Unfortunately, we had another down close yesterday, in spite of rising bearishness. That's not a surprise, but I ended up giving back the bulk of my gains. Still, I had a positive trade and hope that this sell signal will lead me to lower prices on the next buy signal. I do not think it will be too long before we see it either. I'm leaning towards early October to see another reversal, but we'll just have to see how it plays out.

I had mentioned that this is still a bull market, and there's nothing in the charts to suggest otherwise. Our top 25% continue to largely hold their equity positions. This is part of the reason I'm expecting this sell signal to be relatively tame with a quick reversal...again.

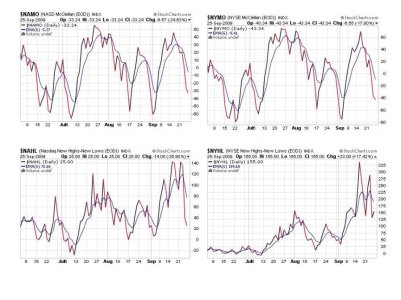

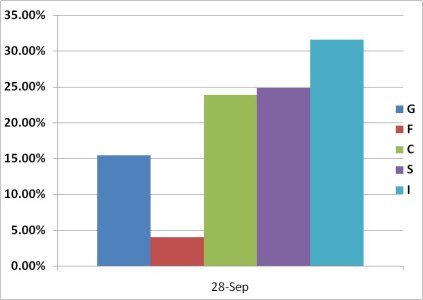

For the moment, all seven signals remain in a sell condition. Take a look:

Four for four here.

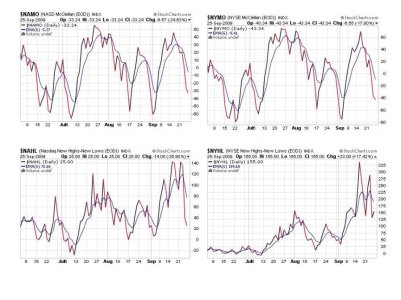

Three for three here. We are in a sell condition now until all seven give a simultaneous buy signal.

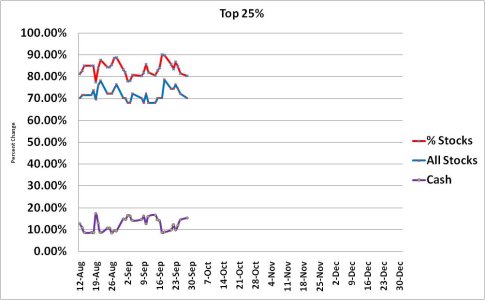

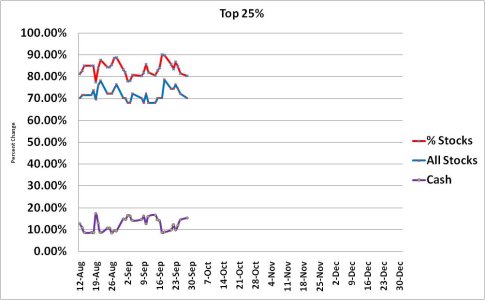

Here's how our Top 25% are positioned going into Monday's action.

Here's their collective position.

We can see cash levels rose modestly again, but as has been the case for some time the context of the market is still bullish according to our top performers.

Thursday is October 1st and of course that means we get two new IFTs. I doubt we see a buy signal before then. The SS charts suggest that the current weakness we are seeing is not over, but we are probably not too far from the bottom. This is the end of the quarter, so we may be seeing some quick profit taking ahead of the typical window dressing action normally seen at this time. That's another reason why I favor an early October reversal and that this past week's action is more than likely a modest pause before a continuation higher.

I had mentioned that this is still a bull market, and there's nothing in the charts to suggest otherwise. Our top 25% continue to largely hold their equity positions. This is part of the reason I'm expecting this sell signal to be relatively tame with a quick reversal...again.

For the moment, all seven signals remain in a sell condition. Take a look:

Four for four here.

Three for three here. We are in a sell condition now until all seven give a simultaneous buy signal.

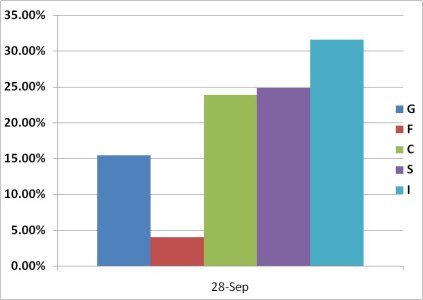

Here's how our Top 25% are positioned going into Monday's action.

Here's their collective position.

We can see cash levels rose modestly again, but as has been the case for some time the context of the market is still bullish according to our top performers.

Thursday is October 1st and of course that means we get two new IFTs. I doubt we see a buy signal before then. The SS charts suggest that the current weakness we are seeing is not over, but we are probably not too far from the bottom. This is the end of the quarter, so we may be seeing some quick profit taking ahead of the typical window dressing action normally seen at this time. That's another reason why I favor an early October reversal and that this past week's action is more than likely a modest pause before a continuation higher.