Volatile action was the name of the game again today as the indicies had a huge gap down to begin trading, but managed to close mixed by the close.

On the data front, initial claims climbed to 496,000, up 22,000. Continuing claims were also worse than expected as the came in at 4.62 million.

Durable goods increased by 3.0% in January, which was much higher than expected, but once transportation was stripped out it showed a decline of 0.6%.

December housing saw a 1.6% decline, a far cry from the 0.4% increase that had been expected.

The dollar had initially climbed early on in trading, but finished with a 0.1% loss instead. This is probably the main reason for the market reversal we saw late in the day.

So the wall of worry is firmly in place and should continue to help temper downside action unless something unexpected happens. The Seven Sentinels remain on a buy with several of the signals oscillating above and below their EMAs of late. Here's today's charts:

NAMO and NYMO both flipped back to sells today, but remain near their 6 day EMA.

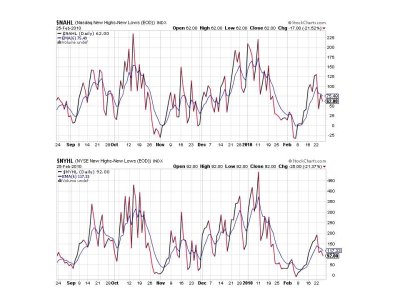

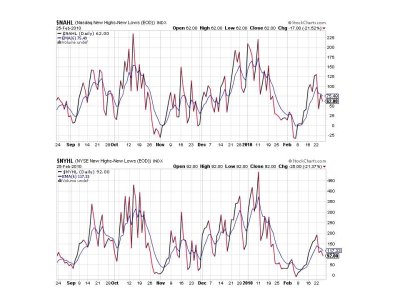

NAHL and NYHL dipped a bit today too, but like the signals above remain near their respective 6day EMAs.

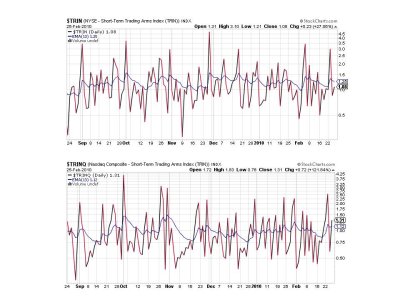

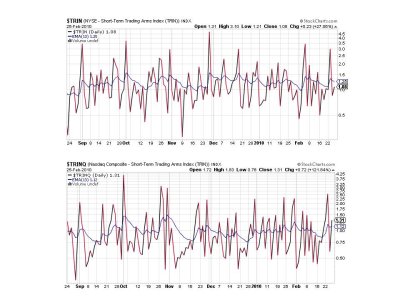

TRIN remained on a buy, while TRINQ flipped to a sell.

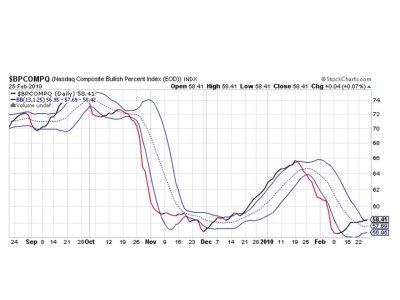

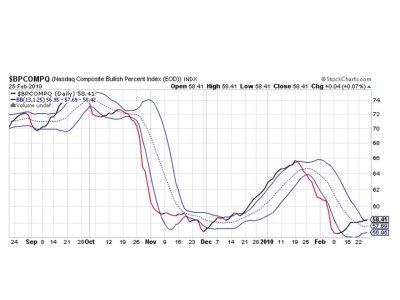

BPCOMPQ remains on an upward tack if ever so slightly. It also remains very close to the upper bollinger band. If it crosses that BB to the downside it would trigger a sell for this signal.

So today we've flipped some of the signals back over with 5 of 7 sentinels now flashing sells. The system remains on a buy though, but the action is making it trickier to discern market direction in the very short term. Any follow through selling pressure tomorrow could conceivably roll the system over to a sell, assuming BPCOMPQ dips. But that's a big if. I am neutral right now as I can see this market going either way, but I do have a slight bullish bias with the news being mostly bad of late. I'd be inclined to think we'd chop around at this point, but volatility has picked back up and we could get some whipsaw signals too. We'll just have to see how it all plays out. That's it for this evening, see you all tomorrow.

On the data front, initial claims climbed to 496,000, up 22,000. Continuing claims were also worse than expected as the came in at 4.62 million.

Durable goods increased by 3.0% in January, which was much higher than expected, but once transportation was stripped out it showed a decline of 0.6%.

December housing saw a 1.6% decline, a far cry from the 0.4% increase that had been expected.

The dollar had initially climbed early on in trading, but finished with a 0.1% loss instead. This is probably the main reason for the market reversal we saw late in the day.

So the wall of worry is firmly in place and should continue to help temper downside action unless something unexpected happens. The Seven Sentinels remain on a buy with several of the signals oscillating above and below their EMAs of late. Here's today's charts:

NAMO and NYMO both flipped back to sells today, but remain near their 6 day EMA.

NAHL and NYHL dipped a bit today too, but like the signals above remain near their respective 6day EMAs.

TRIN remained on a buy, while TRINQ flipped to a sell.

BPCOMPQ remains on an upward tack if ever so slightly. It also remains very close to the upper bollinger band. If it crosses that BB to the downside it would trigger a sell for this signal.

So today we've flipped some of the signals back over with 5 of 7 sentinels now flashing sells. The system remains on a buy though, but the action is making it trickier to discern market direction in the very short term. Any follow through selling pressure tomorrow could conceivably roll the system over to a sell, assuming BPCOMPQ dips. But that's a big if. I am neutral right now as I can see this market going either way, but I do have a slight bullish bias with the news being mostly bad of late. I'd be inclined to think we'd chop around at this point, but volatility has picked back up and we could get some whipsaw signals too. We'll just have to see how it all plays out. That's it for this evening, see you all tomorrow.