Another lackluster trading day with a mostly flat close. What are we to think given this is the end of the quarter? Where's the strength? Where's the volume?

Where's the sellers?

One economic data point of note today was the May Consumer Confidence Index, which posted a 52.5 reading (higher than expected). But stocks didn't seem too exited about it.

The Seven Sentinels have been on a sell for awhile now with little downside movement to show for it. However, the upside hasn't been there either. We've been trading sideways since that sell signal was issued and the signals seem to be weakening still with one exception, which I'll show you below. Here's the charts:

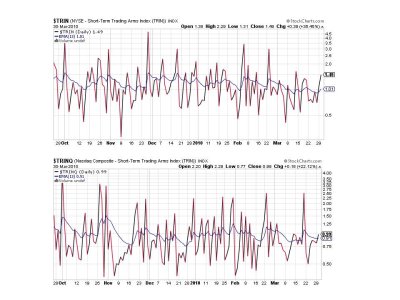

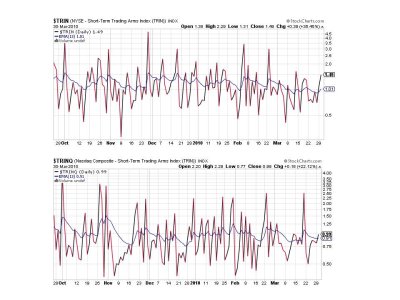

We're still below zero here, but I'd still consider these signals neutral. They've been trending lower for about three weeks and both remain on sells.

Two sell signals here too.

Two more sells, which is pushing the system close to another sell signal, but...

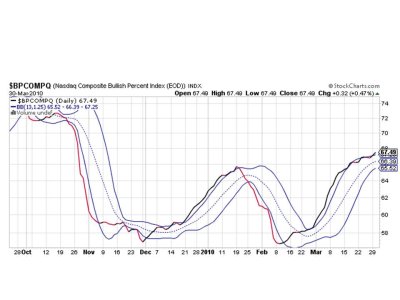

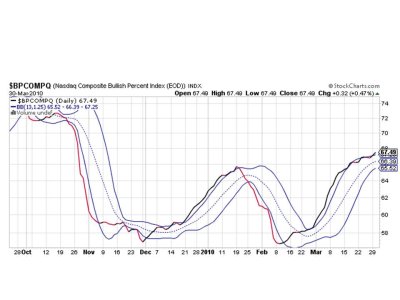

BPCOMPQ turned up just a bit more today. I can't get too excited about it as it can roll over with some moderate selling pressure. But we haven't been getting much of that. This is the lone buy signal of the bunch.

So we have 6 of 7 signals on a sell, which keeps the system on a sell. But the fact that the market has refused to sell down thus far is a bit perplexing to me. It seemed the set-up was there to take it down, but that just hasn't happened as of yet. But we have a test coming up on both Thursday and Friday (which will carry over into Monday). Thursday we will be getting some potential market moving data in the form of Initial Claims, Continuing Claims, Construction Spending and the ISM. Friday we'll see Non-Farm Payrolls and the Unemployment Rate. Thursday is the first day after the 1st quarter, which is a test all by itself, but those data points could provide a catalyst to move this market in one direction or the other. Friday, the markets will be closed. It's possible we could also see some selling pressure Thursday if participants are uncomfortable holding long from Friday to Monday. Might we see some selling then?

I don't know. The Seven Sentinels seem to indicate we have weakness coming very soon. That's my read anyway. It wouldn't take much selling to roll over the one lone buy signal either. Seems an easy enough call. Maybe too easy? We'll know soon enough.

See you tomorrow.

Where's the sellers?

One economic data point of note today was the May Consumer Confidence Index, which posted a 52.5 reading (higher than expected). But stocks didn't seem too exited about it.

The Seven Sentinels have been on a sell for awhile now with little downside movement to show for it. However, the upside hasn't been there either. We've been trading sideways since that sell signal was issued and the signals seem to be weakening still with one exception, which I'll show you below. Here's the charts:

We're still below zero here, but I'd still consider these signals neutral. They've been trending lower for about three weeks and both remain on sells.

Two sell signals here too.

Two more sells, which is pushing the system close to another sell signal, but...

BPCOMPQ turned up just a bit more today. I can't get too excited about it as it can roll over with some moderate selling pressure. But we haven't been getting much of that. This is the lone buy signal of the bunch.

So we have 6 of 7 signals on a sell, which keeps the system on a sell. But the fact that the market has refused to sell down thus far is a bit perplexing to me. It seemed the set-up was there to take it down, but that just hasn't happened as of yet. But we have a test coming up on both Thursday and Friday (which will carry over into Monday). Thursday we will be getting some potential market moving data in the form of Initial Claims, Continuing Claims, Construction Spending and the ISM. Friday we'll see Non-Farm Payrolls and the Unemployment Rate. Thursday is the first day after the 1st quarter, which is a test all by itself, but those data points could provide a catalyst to move this market in one direction or the other. Friday, the markets will be closed. It's possible we could also see some selling pressure Thursday if participants are uncomfortable holding long from Friday to Monday. Might we see some selling then?

I don't know. The Seven Sentinels seem to indicate we have weakness coming very soon. That's my read anyway. It wouldn't take much selling to roll over the one lone buy signal either. Seems an easy enough call. Maybe too easy? We'll know soon enough.

See you tomorrow.