userque

TSP Legend

- Reaction score

- 36

06-15-15 SHORT AT OPEN

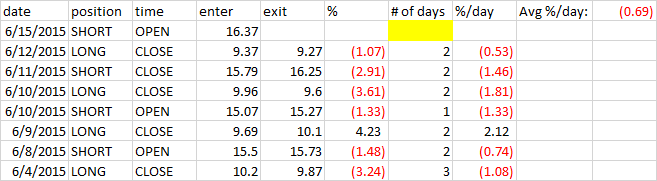

SPREADSHEET:

View attachment 34047

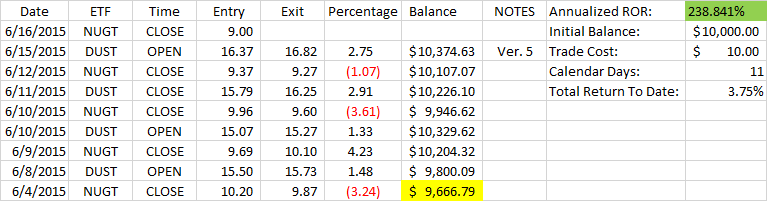

I'll likely post the updated spreadsheet weekly rather than daily/per-trade.

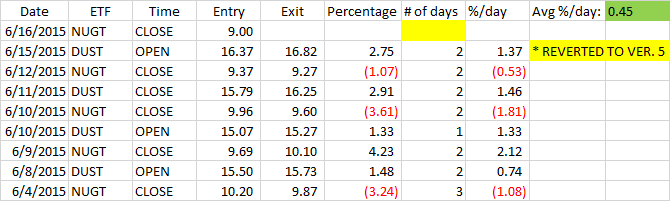

A buddy brought to my attention that those don't seem to be NUGT/DUST prices!:blink: Ha, he's right! Those are GDX prices (the 'underlying' my system uses to generate NUGT/DUST signals)!

I'll repost a corrected sheet today/tonight.