For just a little while this morning it looked like we might be off the races again, but a rebound by the dollar and technical resistance in the charts caused stocks to pullback and meander the rest of the day. We have a couple of data releases tomorrow (Initial Claims and Continuing Claims) which may provide the trading catalyst for tomorrow's action.

We did poke through 1100 on SPX today, and market action seems to indicate we'll break through and close above that level soon. The bears know we're hitting resistance right now and many of them are convinced this market is toast. Interestingly, the Seven Sentinels continue to show 7 of 7 buy signals, and some of those signals have room to move higher. I think it's just a matter of time. Here's todays charts:

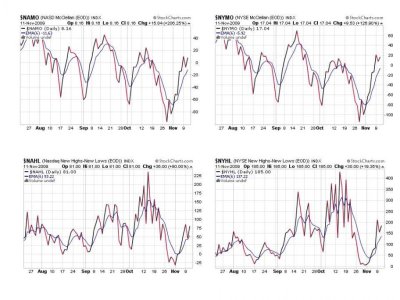

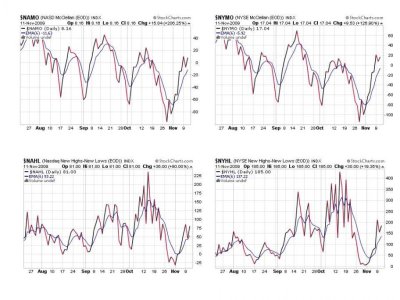

All four on a buy here.

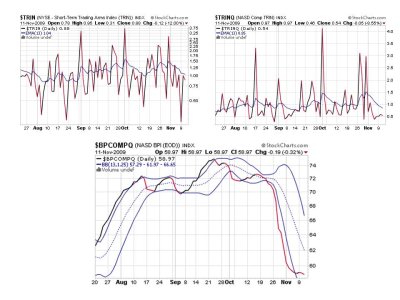

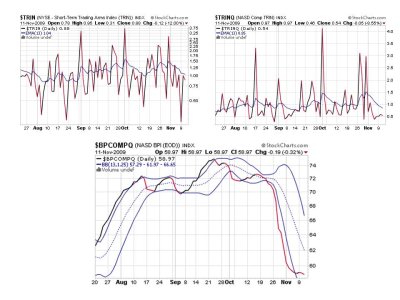

Three for three on a buy here. BPCOMPQ continues to look weak, which makes me wonder how much upside there might be if it begins to strengthen.

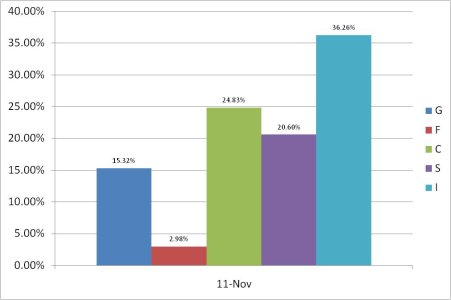

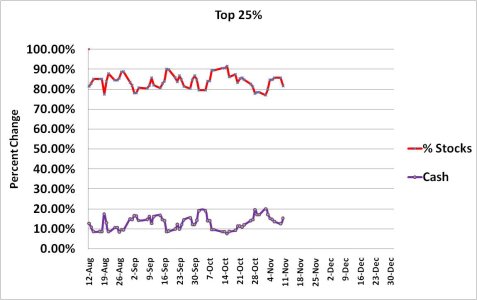

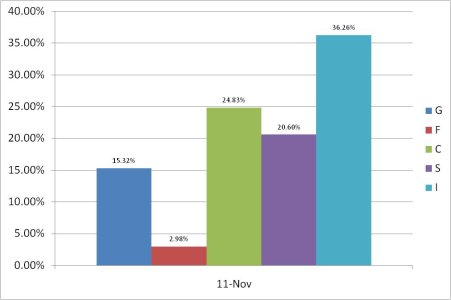

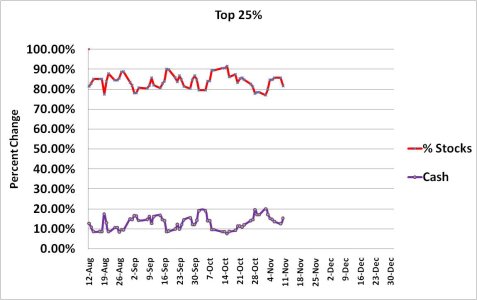

Nothing new here. Although some cash was raised and the I fund dropped below a 40% allocation. Not particularly meaningful though.

This market looks poised to begin a new leg higher. The holidays are approaching, interest rates are still near zero, the fed is still pumping cash, and bearishness continues to rise quickly every time the market stumbles. If you're a bull, what's not to like?

We did poke through 1100 on SPX today, and market action seems to indicate we'll break through and close above that level soon. The bears know we're hitting resistance right now and many of them are convinced this market is toast. Interestingly, the Seven Sentinels continue to show 7 of 7 buy signals, and some of those signals have room to move higher. I think it's just a matter of time. Here's todays charts:

All four on a buy here.

Three for three on a buy here. BPCOMPQ continues to look weak, which makes me wonder how much upside there might be if it begins to strengthen.

Nothing new here. Although some cash was raised and the I fund dropped below a 40% allocation. Not particularly meaningful though.

This market looks poised to begin a new leg higher. The holidays are approaching, interest rates are still near zero, the fed is still pumping cash, and bearishness continues to rise quickly every time the market stumbles. If you're a bull, what's not to like?