The action today may not have been as bad as it seemed at the end of the trading day. In spite of the euro shedding 1.6% vs the dollar, some of the major European bourses managed to trim losses or even post modest gains. And that seemed to float our domestic market around the neutral line most of the day.

But a 2.9% decline in financials led the way to a negative close across the broader market.

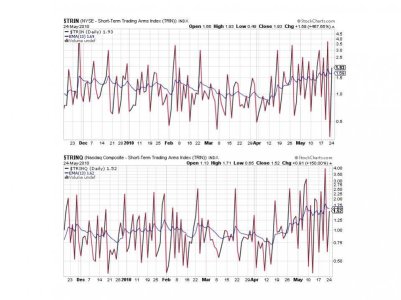

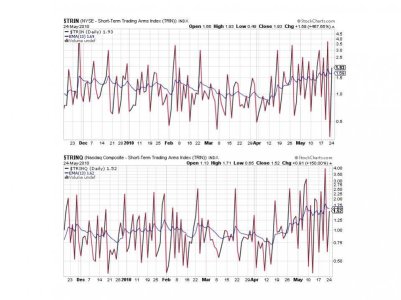

Looking at the Seven Sentinels, one might get the impression the market had a relatively neutral day. Of course we didn't, but take a look at the charts:

NAMO hardly moved at all. Just a very modest tick lower. And NYMO actually ticked a bit higher, and maintained its buy status.

Both NAHL and NYHL flipped to buys. This says that in spite of the red close, internals were not as bad as closing prices might otherwise suggest.

One buy and one sell here.

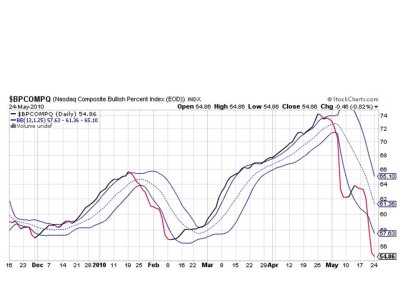

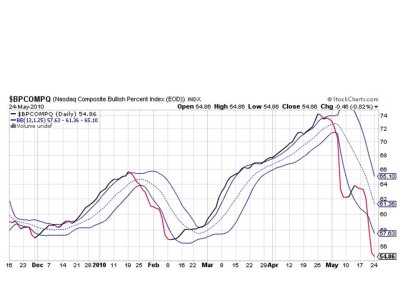

BPCOMPQ remains on a sell.

So we have 4 of 7 signals on a sell, which keeps the system on a sell. Today's action could be interpreted as bottoming action. We may get another shot down, but I suspect the worst of the decline is over for now.

But keep in mind, that's only my opinion. The system is still on a sell and it could be a little while yet before it turns back up. Unless one was caught in this downward move (like me), I'd stay in cash. The lack of an IFT keeps me in this market in case a hard reversal to the upside materializes.

That's it for this evening. Good luck, and see you tomorrow.

But a 2.9% decline in financials led the way to a negative close across the broader market.

Looking at the Seven Sentinels, one might get the impression the market had a relatively neutral day. Of course we didn't, but take a look at the charts:

NAMO hardly moved at all. Just a very modest tick lower. And NYMO actually ticked a bit higher, and maintained its buy status.

Both NAHL and NYHL flipped to buys. This says that in spite of the red close, internals were not as bad as closing prices might otherwise suggest.

One buy and one sell here.

BPCOMPQ remains on a sell.

So we have 4 of 7 signals on a sell, which keeps the system on a sell. Today's action could be interpreted as bottoming action. We may get another shot down, but I suspect the worst of the decline is over for now.

But keep in mind, that's only my opinion. The system is still on a sell and it could be a little while yet before it turns back up. Unless one was caught in this downward move (like me), I'd stay in cash. The lack of an IFT keeps me in this market in case a hard reversal to the upside materializes.

That's it for this evening. Good luck, and see you tomorrow.