JPH543

Rising Member

- Reaction score

- 132

BLUF: The I Fund is a completely different new fund and just has the old name...

Can we even look at past performance for comparisons or for predictions?

Tom's market commentary for today was eye opening; it included a historical look at I fund performance compared to C and that is what spurred me to look into the I fund history deeper so here is a synopsis of my research for the 2024 changes and looking forward to what you all think on the matter.

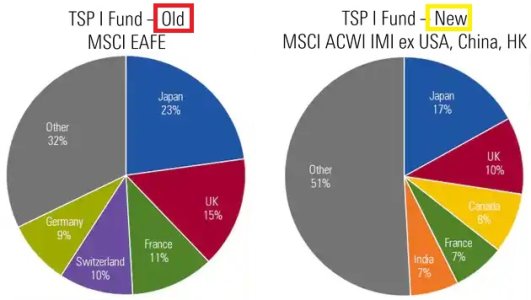

In 2024 the I fund was in a phased transition and completed its evolution by late 2024, so we now have one full year (in a few days) of this new fund's performance for 2025. To just say it is a benchmark revision, just tracking new diversified markets or simply an expansion would still be an understatement (imo it is a completely new fund).

While yes, the new I fund still has the Europe, Australia and Eastern developed markets that's where the similarities really end.

The old was limited and tracked around 750 companies in 21 countries, the new over 5,500 companies in over 40 different countries and only excludes the US, China and Hong Kong. Of those old 750 companies it was limited to large and mid-cap only, the new includes large, mid and small caps and now includes these 23 emerging market countries (23 out of a total of 24 possible were added).

The old was trying to be low risk, low average growth over time with developed international markets. Well, the new I fund seems to be the complete opposite, it is looking to capitalize on emerging companies from the entire breadth of the international markets with opportunities for high growth with diversity to stabilize and potentially reduce risk. We have all these developing markets in countries that are in different acceleration rates of economic growth now comparatively. (this is just scratching the surface)

So, what little remains of the old fund is really of no consequence on the fund's performance moving forward. As I see it, we got a completely new fund for 2025.

Is 2025's performance just a good year? Do we throw out the sub 6% average rate gain since 2002 and start the tracking over contrary to what TSP is displaying? Can the old fund predict the new funds potential in a meaningful way? Did they really dampen out I fund volatility for long term growth potential or are we going to still see big swings year to year?

-Jeremy

Can we even look at past performance for comparisons or for predictions?

Tom's market commentary for today was eye opening; it included a historical look at I fund performance compared to C and that is what spurred me to look into the I fund history deeper so here is a synopsis of my research for the 2024 changes and looking forward to what you all think on the matter.

In 2024 the I fund was in a phased transition and completed its evolution by late 2024, so we now have one full year (in a few days) of this new fund's performance for 2025. To just say it is a benchmark revision, just tracking new diversified markets or simply an expansion would still be an understatement (imo it is a completely new fund).

While yes, the new I fund still has the Europe, Australia and Eastern developed markets that's where the similarities really end.

The old was limited and tracked around 750 companies in 21 countries, the new over 5,500 companies in over 40 different countries and only excludes the US, China and Hong Kong. Of those old 750 companies it was limited to large and mid-cap only, the new includes large, mid and small caps and now includes these 23 emerging market countries (23 out of a total of 24 possible were added).

The old was trying to be low risk, low average growth over time with developed international markets. Well, the new I fund seems to be the complete opposite, it is looking to capitalize on emerging companies from the entire breadth of the international markets with opportunities for high growth with diversity to stabilize and potentially reduce risk. We have all these developing markets in countries that are in different acceleration rates of economic growth now comparatively. (this is just scratching the surface)

So, what little remains of the old fund is really of no consequence on the fund's performance moving forward. As I see it, we got a completely new fund for 2025.

Is 2025's performance just a good year? Do we throw out the sub 6% average rate gain since 2002 and start the tracking over contrary to what TSP is displaying? Can the old fund predict the new funds potential in a meaningful way? Did they really dampen out I fund volatility for long term growth potential or are we going to still see big swings year to year?

-Jeremy

Last edited: