Bulls & the Bears and we finished out with an absurdly scarce gain of (+.02%). Although I don’t feel optimistic, I still see 1015 as a target sometime between July & August. My current unsubstantiated theory is that back to school sales will be the beginning of the downturn.

<O

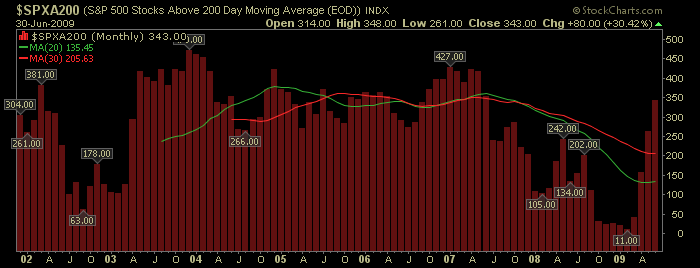

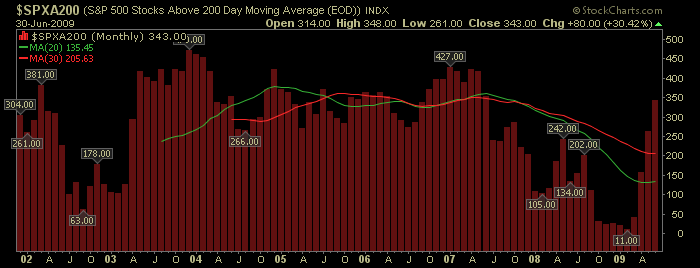

As for $SPXA200 (in monthly form), we put in a higher high with 348 stocks above their 200MA. Interestingly enough, the previous monthly higher high was in September 2007, just before the beginning of this bear market.

<O

If you like to watch moving averages, then you may be concerned with $TRANS second failed test of the 200MA and its recent impotence with the 20MA.

<O

Sorry to keep it short, I’m still knocking off the rust and need to ease back into things.

<O

Cheers…

<O

<O

For now, I’ll hold this allocation because I like using the F-Fund to hedge against stocks. But the truth is I don’t have a better plan and sometimes doing nothing is better than blindly doing something, hence the “Whole lot of nothing.”

<O

For the good news, we did close out the monthly charts with a higher high and a higher low. But you can tell it was one heck of a war between the Bulls & the Bears and we finished out with an absurdly scarce gain of (+.02%). Although I don’t feel optimistic, I still see 1015 as a target sometime between July & August. My current unsubstantiated theory is that back to school sales will be the beginning of the downturn.

<O

As for $SPXA200 (in monthly form), we put in a higher high with 348 stocks above their 200MA. Interestingly enough, the previous monthly higher high was in September 2007, just before the beginning of this bear market.

<O

If you like to watch moving averages, then you may be concerned with $TRANS second failed test of the 200MA and its recent impotence with the 20MA.

<O

Sorry to keep it short, I’m still knocking off the rust and need to ease back into things.

<O

Cheers…

<O

<O