- Reaction score

- 615

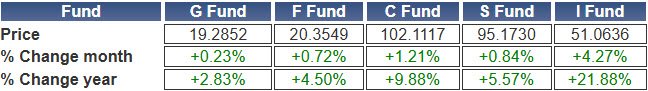

Almost through Wednesday’s trading session, the I-fund is on track to deliver a modest gain of about 0.1%, while C and S-fund investors are staring at losses of roughly 0.5%. With less than three hours until the close, the message is clear: the I-fund continues to outpace its U.S. counterparts. That has been the theme of 2025, and it’s especially evident this month.

This year, the tables have turned. The I-fund has been a powerhouse, climbing 22% year-to-date while the C and S-funds are stuck below 10%.

The strength hasn’t let up in August. With the C and S-funds fighting to stay positive for the month, the I-fund has already gained 4.3%.

That raises the question: How many TSP Talk AutoTracker members are actually riding the I-fund’s success?

Want to see where top TSP investors are putting their money each day? Start a free trial of the Last Look Report and get real-time insights 30 minutes before the IFT deadline.

Among active AutoTracker members (those who’ve logged in this year):

The one exception at the top: nightman (ranked #4), who is fully invested in the I-fund.

Beyond the all-in investors, a small group is giving the I-fund meaningful weight.

Some overlap exists. For example, BHRUNIKH (ranked #2 overall) is evenly split: 50% C-fund, 50% I-fund.

Totals:

The takeaway is clear: C and S still dominate. But the I-fund has a foothold among a smaller, more selective group.

Among the Top 100

Among the top 100 performers of 2025 (active members only):

Only one top-100 member has been parked in 100% I-fund all year. The rest have actively rotated, but the data shows the I-fund is no longer ignored at the top.

Average allocation of the top 100:

Conclusion

The I-fund’s strong 2025 has not translated into broad adoption among AutoTracker members, but it has become a tool used more often by the best-performing investors. That doesn’t guarantee future success—but it does suggest the I-fund deserves more than “afterthought” status in TSP strategies.

Learn more about what you’re actually investing in with the I-fund here.

Stay on top of AutoTracker trends (and support TSP Talk) by subscribing to the Last Look Report.

This is not a recommendation to buy the I-fund. I currently hold no shares of the I-fund or I-fund-related ETFs.

The I-fund’s Rare Streak

For most TSP investors, the I-fund is an afterthought, overshadowed by the C and S-funds. The last time it pulled ahead for an entire year was 2022—when it lost less than the others (-13% versus -18% for the C-fund and -26% for the S-fund).This year, the tables have turned. The I-fund has been a powerhouse, climbing 22% year-to-date while the C and S-funds are stuck below 10%.

The strength hasn’t let up in August. With the C and S-funds fighting to stay positive for the month, the I-fund has already gained 4.3%.

That raises the question: How many TSP Talk AutoTracker members are actually riding the I-fund’s success?

Want to see where top TSP investors are putting their money each day? Start a free trial of the Last Look Report and get real-time insights 30 minutes before the IFT deadline.

100% Single-Fund Holders

Among active AutoTracker members (those who’ve logged in this year):

- 13 hold 100% in the I-fund

- 35 hold 100% in the C-fund

- 75 hold 100% in the S-fund

- 136 hold 100% in the G-fund

The one exception at the top: nightman (ranked #4), who is fully invested in the I-fund.

Partial Allocations: 50% or More

Beyond the all-in investors, a small group is giving the I-fund meaningful weight.

- 15 members hold 50% or more in the I-fund

- 97 hold 50% or more in the C-fund

- 76 hold 50% or more in the S-fund

Some overlap exists. For example, BHRUNIKH (ranked #2 overall) is evenly split: 50% C-fund, 50% I-fund.

Totals:

- I-fund: 28 members with ≥50%

- C-fund: 132 members with ≥50%

- S-fund: 151 members with ≥50%

The takeaway is clear: C and S still dominate. But the I-fund has a foothold among a smaller, more selective group.

Among the Top 100

Last Look Subscribers already know the I-fund shows up more prominently among the leaders.Among the top 100 performers of 2025 (active members only):

- 16 hold 50% or more in the I-fund

- 23 hold 50% or more in the C-fund

- 26 hold 50% or more in the S-fund

Only one top-100 member has been parked in 100% I-fund all year. The rest have actively rotated, but the data shows the I-fund is no longer ignored at the top.

Average allocation of the top 100:

- G: 26.2%

- F: 1.5%

- C: 24.4%

- S: 26.8%

- I: 16.9%

The I-fund’s strong 2025 has not translated into broad adoption among AutoTracker members, but it has become a tool used more often by the best-performing investors. That doesn’t guarantee future success—but it does suggest the I-fund deserves more than “afterthought” status in TSP strategies.

Learn more about what you’re actually investing in with the I-fund here.

Stay on top of AutoTracker trends (and support TSP Talk) by subscribing to the Last Look Report.

This is not a recommendation to buy the I-fund. I currently hold no shares of the I-fund or I-fund-related ETFs.