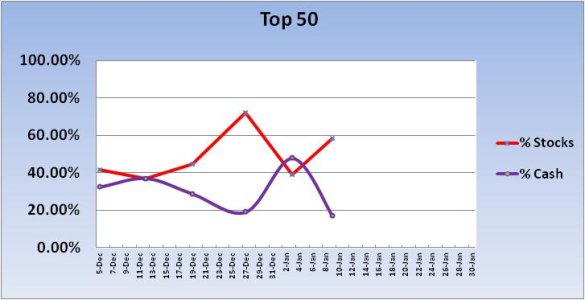

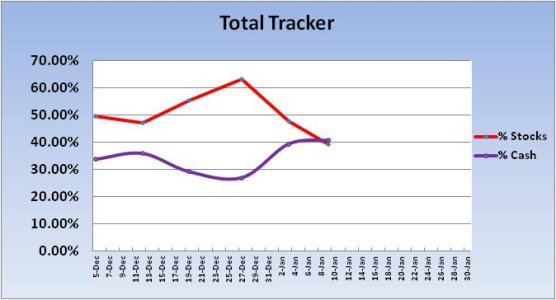

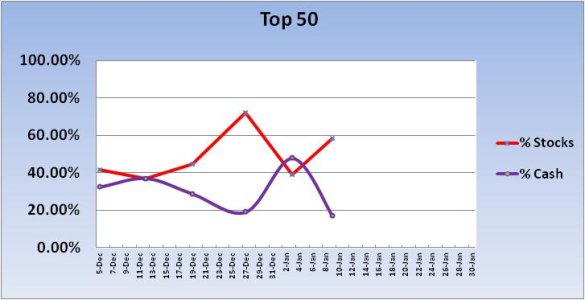

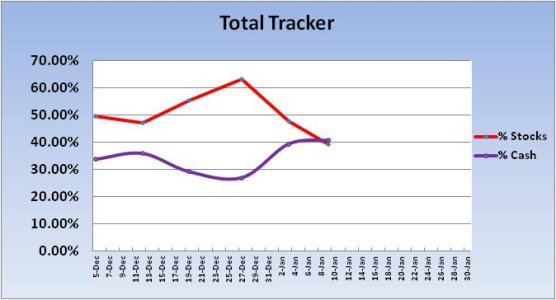

Last week the tracker charts showed that we were collectively moving to the G fund as the Santa Claus rally ran its course (last Wednesday was officially the end of the SC rally). The Top 50 had dropped their stock exposure a whopping 33.34% to begin last week's trading, which put them at a total stock allocation of 47.92%. The herd had also dropped their stock allocation last week, but by a more modest 15.27%. That gave them a total stock exposure of only 39.09%.

Both groups ended up being under-invested as our C and S funds tacked on more than 1.6% last week (although the I fund was down 0.41%).

Going into this week, we collectively remain defensive.

Here's the charts:

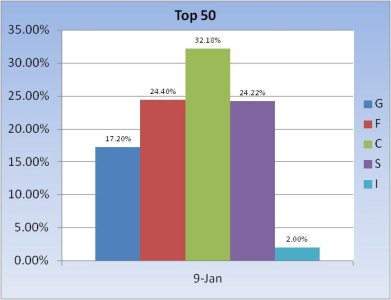

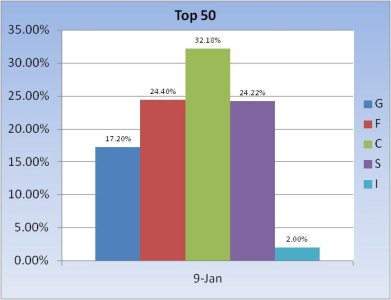

As you can see, the Top 50 is showing a much higher stock exposure than last week (19.42% higher). Total stock allocation for this group is now at 58.4%.

Keep in mind that our tracker charts are reset for the new year, which means they will be a bit volatile for a few weeks until enough data is compiled, which over time will slowly settle down the volatility.

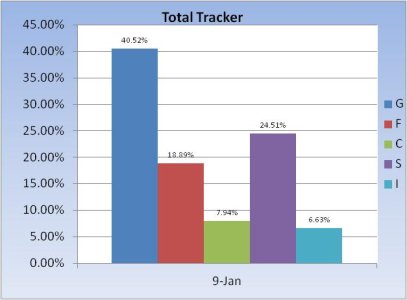

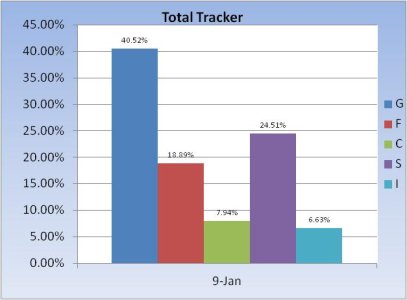

The herd is getting more conservative. Total stock allocations were down 8.7%, which collectively puts us at a total stock allocation of 39.09%.

If you weren't aware, Tom has changed our sentiment survey from bear market rules to bull market rules, as we are now officially back in a bull market. Generally, that means we should be buying weakness with an expectation of an upward bias in stock prices over the longer haul. Currently, our sentiment survey is on a buy (the first buy signal since the week of 3 October).

For the record, our sentiment survey remained in the G fund from the 10th of October to the 6th of January. In that time the stock market, while very volatile, was up 9.32% overall. Just some food for thought.

This market is currently fooling a lot of folks. Given how low our overall stock exposure is I would not be surprised if this market continues to rise (the Seven Sentinels are in a buy condition too). From a technical standpoint, I would expect weakness in the short term, but there seems to be a floor under this market right now.

This week could prove interesting.

Both groups ended up being under-invested as our C and S funds tacked on more than 1.6% last week (although the I fund was down 0.41%).

Going into this week, we collectively remain defensive.

Here's the charts:

As you can see, the Top 50 is showing a much higher stock exposure than last week (19.42% higher). Total stock allocation for this group is now at 58.4%.

Keep in mind that our tracker charts are reset for the new year, which means they will be a bit volatile for a few weeks until enough data is compiled, which over time will slowly settle down the volatility.

The herd is getting more conservative. Total stock allocations were down 8.7%, which collectively puts us at a total stock allocation of 39.09%.

If you weren't aware, Tom has changed our sentiment survey from bear market rules to bull market rules, as we are now officially back in a bull market. Generally, that means we should be buying weakness with an expectation of an upward bias in stock prices over the longer haul. Currently, our sentiment survey is on a buy (the first buy signal since the week of 3 October).

For the record, our sentiment survey remained in the G fund from the 10th of October to the 6th of January. In that time the stock market, while very volatile, was up 9.32% overall. Just some food for thought.

This market is currently fooling a lot of folks. Given how low our overall stock exposure is I would not be surprised if this market continues to rise (the Seven Sentinels are in a buy condition too). From a technical standpoint, I would expect weakness in the short term, but there seems to be a floor under this market right now.

This week could prove interesting.