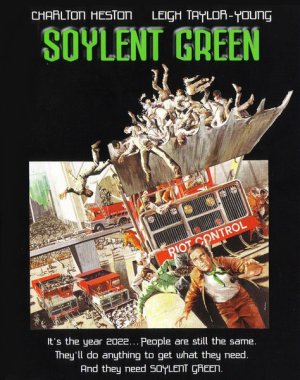

I can't forget it. Scary prospect. History shows that human beings are capable of the most extraordinary and heroic acts, but also capable of the most inhumane conduct. That film apears to have been the creative product of an author proccupied with the future of the world as we know it. In a world of instability, scarcity, an overflowing growth in population, and diminishing food reserves, they found a tragic solution in controlling the population and feeding them transformed human protein as a source of sustenance (without their knowledge or consent).

In my opinion, that scenario is one of many apocalyptic works, including "1984" and "Brave New World". These works keep very much alive the reason why liberty and freedom are critically important. In times of desperation, many governments turn to becoming dictatorships as solutions to the problems. This is one reason why human and natural resources must be managed with wisdom and extraordinary care. I know that when our security is genuinely threatened some measure of freedom has to be temporarily curtailed or suspended in order to deal with the emergencies. I accept that emergency state of affairs, but only as a very temporary "ad hoc" measure. Most important, as rational beings must be aware of the necessity of maintaining the check and balances built into our Constitution by the Founders of the United States. We must protect our democracy and our way of life. The apocalyptic scenarios explain why our dear United States still is the political Beacon of Freedom and holds the blueprints of the best hope for peace and security in the world.