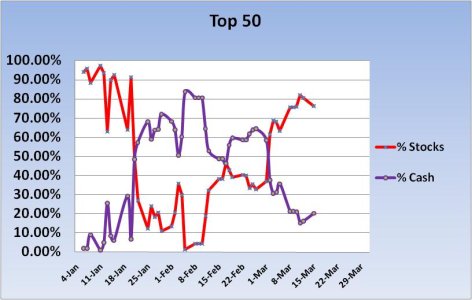

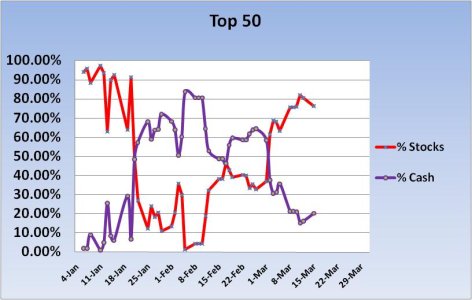

The tracker has changed quite a bit in the past month or so. I'm talking about the whole tracker. Early on in January few folks had negative returns as the Santa Claus rally got extended. And then we had some serious selling pressure, which flipped the whole picture around as negative returns were the norm. Now we've had a big turn back to the upside and most folks have managed to get well again.

Here's how things look going into Monday's trading activity:

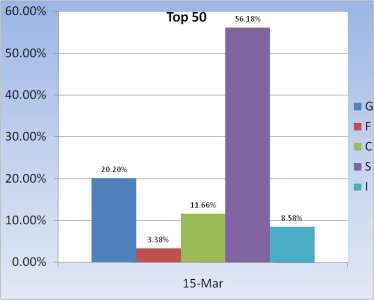

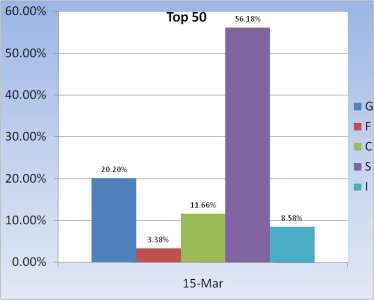

The Top 50 continue to hold a significant stock position with the S fund easily leading the way.

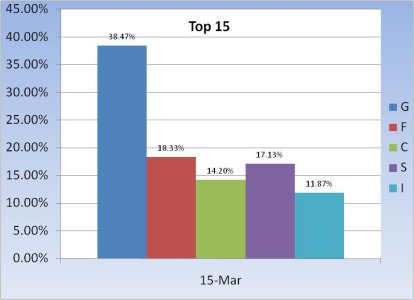

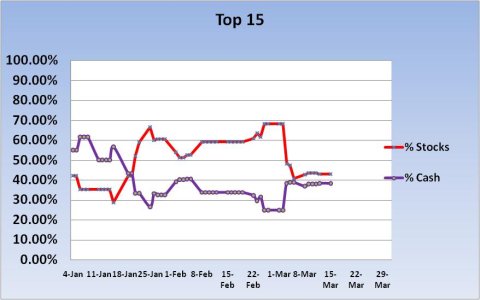

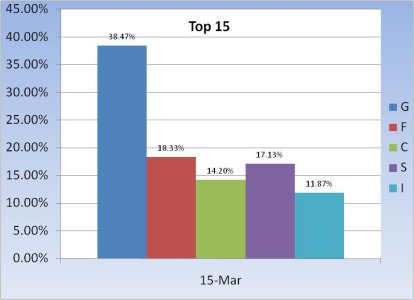

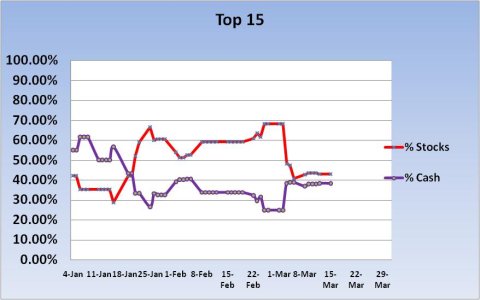

By comparison, the Top 15 hold almost double the cash reserves of the Top 50 and their stock allocations are much more evenly distributed. They're still maintaining a healthy exposure to the F fund too.

Here's how things look going into Monday's trading activity:

The Top 50 continue to hold a significant stock position with the S fund easily leading the way.

By comparison, the Top 15 hold almost double the cash reserves of the Top 50 and their stock allocations are much more evenly distributed. They're still maintaining a healthy exposure to the F fund too.