Well, if you followed the the SS two buy signals ago and stuck with it in spite of the initial selling pressure, you've done very well. It now appears that signal was valid and yesterday's signal was simply confirmation. Even if you only followed the last buy signal, you've picked up some nice gains. And aside from the SS buy signal the S&P closed well above its 200 DMA.

And today's continued rally coincided with additional strength in the euro, which saw gains of 0.9% to $1.234.

I don't have much of an argument to offer on the bearish side after today's rally. The action was basically a big exclamation point with the S&P easily slicing though 1108 to settle around 1115.

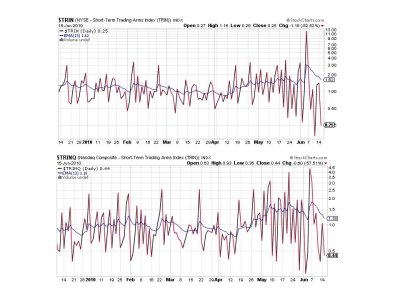

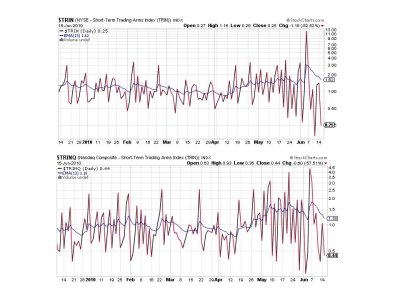

Here's the charts:

I can now view these two signals as bullish given the S&P's action today.

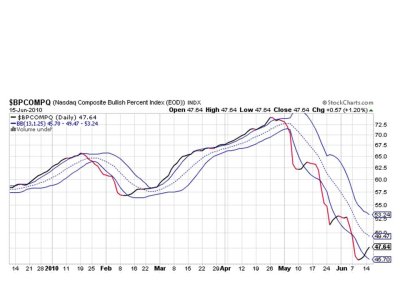

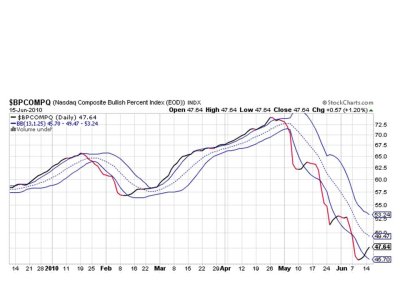

Oddly, not much upside if any on these two, but they're still on a buy.

Two more buy signals here, but these signals suggest a pause or some measure of a retracement may be close. That shouldn't change the upward bias in the longer term however.

More upside here. Looking good.

So all seven signals continue to flash buys, which keeps the system on a buy. I am now anticipating entry into a stock position tomorrow.

Don (the developer of the Seven Sentinels system) is offering 24-hour free access to his Seven Sentinels web-site. Here is his offer, along with a link to the site...

"I've had a number of questions about the Seven Sentinels lately. Those who watch them individually know that they are on buy mode, but rather than explain all of the details here, I thought maybe this would be a great time to let anyone who is interested take a free look for themselves at the signals, explanations and everything else on the SevenSentinels.com website.

Of special interest may be the June 11 lead article in the middle column entitled: "6-11 Timing Comment How sustainable is this trend?"

To set up your own username and password good for 24 hours, just click on any article in the middle column and when you see: "Click here to register for a Premium Subscription to this publication" just click on the link, then follow the instructions, EXCEPT that when you put in Test Drive where it asks for a coupon. It's free, as said.

Good trading, Don"

http://sevensentinels.com/

That's it for this evening. See you tomorrow.

And today's continued rally coincided with additional strength in the euro, which saw gains of 0.9% to $1.234.

I don't have much of an argument to offer on the bearish side after today's rally. The action was basically a big exclamation point with the S&P easily slicing though 1108 to settle around 1115.

Here's the charts:

I can now view these two signals as bullish given the S&P's action today.

Oddly, not much upside if any on these two, but they're still on a buy.

Two more buy signals here, but these signals suggest a pause or some measure of a retracement may be close. That shouldn't change the upward bias in the longer term however.

More upside here. Looking good.

So all seven signals continue to flash buys, which keeps the system on a buy. I am now anticipating entry into a stock position tomorrow.

Don (the developer of the Seven Sentinels system) is offering 24-hour free access to his Seven Sentinels web-site. Here is his offer, along with a link to the site...

"I've had a number of questions about the Seven Sentinels lately. Those who watch them individually know that they are on buy mode, but rather than explain all of the details here, I thought maybe this would be a great time to let anyone who is interested take a free look for themselves at the signals, explanations and everything else on the SevenSentinels.com website.

Of special interest may be the June 11 lead article in the middle column entitled: "6-11 Timing Comment How sustainable is this trend?"

To set up your own username and password good for 24 hours, just click on any article in the middle column and when you see: "Click here to register for a Premium Subscription to this publication" just click on the link, then follow the instructions, EXCEPT that when you put in Test Drive where it asks for a coupon. It's free, as said.

Good trading, Don"

http://sevensentinels.com/

That's it for this evening. See you tomorrow.