The Triade

Axial-Drifter-Long (ADL)

Axial-Drifter-Intermediate (ADI)

Big 3 Golden Cross (B3GC)

Axial-Drifter-Long (ADL)

Axial-Drifter-Intermediate (ADI)

Big 3 Golden Cross (B3GC)

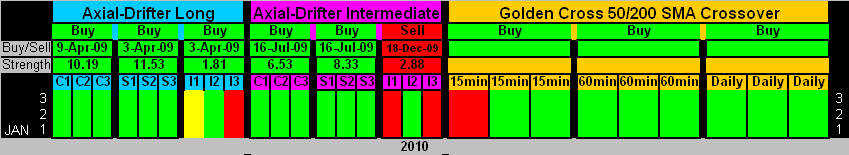

First off, thank you for your feedback on the Market Quilts. For 2010 I'll also be adding & monitoring 3 trading systems. Most of you know about the Axial-Drifter. Well it's now been renamed because I've created two of them. The original is Axial-Drifter-Long (ADL) and the other is Axial-Drifter-Intermediate (ADI.) ADI uses faster signals designed to get you in & out faster, yet still not exceed the 2 IFT limit.

The Axial-Drifters by nature rarely invest in the C-Fund because the I-Fund is the default. If the I-fund is on a sell you go to the S-Fund. If the S-fund switches to a sell, odds are the I-Fund is still on a sell. Since two funds are on a sell, you would exit the markets completely.

This is why I've created a hybrid Golden Cross trading system called Big 3 Golden Cross (B3GC) designed solely for the C-Fund. It is comprised of using the famous Golden Cross 50/200 SMA crossover on 15 minute, 60 minute, and Daily charts. It uses what I feel to be the 3 most important leading charts; It uses the Dow Transportation Index, the NASDAQ, and the S&P 500. Together these 3 charts and 3 time-frames use short, intermediate, and long trading signals. I will monitor the performance of these 3 time-frames as separate systems B3GC-S (short), B3GC-I (intermediate), & B3GC-L (long.)

I've also added a new feature to the ADL & ADI. I've added strength numbers based a percentile difference then the accumulation of the 3 differences by how close they are to switching from a buy to sell or vice verse. You can see the strength numbers on ADL.

C-fund 10.19

S-Fund 11.53

I-Fund 1.81

These strength numbers tell you the S-Fund signals are the strongest and the I-Fund signals are the weakest and closest to switching over to a Sell.

One important item of note.

ADL starts off the year in the I-Fund

ADI starts off the year in the S-Fund. On this system the I-Fund went into a sell 18 Dec 2009.

B3GC starts off in the C-Fund on all time frames.

Another VERY IMPORTANT item of note.

ADL has only been back-tested to 2006.

ADI & B3GC have NOT been back tested.

These trading systems were not created so you can follow them and lose your azz. They were created as a means to entertain myself and a tool you can use to identify market trends.

Take care & Happy New Year... Jason