userque

TSP Legend

- Reaction score

- 36

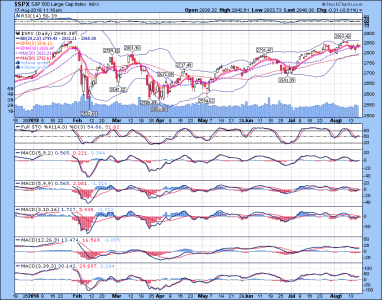

... and some additional tariff tantrums will get us a nice pullback/reset. From the Lilly Pad...

LOL...that's all it is...tariff tantrums...noted for future reference.

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

... and some additional tariff tantrums will get us a nice pullback/reset. From the Lilly Pad...

LOL...that's all it is...tariff tantrums...noted for future reference.opcorn:

Ignore the emails and phone, tell the boss to come back after lunch. No, I don't do that either. I have to stop eating at my desk where my lunch usually ends up cold and unappetizing.Was looking at jumping in yesterday before lunch, then read an email, the boss stopped by, the phone rang... 12:02 :-/

My worst IFT interruption occurred once when I rushed back to my desk to make an IFT before the Noon deadline only to be greeted by my boss telling me I had to leave right now for a random drug test. OUCH! Missing that IFT by a day cost me over 1%.

Interfund-Transferrus Interuptus! A terrible thing... On the road this week with no access to a workstation during the day. Withdrawal symptoms appearing - distant stare :blink:, restlessness :1244:, muttering '*&%@!! market' under my breath... :notrust:

DCB today, maybe?

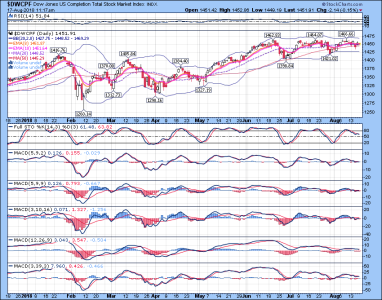

Hi Whipsaw, The Bollinger bands are narrowing. So looks like a big move coming... one way or the other. Not sure which. The June, July and August highs on S charts are in the same resistance zone... not telling when it will punch through. China's economy in trouble... will they blink? But even if they do blink, when will their woes impact the world?The up-down action continues; what still stands out to me is the downward trend of lower highs and lower lows; esp on the S fund. I think this is a negative, anyone with thoughts on this pattern?