It's been quite a ride the past 3 weeks or so. We had a huge rally towards the end of June that saw the S&P 500 move from 1268.45 to a reading of 1353.22 by the 7th of July. Many traders were caught on the sidelines for that one, but it certainly appeared the next bull run had started. As of today, just eight days later, the S&P 500 sits at 1316.14. And it's been a volatile drop too. One that has many traders now wondering if the trend has reversed to the downside.

For the week, the S&P 500 lost about 2.5%. Of course the other major averages also had significant losses. And we're all very familiar by now of the headline events being blamed for this volatility; Europe's fragile financial affairs, negative commentary about the potential for QE3, ratings agency warnings about the U.S. credit rating, and the political fight over the US debt ceiling.

And earnings? This week we've had positive earnings reports from Google, JP Morgan (JPM) and Citigroup (C), but none appeared to matter much to the market. However, next week more than 300 companies will be reporting earnings so maybe the current downward bias will change based on those collective results.

I'm not betting on it myself as long as those unresolved economic headwinds remain, but we'll see.

Here's today's charts:

NAMO and NYMO ticked a bit higher today, but there's nothing to suggest that they are ready to continue higher next week. That's not say they can't or won't, only that today proves nothing. Both remain on sells.

NAHL and NYHL both ticked a bit lower and also remain on sells.

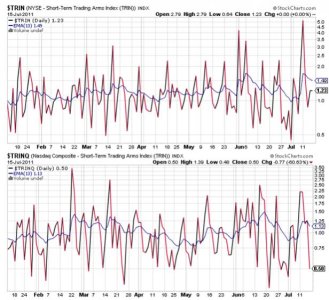

TRIN didn't show much movement in today's action, but TRINQ spiked lower and now suggests an moderately overbought index. Both are in buy conditions.

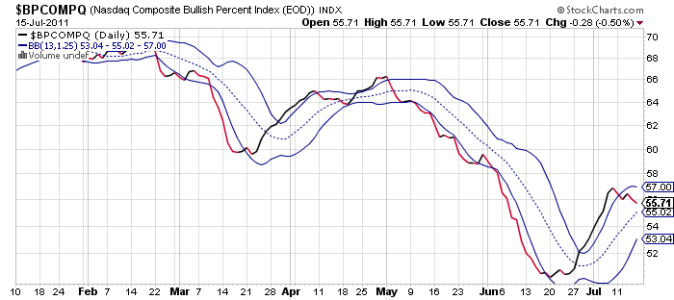

BPCOMPQ moved a bit lower today and remains on a sell. This is s trend indicator and so far, it's pointing down, but not convincingly.

So the signals remain mixed, but that still keeps the system in a buy condition.

I am largely neutral right now, but with a bearish bias, if that makes sense. I can see this market making a move in either direction. But I'm thinking the market will continue to trend lower until the economic landscape comes more into focus, and that will probably happen between now and the end of this month. Of course, who knows where prices will be by the time these headline events are successfully addressed. And while our sentiment is back to buy mode with more than 50% bears, that bearish sentiment is not universal. The market may want to exact a bit more pain from the bulls and raise that bearish sentiment before making that next big move higher. We seem to have the set-up for that.

But these are only educated guesses on where this market might go from here. One thing I do know, is that risk certainly appears elevated and that keeps me in the G fund as long as that's the case.