It would seem that between Greece's fiscal woes and under capitalized Italian banks the market will have reason to retain a bearish European outlook. Of course there are other fiscal troubles beyond those two, but they are front and center at the moment.

On the domestic front, our first quarter GDP was revised upward by 1.9%, which was unexpected. May's durable goods orders climbed 1.9% and April's numbers were revised upward 2.7%. That sounds bullish, but after stripping out transportation orders for May were only up 0.6%, which was a tad lower than the 0.7% increase economists were looking for, while April saw an overall 0.4% decline.

From a strictly fundamental point of view, risk remains elevated as evidenced by buying interest in fixed income plays. The yield on the benchmark 10-year Note dropped to a new 2011 low below 2.90%, which was a key resistance level.

Let's take a look at how the charts ended the week:

NAMO and NYMO both fell lower on Friday's selling pressure with NAMO retaining its buy status, while NYMO flipped to a sell. Both are near the neutral line now.

Internals improved a bit, which helped NYHL flip back to a buy condition while NAHL remained on a buy.

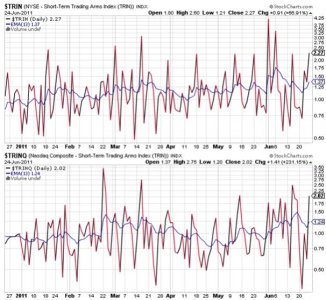

Both TRIN and TRINQ spiked upward into sell conditions, but they are also both suggesting an oversold market. I expect to see some buying strength early on next week as a result of these readings.

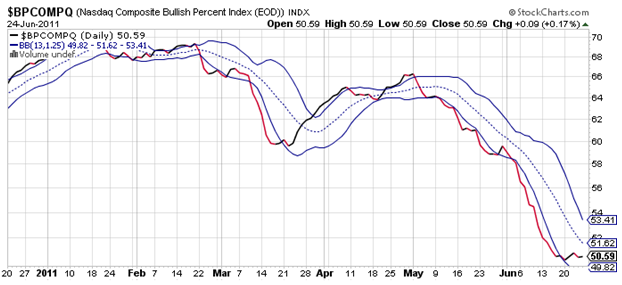

BPCOMPQ has been tracking sideways now for several trading days. This suggests a bottoming process is in progress, but whether it's short or intermediate term has yet to be seen. It remains in a buy condition, which is bullish.

So the Seven Sentinels haven't changed their status. They are in an unconfirmed buy condition, but officially retain their intermediate term sell status. This coming week should be interesting. Our sentiment survey is quite bearish, which gives us a buy condition. That hasn't hasn't been paying dividends of late, but I'm optimistic that this coming week could change that. I'm looking for higher prices for the week, but my intermediate term outlook is neutral. While the charts have stabilized somewhat, they have not confirmed a turn higher so caution is still warranted.