The major averages closed mixed today and with exception of the DOW (up 0.76%) the other averages closed near the flat line as OPEX came to a close.

There was only one economic report today and that was existing home sales, which hit an annualized rate of 4.61 million units. That was above estimates of 4.55 million units.

Here's today's charts:

NAMO and NYMO remain in buy conditions.

NAHL and NYHL both dipped, with NAHL remaining in a buy condition, while NYHL flipped to a sell.

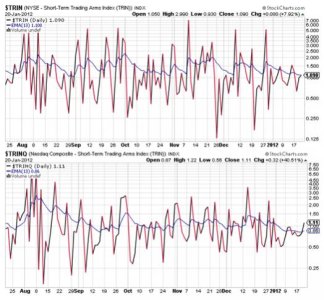

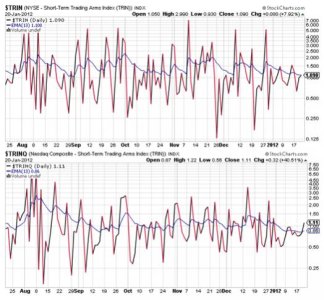

TRIN remains on a buy, but is right at its trigger point. TRINQ flipped to a sell on today's action.

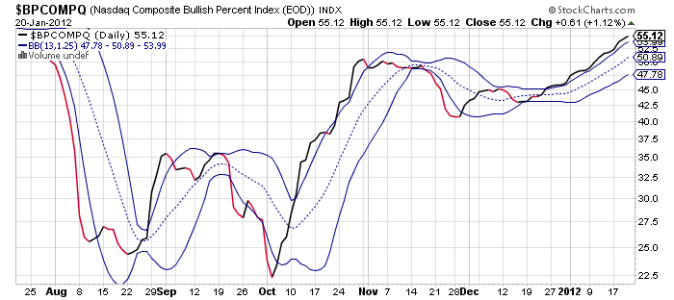

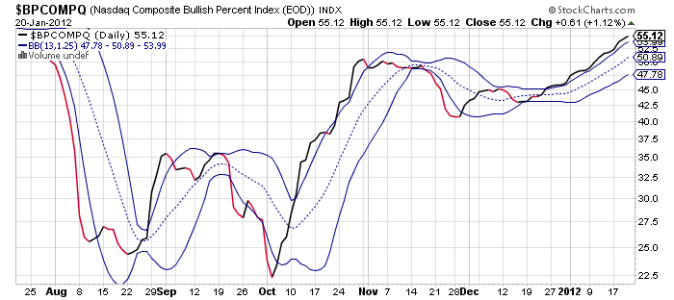

BPCOMPQ continued its ascent and remains on a buy.

So the signals are mixed again, but that still keeps the system in a buy condition.

The charts remain bullish.

One thing I would like to point out about the Seven Sentinels is that (as many of you already know) it is designed to be an intermediate term trend predictor. As long as market character is one of trending (whether it be up or down) the system will perform well. If market volatility is high, which it often has been for the past two plus years, it can produce unwanted results as whipsaws can occur. I bring this up because I'm sure many of you have noticed the Seven Sentinels (7-Sentinels) are near the top of the tracker (it's actually tied with more than 70 TSPers). That's because this market is trending with the downside being largely limited so far this year.

Be aware though that if the downside comes as a fast, deep correction the system will not catch it quickly. This is why I decoupled from following the signals lock-step early last year. And it paid off in a big way as the system was down more than 12% for the year, while I managed just under a 1% gain. Of course, the trend could continue for weeks or even months too, and if it does the system should continue to perform well.

I hope that's the case as I'd love to rely more on the system than I have been. Unfortunately, I'm not convinced that those swift moves are over, but I'm open to the possibility that the upside could continue to be resilient for some time yet.

We shall see. Stop by Sunday evening when I'll have the tracker charts posted. See you then.

There was only one economic report today and that was existing home sales, which hit an annualized rate of 4.61 million units. That was above estimates of 4.55 million units.

Here's today's charts:

NAMO and NYMO remain in buy conditions.

NAHL and NYHL both dipped, with NAHL remaining in a buy condition, while NYHL flipped to a sell.

TRIN remains on a buy, but is right at its trigger point. TRINQ flipped to a sell on today's action.

BPCOMPQ continued its ascent and remains on a buy.

So the signals are mixed again, but that still keeps the system in a buy condition.

The charts remain bullish.

One thing I would like to point out about the Seven Sentinels is that (as many of you already know) it is designed to be an intermediate term trend predictor. As long as market character is one of trending (whether it be up or down) the system will perform well. If market volatility is high, which it often has been for the past two plus years, it can produce unwanted results as whipsaws can occur. I bring this up because I'm sure many of you have noticed the Seven Sentinels (7-Sentinels) are near the top of the tracker (it's actually tied with more than 70 TSPers). That's because this market is trending with the downside being largely limited so far this year.

Be aware though that if the downside comes as a fast, deep correction the system will not catch it quickly. This is why I decoupled from following the signals lock-step early last year. And it paid off in a big way as the system was down more than 12% for the year, while I managed just under a 1% gain. Of course, the trend could continue for weeks or even months too, and if it does the system should continue to perform well.

I hope that's the case as I'd love to rely more on the system than I have been. Unfortunately, I'm not convinced that those swift moves are over, but I'm open to the possibility that the upside could continue to be resilient for some time yet.

We shall see. Stop by Sunday evening when I'll have the tracker charts posted. See you then.