crws

TSP Pro

- Reaction score

- 20

round and round she goes, where she stops...

Is Bank Of America WikiLeaks’ Next Target?

only the market knows?

Is Bank Of America WikiLeaks’ Next Target?

only the market knows?

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

I hope someone looks into when this guy trades the stock market and when he releases info..............................:suspicious:

Now an eagle-eyed reader has sent me a link to a quote from a Computer World interview

with Assange from October of 2009, which, if true, may contain a clue to that bank’s identity:

“At the moment, for example, we are sitting on five gigabytes from Bank of America,

one of the executive’s hard drives,” he said. “Now how do we present that? It’s a difficult problem.

We could just dump it all into one giant Zip file, but we know for a fact that has limited impact.

To have impact, it needs to be easy for people to dive in and search it and get something out of it.”

When we last wrote about Ally, we noted how the company promised it "won't deal in half-truths, kindatruths, or truths only buried in fine print.

That's because we don't have anything to hide. We're always going to give it to you straight."

Two years later, Ally continues to promote honesty and straight talk while still on the taxpayers' dime.

Just like Treasury Secretary Tim Geithner, who calls those not paying their mortgages "responsible homeowners" or President Obama,

whose administration adamantly holds forth that "gamblers playing with other people's money" caused the economic collapse, the ads require a willing suspension of objective reality.

I had the good fortune back in the day to purchase many toxic financials for both myself and my daughter. They are now part of our core holdings. It took much courage and a willingness to throw money away - but I have no regrets. Now if I can be as successful with my coal holdings.

Wells Fargo (WFC), one of the largest U.S. banks, has acknowledged that it will be a casualty. It announced late last month that its third-quarter dividend will need to be reduced, from its current 51 cents a share.

Research firm IHS Markit is projecting that the bank’s payout will be slashed by 60%, to 20 cents a share.

One tail wind for dividends is that many companies—large banks in particular— have cut back on share repurchases. Instead of directing cash to what had become a popular way to return capital to shareholders in recent decades, companies might now have spare cash for dividends.

Last year, Nijenhuis says, S&P 500 members spent roughly $800 billion on buybacks. He expects that figure to be halved this year. “That does make paying a dividend much easier,” he observes.

About a month ago, we highlighted a bearish divergence in the semiconductor ETF (SMH) that indicated a potential rotation away from this growth-oriented group into more value plays. That rotation played out fairly well, as the SMH has indeed pulled back and broken its swing low from February.

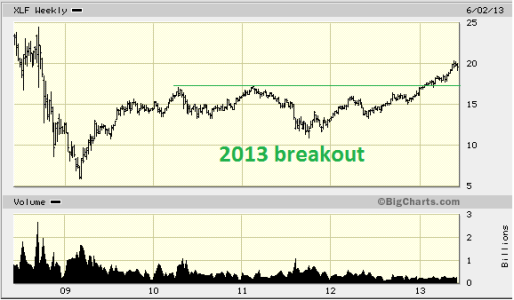

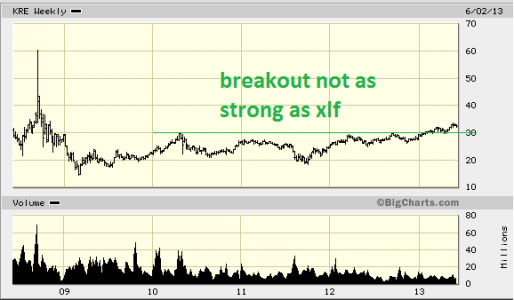

Now we are detecting a similar bearish pattern in the Financial Sector ETF NYSEARCA: XLF as well as many of the big financial stocks and regional bank names.

The Fed last week said 23 of the largest banks had adequate capital to withstand a crisis, a necessary hurdle for banks to pass to return money to shareholders. The central bank had restricted shareholder payouts during the pandemic, asking banks to preserve capital in case the recession led to a wave of soured loans.

MS, GS, BAC, JPM, WFC all increasing dividends by a substantial amount after getting the green light. A very bullish move.

Banks are probably the best all around value play that's left out there. Oil sector can get another push higher, but it's very cyclical, prone to big swings, and will sell off well before the numbers start to show peaking inventories. Sold my only oil sector stock two weeks which I picked up when oil was some $30 cheaper. The fed turmoil hit my stop and even though there is probably more upside, oil stocks are always just a swing trade for me and this just happened to be a wonderful snap back rally.

Bank stocks though, those are long term holds, especially when dividends are rising.