2010: Bear Market Recoveries

Bears take the elevator down.

Bulls take the stairs up.

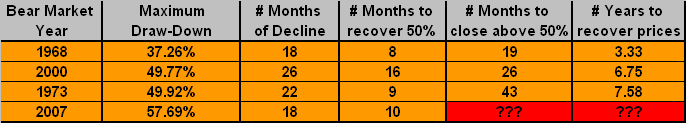

This is the last of the 2010 series in which I've worked to convey some of the lessons I've learned. Hopefully you've benefited from this series as much as I have. Prior to 2007, I'm going to examine three of the strongest S&P 500 Bear markets and their recoveries. This should shed some light on where we stand within this latest Bull leg and how long it may take for us to fully recover to the October 2007 peak.

First let's talk about the 2007 Bear market. Percentage wise it has the strongest maximum draw-down with a loss of 57.69% over 18 months. Assuming we finish above the 50% retracement, during the recovery it's taken 10 months to close at this level. Please take note this is our first month at this 50% level.

The third strongest Bear market was in 1968 and it too declined for 18 months. With a maximum draw-down of 37.26% it took 23 months to recover from the bottom and 3.33 years to fully recover prices. It took 8 months to reach the 50% retracement and 19 months to finally close above it.

The second strongest Bear market was in 2000, and it declined for 26 months. With a maximum draw-down of 49.77% it took 56 months to recover from the bottom and 6.75 years to fully recover prices. It took 16 months to reach the 50% retracement and 26 months to finally close above it.

Prior to 2007, the strongest Bear market was in 1973, and it declined for 22 months. With a maximum draw-down of 49.92% it took 70 months to recover from the bottom and 7.58 years to fully recover prices. It took 9 months to reach the 50% retracement and 43 months to finally close above it.

Hopefully you get the point. Although we are in a Bull market, we are by no means out of the woods yet. What these charts tell us is that we can expect more of this sideways trading action in the future.

Cheers... Jason

Bears take the elevator down.

Bulls take the stairs up.

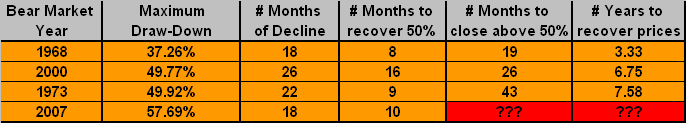

This is the last of the 2010 series in which I've worked to convey some of the lessons I've learned. Hopefully you've benefited from this series as much as I have. Prior to 2007, I'm going to examine three of the strongest S&P 500 Bear markets and their recoveries. This should shed some light on where we stand within this latest Bull leg and how long it may take for us to fully recover to the October 2007 peak.

First let's talk about the 2007 Bear market. Percentage wise it has the strongest maximum draw-down with a loss of 57.69% over 18 months. Assuming we finish above the 50% retracement, during the recovery it's taken 10 months to close at this level. Please take note this is our first month at this 50% level.

The third strongest Bear market was in 1968 and it too declined for 18 months. With a maximum draw-down of 37.26% it took 23 months to recover from the bottom and 3.33 years to fully recover prices. It took 8 months to reach the 50% retracement and 19 months to finally close above it.

The second strongest Bear market was in 2000, and it declined for 26 months. With a maximum draw-down of 49.77% it took 56 months to recover from the bottom and 6.75 years to fully recover prices. It took 16 months to reach the 50% retracement and 26 months to finally close above it.

Prior to 2007, the strongest Bear market was in 1973, and it declined for 22 months. With a maximum draw-down of 49.92% it took 70 months to recover from the bottom and 7.58 years to fully recover prices. It took 9 months to reach the 50% retracement and 43 months to finally close above it.

Hopefully you get the point. Although we are in a Bull market, we are by no means out of the woods yet. What these charts tell us is that we can expect more of this sideways trading action in the future.

Cheers... Jason