In Thursday's blog, I had said I was leaning bearish based on the current condition of the Seven Sentinels, which was still in a sell condition. And for a short period of time early on in Friday's trading I was dead on with that expectation. But this market is making very fast, volatile moves and in spite of the major averages declining by as much as 2% in early trade, the market closed the day with heft gains. The S&P 500 swung by almost 4% between its low and high of the day before finishing with a gain of 1.51%.

The selling pressure kicked in early on as the stock market responded to a very disappointing GDP report, which suggested that the economy's second quarter growth was only 1.0%. That was worse than the already anemic expectation by economists for a 1.1 gain%.

Shortly after that the Fed Chairman delivered some uninspiring comments about the economy moving forward, and stopped short of saying anything specific about a possible QE3 being deployed, although he did say the FOMC was ready to employ more tools as needed. Bottom line was that no change in economic policy came from this week's meeting at Jackson Hole, WY.

The market plunged to its lows of the day after the release of those comments, but within minutes buyers stepped in and drove the market higher by almost 2% in less than 20 minutes. It then chopped its way to new highs shortly after noon and traded mostly sideways from there.

So the S&P 500 finished the week with a gain of about 4.7%. That means our sentiment survey was right on target for the week in spite of the Top 50 having a collective stock allocation of just 13% at the open on Monday. Such is the power of sentiment.

As a side note, gold and treasuries also rallied today, with gold climbing more than 2% to $1812 per ounce, while the 10 year note saw its yield drop to 2.19%.

Here's Friday's charts:

NAMO and NYMO moved higher on Friday's action, but NYMO did not tag a new 28 day trading high. Still, these two signals seem to be suggesting more upside to come.

NAHL and NYHL remained in buy conditions (barely), but both dropped marginally in spite of the rally. Internals seem to be in conflict with the momentum being shown by NAMO and NYMO.

TRIN and TRINQ both spiked lower and remain on buys, but they are also showing a moderately overbought market. The problem though is that this market has an affinity to drive technicals to extremes in both directions, so we could see more buying pressure in the short term next week.

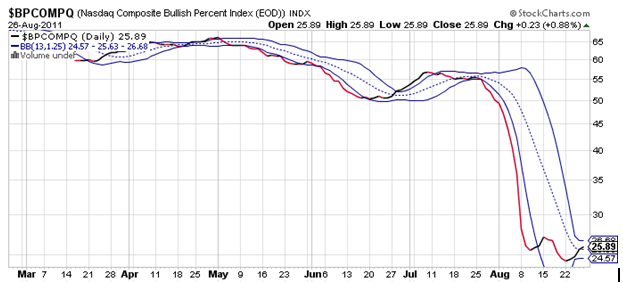

BPCOMPQ ebbed a tad bit higher and remains on a buy.

So the Seven Sentinels officially remain in a sell condition, although an unconfirmed buy signal remains active until NYMO can tag that fresh 28 day trading high. And it's very close right now.

My take is that this market has more upside, but there's plenty of reason to remain wary. Important market events such as Friday's Fed Chair commentary can set-up whip-saw action in the days following their release. I also note the disparity between NAMO/NYMO and NAHL/NYHL.

Sentiment did get bearish last week and that certainly played a big factor in this weeks action, but if that sentiment shifts quickly to the bullish side (this market is showing positive divergences) we could get another reversal to the downside.

This is very frustrating action for those of us in TSP. But even the professionals are frustrated, so don't get discouraged. Try to take a longer view of the market without getting to caught up in the day-to-day action. We don't have enough bullets for it anyway.

I'll be posting the Tracker charts tomorrow. We already know the Top 50 weren't positioned well at the beginning of the week, but it will be interesting to see how trusting they are of this rally going into next week.