The pre-holiday bias has definitely delivered for the bulls as the broader market made it three straight gains in a row today.

And there were no surprises over in Europe as the Greek Parliament finally passed the country's new austerity plan in the face of ongoing protests in the streets of Athens.

On the domestic front, pending home sales increased by 8.2% in May, which was much better than the 0.6% decline economists expected. But that report didn't seem to be a focal point in today's trading environment.

Here's today's charts:

NAMO leveled off today, while NYMO rose to its highest level for the year. Both signals remain in buy conditions, but we are now at levels where selling pressure may come at any time.

NAHL and NYHL also remain on buys.

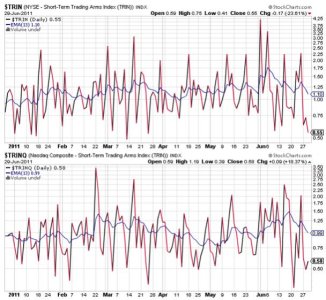

TRIN and TRINQ are definitely showing an overbought condition and suggest selling pressure may come into play soon.

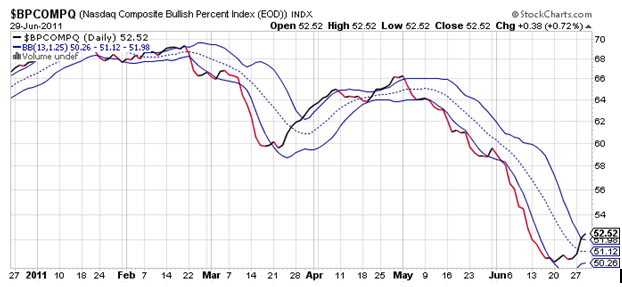

BPCOMPQ poked through the upper bollinger band today and remains in a buy condition, but now that's it's above that band it too suggests we could see some weakness soon.

So all signals remain on buys and the system also remains on a buy, but the technical picture looks stretched to the upside. I'm not expecting prices to get much higher than they already are, but that's not to say they can't go higher. I'm inclined to believe that the market might get choppy through the rest of the week. I'm not so sure we'll see any serious selling pressure just yet given the pre-holiday bias, but that's a possibility with these readings.

I have been selling this rally since yesterday and now have an allocation of 40% G and 60% S. I intend to reduce my exposure some more by the end of the week, although I anticipate I'll leave something in the S fund when I'm done selling. I am looking for another shot down in July that could take out the previous low, and my time line for that is sometime over the next two or three weeks beginning Tuesday. That's just a hunch and is partially based on the current overbought condition in this market. July has also seen some severe volatility in recent years and this time around may not be an exception. I'd like to have some cash on hand in the event lower prices present themselves once again.